Key Insights on Market Trends

Matrixport's recent analysis has revealed a persistent trend of low retail participation in the cryptocurrency market, posing challenges for trading platforms and potential IPOs. This lack of retail investor engagement suggests that monetary policy changes alone may not be sufficient to sustain market rallies or boost trading volumes significantly.

Challenges for Trading Volumes and Market Sustainability

Matrixport, a crypto financial services platform co-founded by Jihan Wu and John Ge, has published an analysis indicating that low retail participation continues to be a significant factor in the cryptocurrency market. According to updates from Matrixport on Twitter, without a substantial influx of retail investors, even anticipated monetary easing, such as potential Federal Reserve interest rate cuts, may not result in a sustainable rally.

The analysis further highlights that South Korean trading volumes have remained considerably lower than their historical peaks observed in December of 2023 and 2024, periods when daily volumes reached billions of dollars.

"Without a broader influx of retail investors, even if the Federal Reserve chooses to cut interest rates, monetary policy easing alone will hardly drive a truly sustainable rally."

Jihan Wu, Co-founder, Matrixport

South Korean Trading Volumes Lag Behind Historical Peaks

During previous market peaks, South Korean cryptocurrency trading volumes consistently reached billions of dollars daily. In contrast, current daily volumes are hovering around the $1 billion threshold, underscoring Matrixport's findings regarding low retail activity.

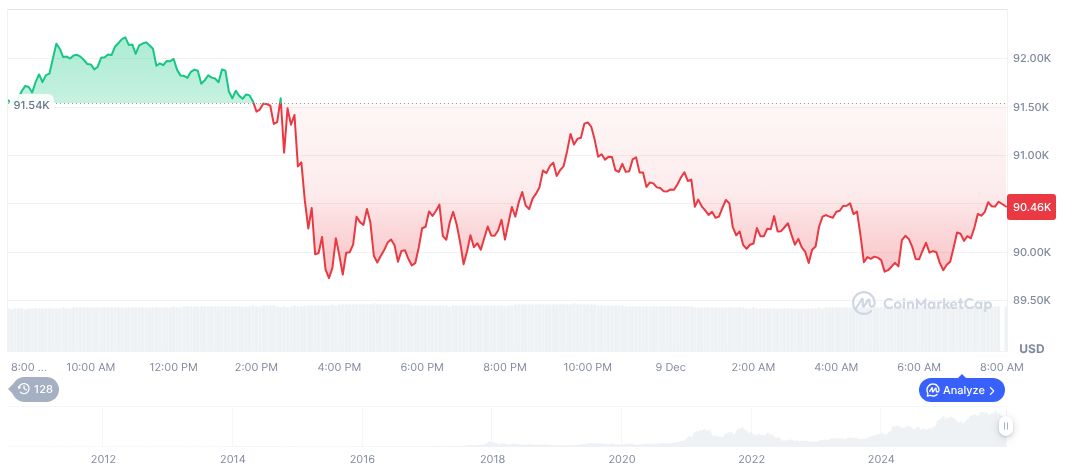

As of the latest reporting, Bitcoin (BTC) is priced at $93,706.28, holding a dominant 58.42% market share. Over the last 90 days, Bitcoin has experienced a 17.52% decrease in price. Its daily trading volume stands at $64.27 billion, with a minor 3.81% increase in value over the past 24 hours.

Research from the Coincu research team suggests that the cryptocurrency market's financial and technological expansion will likely remain constrained unless retail inflows experience a revival. The absence of significant retail activity could lead to continued challenges in sustaining price and volume growth, reinforcing the conclusions drawn by Matrixport's analysis.