Metaplanet plans to raise $135 million to expand its Bitcoin holdings, doubling down on the asset even after it plunged 33% from an all-time high on Oct. 6.

The Japan-based Bitcoin treasury firm announced on November 20 that it intends to issue 23.6 million Class B shares priced at 900 yen ($5.71) each, totaling 21.249 billion yen in the planned offering.

This offering will be executed through a third-party allotment to overseas investors, contingent on approval from a shareholder meeting scheduled for December 22.

The announcement coincided with Bitcoin heading for its worst monthly performance since June 2022, a period marked by the collapse of Do Kwon’s TerraUSD stablecoin. As of 6:07 a.m. EST, Bitcoin has fallen more than 10% in the past 24 hours to trade at $81,956.25.

Metaplanet Offering Features 4.9% Dividend

The new offering, branded "MERCURY," will provide holders with a 4.9% fixed annual dividend. Additionally, it grants them the right to convert their preferred shares into common stock at a conversion price of $6.34.

Today we announced MERCURY, our new Class B perpetual preferred equity. 4.9% fixed dividend. ¥1,000 conversion price. A new step in scaling Metaplanet’s Bitcoin treasury strategy. pic.twitter.com/UtnHA2lPRE

— Simon Gerovich (@gerovich) November 20, 2025

The company will maintain a market-price call option, which can be exercised if Metaplanet’s stock trades more than 130% above the liquidation preference for 20 consecutive trading days. These shares will not carry voting power but will include redemption rights under specific circumstances.

Metaplanet Stock Experiences Decline

Metaplanet shares have seen a significant drop, falling more than 61% in the past six months and an additional 7% in the last 24 hours.

The company's mNAV (multiple Net Asset Value), calculated by dividing its market cap by the value of its Bitcoin holdings, has fallen below 1, standing at 0.98 as of 5:37 a.m. EST.

Metaplanet ranks as the fourth-largest corporate Bitcoin holder globally, with 30,823 BTC on its balance sheet. At current market prices, these holdings are valued at approximately $2.55 billion, according to data from Bitcoin Treasuries.

The firm acquired its Bitcoin holdings at an average price of $108,036, resulting in an unrealized loss exceeding 23% for the company.

Potential MSCI Exclusion Looms for Metaplanet

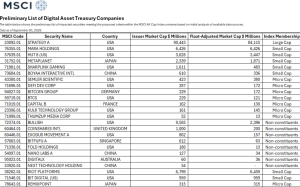

Metaplanet may face further challenges as MSCI is currently consulting with the investment community regarding the potential exclusion of firms with over 50% of their assets in crypto from its indexes.

A preliminary list released by MSCI indicates that 38 crypto companies might be subject to exclusion.

MSCI has noted that some digital asset treasury companies may exhibit characteristics more akin to investment funds, which are not eligible for inclusion in its indexes.

Charlie Sherry, head of finance at BTC Markets, commented that the odds of MSCI excluding such firms are "solidly in favor of it." He added that MSCI typically only initiates consultations for such changes when they are already leaning towards a specific decision.

JPMorgan estimates that if MSCI were to exclude Michael Saylor's Strategy, along with similar actions from other index providers, it could result in a $12 billion impact as passive investors tracking these indexes rebalance their portfolios.