Crypto markets are experiencing a significant rally, driven by a rare confluence of favorable monetary and institutional developments. Traders are responding positively to the increasing likelihood of a pro-crypto economist leading the Federal Reserve and the growing acceptance of Bitcoin within traditional investment portfolios by major asset managers.

Kevin Hassett Emerges as Front-Runner for Fed Chair

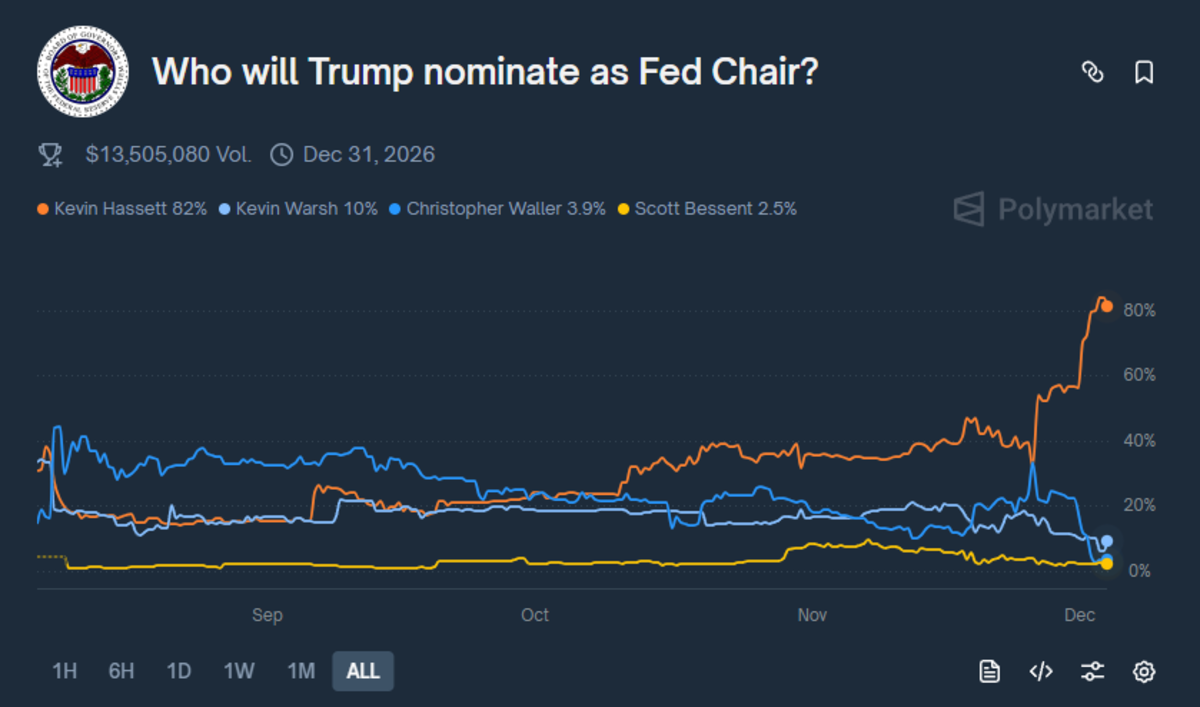

Prediction markets and Wall Street analysts are increasingly favoring Kevin Hassett, a long-standing economic advisor to President Trump, as the successor to Jerome Powell as the next Federal Reserve chair.

During an appearance in the Oval Office on December 2, President Donald Trump alluded to the potential appointment in front of reporters:

“I guess a potential Fed Chair is here too… I don’t know, are we allowed to say that? ‘Potential.’ He’s a respected person, that I can tell you. Thank you, Kevin.”

Hassett currently serves as the head of the National Economic Council and, like President Trump, has advocated for lower interest rates throughout the year. He has been a prominent candidate on Treasury Secretary Scott Bessent's shortlist for an extended period.

Significantly for the cryptocurrency sector, Hassett previously held a position on the Asset Management Academic and Regulatory Advisory Council at Coinbase, the largest crypto exchange in the United States. This development suggests the possibility that the individual overseeing the nation's monetary policy could also be a vocal supporter of cryptocurrencies.

Furthermore, Hassett has disclosed owning a stake in Coinbase valued at a minimum of $1 million, stemming from his advisory role with the exchange.

With Polymarket indicating an 82% probability of Kevin Hassett being nominated as Fed chair, market participants are already factoring in a more accommodating and dovish economic environment for 2026.

Vanguard's Policy Shift and ETF Demand Bolster Market Confidence

In a notable departure from its previous stance, Vanguard Group has announced it will now permit the trading of ETFs and mutual funds that primarily invest in cryptocurrencies, including products focused on Bitcoin, Ether, XRP, and Solana, on its brokerage platform.

"Vanguard Group, the world’s second-largest asset manager, has decided to allow ETFs and mutual funds that primarily hold cryptocurrencies to be traded on its platform, reversing a longstanding position," reported Bloomberg. The outlet also noted that this change occurs despite a significant decline of over $1 trillion in the crypto market's value since early October.

According to daily flow data from Farside Investors, the two days following Vanguard's December 2 approval witnessed a substantial increase in demand for crypto-related investment products.

BlackRock's IBIT ETF recorded inflows of $120 million on December 2, following several days of outflows.

Bank of America Suggests a 1%-4% Crypto Allocation May Be Appropriate

Concurrently, Bank of America has transitioned from a cautious approach to digital assets to one of explicit endorsement. In a recent advisory note, the bank's Chief Investment Officer team informed wealth management clients that an allocation of 1% to 4% in digital assets could be suitable, contingent upon individual risk tolerance.

“For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” stated Chris Hyzy, chief investment officer at Bank of America Private Bank.

This policy shift effectively moves away from a "zero crypto" default for one of the largest U.S. banks. It aligns Bank of America with competitors such as JPMorgan, Citi, and Morgan Stanley, which have been actively developing crypto ETF, custody, and structured product businesses throughout 2025.

Bitcoin and Crypto Markets Rebound Strongly

Bitcoin has experienced a robust recovery from its recent lows, trading at approximately $93,200 at the time of this report. This represents a nearly 2% increase on the day and over a 5% gain for the past week.

The total cryptocurrency market capitalization has climbed back to around $3.25 trillion. Bitcoin's dominance stands at approximately 58%, with Ethereum at roughly 11.96%. XRP saw a modest increase of 0.85%, trading at $2.18.

The day's market movements underscore the rapid shift in sentiment that can occur when multiple positive factors align. These include the anticipated appointment of a crypto-friendly Fed chair, a major U.S. bank advising clients to include digital assets in their portfolios, and a highly conservative asset manager like Vanguard finally opening its platform to crypto ETFs.