M-KOPA Kenya, the Kenyan arm of the Pan-African fintech company, announced that it has unlocked over $1.6 billion (KES 207 billion) in credit and served 4.8 million customers traditionally excluded from formal finance since 2010. This achievement highlights the company’s significant contribution to bridging digital and financial inclusion across its five operating markets.

In its first Kenya-focused Impact Report, M-KOPA detailed its ongoing commitment to supporting everyday earners by providing access to the internet and smartphones, while also contributing to the Kenyan economy. During the period covered by the report, the company facilitated digital access for 4.5 million smartphone users, including 2.1 million individuals who acquired their first smartphone through M-KOPA.

Martin Kingori, M-KOPA Kenya’s General Manager, emphasized Kenya's pivotal role in the company's African expansion and its substantial contribution to M-KOPA's growth. He stated, "Our 2025 Impact Report demonstrates how inclusive financing, responsible lending, and digital innovation are transforming lives at scale. What matters most is the life progress of everyday earners – 9 out of 10 report an improved quality of life, and more than half are now earning more."

Impact of Smartphone Offerings

The report revealed the substantial impact of M-KOPA's smartphone offerings on customer opportunities. Sixty-seven percent of customers utilize their M-KOPA devices for income generation, while 64% reported that they can now more easily meet their household needs. Furthermore, 52% of customers indicated an increase in their earnings since joining the M-KOPA platform.

Through its 'More than a Phone' initiative, which provides branded smartphones offering comprehensive daily life experiences, M-KOPA has granted customers access to credit, insurance, and digital services, complemented by flexible daily repayment options.

A notable portion of consumers experienced access to these comprehensive features for the first time:

- •47% are first-time smartphone users.

- •37% accessed their first formal loan.

- •68% received their first health insurance cover.

Economic Contributions to Kenya

Beyond enhancing customers' financial and digital lives, M-KOPA is also making a significant impact on the Kenyan economy. In 2024 alone, the company contributed $29.2 million (KES 3.79 billion) in taxes. Its local procurement activities amounted to $156.7 million (KES 20.3 billion), further bolstering the East African country's economy.

The fintech company has also played a role in alleviating unemployment in Kenya by employing 1,320 staff members and supporting 14,000 sales agents. A considerable number of these employees are young, and for many, these positions represent their initial entry into the labor market.

M-KOPA's Nairobi assembly plant, recognized as Africa's largest, has produced 2 million smartphones to date, reinforcing Kenya's technological and manufacturing sectors.

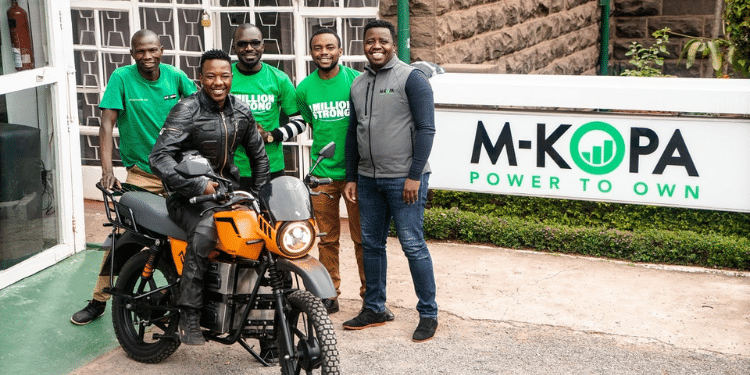

M-KOPA's Electric Boda Boda Initiative

M-KOPA's commitment to supporting "Every Day Earners" extends to its provision of electric motorbikes, available through a flexible daily repayment plan. This initiative, known as 'Boda Boda', is making electric mobility accessible and affordable for riders.

To date, M-KOPA has provided over 5,000 electric motorbikes. This program enables riders to achieve daily savings averaging $5.63 (KES 730) due to reduced fuel costs and lower maintenance expenses compared to traditional petrol bikes.

In addition to the environmental benefits of electric motorbikes, which reduce harmful pollutants by over 90% compared to petrol-powered alternatives, Kenyan Boda Boda riders have experienced significant positive impacts:

- •66% reported increased earnings since transitioning to electric motorbikes.

- •47% are now able to afford essential household expenses.

- •41% are investing more in their children's education.

Brian Njao, General Manager of Mobility at M-KOPA, highlighted that reaching the milestone of 5,000 electric motorbikes demonstrates the efficacy of M-KOPA's financing model across various asset classes. He stated, "Whether it's a smartphone or an e-motorbike, we're solving the same challenge—making expensive, income-generating assets accessible to people earning day by day."