Litecoin (LTC) has broken away from the broader altcoin market with a more than 10% rally on Friday, climbing back above $100 at the time of writing and signaling renewed investor confidence.

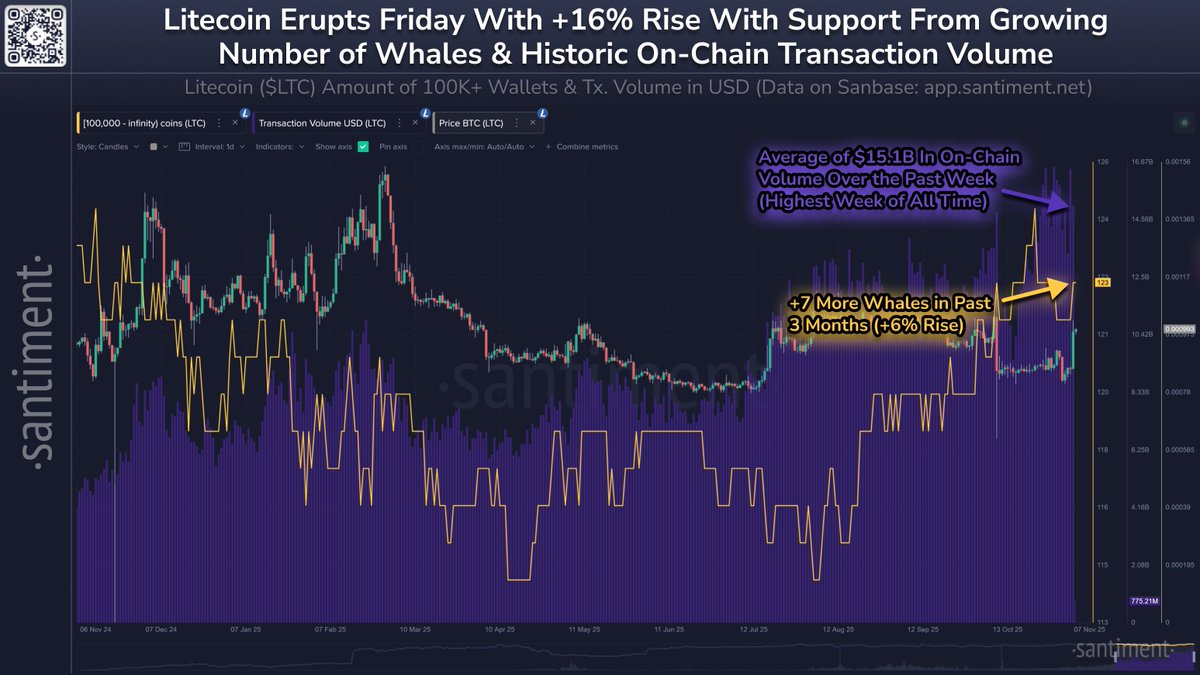

According to Santiment, the move was driven by an increase in whale accumulation and record-breaking on-chain activity, two factors that could fuel continued upside momentum into next week.

Whales Accumulate as On-Chain Activity Soars

Santiment data shows that the number of addresses holding 100,000 or more LTC, typically classified as whale wallets, has risen by 6% in just three months, adding seven new major holders during that period. This signals growing confidence from large investors as market volatility cools across the altcoin space.

In parallel, Litecoin’s on-chain volume has exploded, hitting an average of $15.1 billion in daily transactions, marking the highest week of on-chain activity in its history. Analysts note that such spikes in network activity often precede price continuation phases, particularly when supported by consistent whale accumulation.

Litecoin’s Decoupling and Market Outlook

The surge marks Litecoin’s strongest single-day performance in months, with the asset outperforming most large-cap altcoins. Its “decoupling” from the broader market may reflect investor rotation into older, established assets as traders seek lower-risk opportunities amid macro uncertainty.

If whale accumulation continues at the current pace, Santiment analysts suggest Litecoin could maintain momentum above $100 in the short term. Sustained network engagement will be key to validating this breakout as more institutional and retail traders eye LTC for near-term exposure.

Conclusion

With record-breaking on-chain volume and a clear uptick in whale participation, Litecoin appears to be regaining its relevance in the altcoin market. If the trend persists, LTC could cement a new base above $100 and potentially set up for further gains heading into the final weeks of 2025.