Michael Saylor, founder of Strategy Inc., has claimed that major banks, including JPMorgan Chase and Bank of America, are now offering loans using Bitcoin as collateral. This development, if confirmed, would significantly enhance Bitcoin's status as a recognized financial asset within traditional financial systems.

This emerging trend underscores Bitcoin's growing acceptance in traditional finance. It has the potential to reshape collateralized lending markets and impact Bitcoin's market dynamics on a global scale.

Banks Open to Bitcoin-Backed Loans, Saylor Claims

Michael Saylor has consistently highlighted Bitcoin's role as "pristine collateral" in his presentations. While specific confirmation from the banks themselves remains elusive, Saylor's assertions strongly suggest a growing receptiveness among financial institutions towards Bitcoin-backed lending.

The immediate implications of this trend include potential transformations in how loan structures are designed, with Bitcoin being utilized to secure credit lines. If this proposal gains full adoption, it could substantially influence market practices and alter the perception of cryptocurrency within the traditional finance sector.

Market reactions from various financial leaders indicate divided opinions on this matter. Prominent figures, including Saylor, are advocating for Bitcoin's inherent value as collateral, demonstrating a clear movement towards greater integration of the crypto market. However, explicit public confirmations from all the banks mentioned are still sparse.

Bitcoin's Rising Role in Traditional Finance

Bitcoin is increasingly being viewed as "digital gold," with its acceptance now extending into traditional banking through collateralized loans. This represents a significant shift from previous stances within the financial sector.

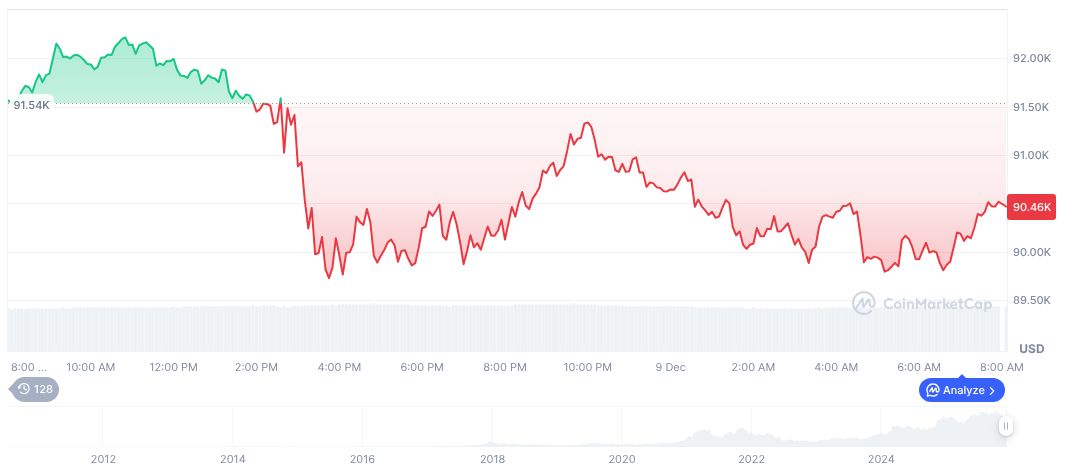

As of recent reports, Bitcoin's price is approximately 92,671.74 USD, with a market capitalization of 1,849,734,193,637 USD. Despite recent price fluctuations, Bitcoin continues to hold a dominant position in the market. Its price has seen a decrease of 18.89% over the past 90 days, indicating ongoing volatility alongside sustained investor interest.

Insights from the Coincu research team suggest that if major banks continue to embrace Bitcoin as collateral, it could spur the development of innovative financial products and lead to altered regulatory standards. Historical patterns indicate that institutional adoption often drives broader market integration, though it also presents challenges related to security and regulation.