Key Market Indicators and Expert Outlook

Spencer Hallarn, Global Head of OTC at GSR, anticipates a favorable year-end for the cryptocurrency market, citing low leverage levels as a key indicator for a potential 'Santa rally.' This optimistic outlook stems from reduced speculative activity, which could pave the way for price increases in major cryptocurrencies like Bitcoin and Ethereum.

Hallarn's analysis suggests that the current market conditions are conducive to positive change. With a significant portion of long positions having been liquidated in prior events, a foundational skepticism remains among market participants. However, this cautious sentiment, combined with low perpetual funding rates, indicates a reduced presence of leverage in the market. This setup, according to Hallarn, is "pretty bullish for a Santa rally" and suggests a positive outlook for the end of the year, with potential for further upside.

Historical Context and Market Dynamics

Historically, the cryptocurrency market has often experienced an upward trend towards the end of the year, a phenomenon commonly referred to as a "Santa rally." Bullish sentiment can reshape investment strategies during these periods, even in the wake of previous liquidations.

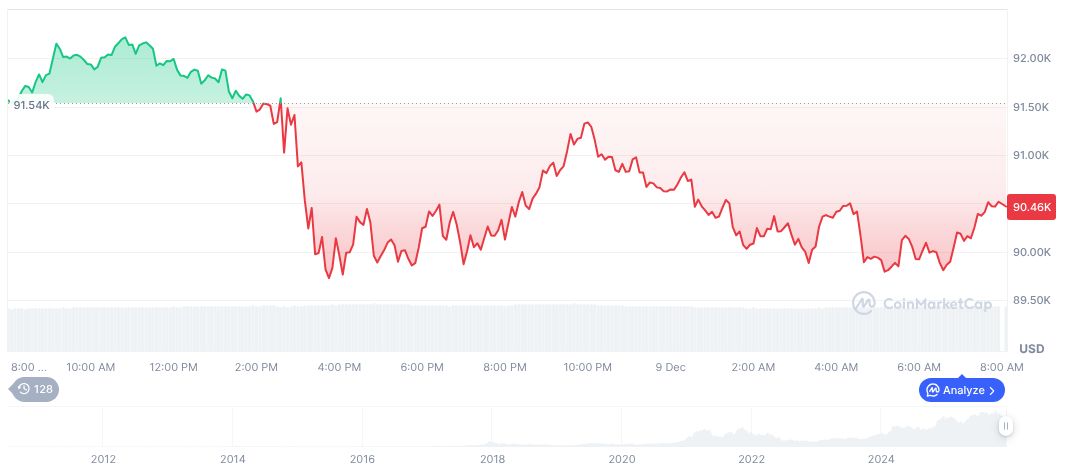

Current market data shows Bitcoin (BTC) trading at $92,585.14, with a market capitalization of $1,848,000,815,512 and a dominance of 58.48%. The 24-hour trading volume has seen a 15.68% change, reflecting active market dynamics. While BTC experienced a 2.95% rise in its recent 24-hour price movement, it has maintained a declining trend over the past 90 days, with an 18.90% decrease.

Research indicates that current leverage conditions are consistent with patterns observed during previous recovery phases in the crypto market. Historically, such conditions have often coincided with rallies, driven by positive market structures. If these trends persist, the market stabilization observed could reinforce confidence in future transactions and investment strategies.