The common adage "don’t fight the Fed" is often cited in financial markets, but according to macro maven Raoul Pal, the true battleground for the crypto market lies not with Jerome Powell's Federal Reserve, but with the monumental wave of global liquidity that dictates the fortunes of all risk assets. Pal's conviction that crypto prices are poised to continue their ascent to record highs remains strong, and he is urging traders to exercise patience.

Drawdowns like this are common place in bull markets and their job is to test your faith.

He advises investors to disregard the prevailing doomsaying and weather the current volatility, emphatically stating: "BTFD if you can." Pal anticipates that the global liquidity spigot is on the verge of reopening, suggesting that the current period of pain in the crypto market may soon transform into a runway for its next significant upswing.

The Real Game: $10 Trillion in Global Liquidity Set to Flood the Crypto Market

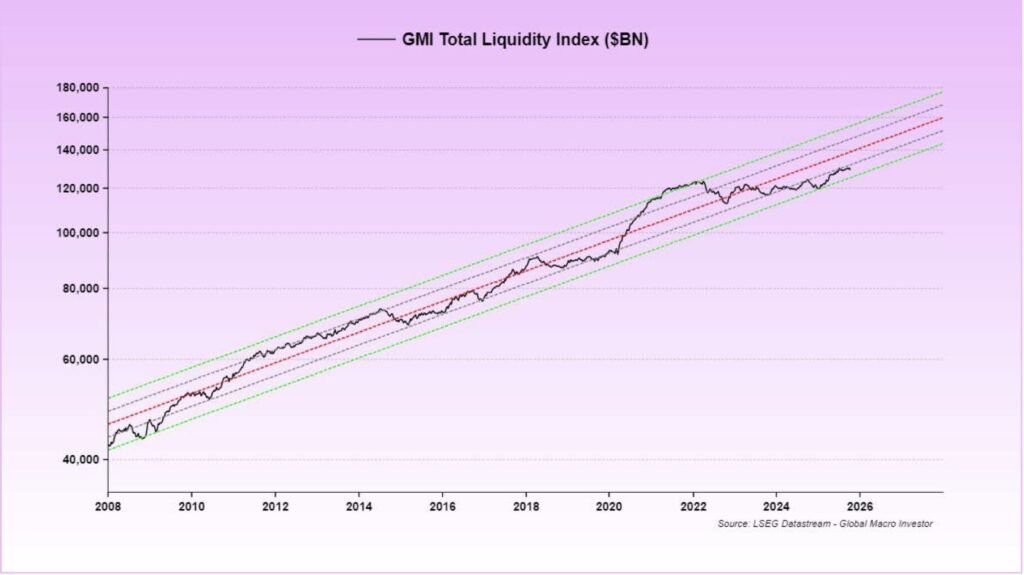

Expanding on his "Road to Valhalla" musings on X, Raoul Pal emphasizes that the single most critical factor influencing the macro landscape is the $10 trillion in global debt. He contends that all other market phenomena, from faltering rallies to the drama of day traders, are merely secondary distractions.

Pal's argument centers on the metric of liquidity, which is currently constrained by the U.S. government shutdown. With government spending frozen, the Treasury General Account (TGA) is accumulating funds, but this capital is not circulating into the broader economy. The reverse repo market has been depleted, and quantitative tightening (QT) continues to withdraw capital from the market.

Why the Crypto Market Got Singed and What’s Next

Pal explains that this liquidity drought disproportionately impacts the crypto market, which is the most hypersensitive asset class to even minor shifts in capital flows due to its extreme liquidity-driven nature. Traditional finance managers are struggling to keep pace with benchmarks after a challenging year. Equity indexes have managed to remain stable, supported by consistent 401(k) contributions and the resilience of the tech sector.

However, Pal warns that if the current government-induced squeeze persists, equities could also be dragged down. He posits that the impending resumption of Treasury spending, estimated between $250 billion and $350 billion, will inject significant liquidity back into the ecosystem, thereby boosting crypto prices.

Quantitative tightening is expected to decelerate, effectively leading to an expansion of the Fed's balance sheet. With spending set to resume, the U.S. dollar is likely to weaken, and market uncertainty may diminish as tariff negotiations conclude. Bill issuance will increase, bolstering bank balance sheets and directing funds into money market funds and stablecoins.

Regarding recession fears, Pal remains unconvinced.

We will have economic weakness from the shutdown, but no, there is no recession.

He anticipates continued interest rate cuts, a sharp market dip, followed by a macroeconomic inflection point that will leave crypto market bears unprepared.

New Catalysts and a Bullish Election Engine

Pal points to subtle structural changes that are poised to catalyze a credit renaissance. Adjustments to the Supplementary Leverage Ratio (SLR) could free up bank balance sheets, facilitating new lending and asset purchases. The anticipated CLARITY Act is expected to provide regulatory certainty for the crypto sector, potentially unlocking a substantial wave of institutional and bank adoption that has been pending for years.

Furthermore, the upcoming "Big Beautiful Bill" on Capitol Hill, coupled with the lead-up to the midterm elections, suggests a policy focus on fostering a strong economy and driving asset prices higher by 2026. Concurrently, China and Japan are increasing fiscal stimulus and balance sheet expansion, both employing their own liquidity strategies to support the global risk appetite.

The ‘Window of Pain’: Why Drawdowns Test the Faithful

Pal acknowledges the difficulties faced by crypto investors, stating that he understands it is hard, but reiterates the need for patience.

Pal's perspective is shared by others in the investment community. Bitcoin and macro investor Dan Tapiero echoes this sentiment, noting that the bull phase for Bitcoin and crypto prices will only conclude when "no one thinks it’s ending (ie not now)." He argues that poor price action is a standard market mechanism designed to shake out less committed investors.

The Kobeissi Letter, a global capital markets expert, also reminds investors that the underlying fundamentals of the crypto market remain strong. They attribute the recent significant shakeout, which saw a $1 trillion market cap reduction, primarily to excessive leverage.

Don’t Miss the Forest for the Trees

Pal urges investors to adopt a broader perspective. The "Liquidity Flood" he forecasts is not merely about bullish chart patterns; it represents a fundamental macroeconomic shift driven by policy changes, fiscal injections, and global stimulus measures.

He advises disregarding the noise and speculative commentary found in online forums. If liquidity, which he identifies as the "only game in town," begins to increase, it is highly probable that risk assets across technology, crypto, and traditional stocks will follow suit. As Pal emphasizes:

“Drawdowns like this are common place in bull markets and their job is to test your faith.“