Key Insights

- •Metaplanet has successfully raised $50 million in new funding, with the primary intention of acquiring more Bitcoin.

- •Both Metaplanet (MTPLF) stock and its Bitcoin accumulation strategy have garnered significant investor interest.

- •The price of Bitcoin experienced a notable dip, falling below $91,000, amidst market volatility leading up to the FOMC Meeting.

Metaplanet Executes $50 Million Loan Using Bitcoin Holdings as Collateral

Metaplanet, often referred to as Asia's MicroStrategy, announced on Friday that it has secured $50 million in funding. This capital infusion is designated for the acquisition of additional Bitcoin.

This development signals the firm's intent to resume its Bitcoin accumulation strategy for the upcoming year, following a recent pause in its purchasing activities.

The company's stock, MTPLF, saw a slight decline of 0.76% as the Bitcoin price dropped below $91,000. The announcement of the new loan was made after the market close.

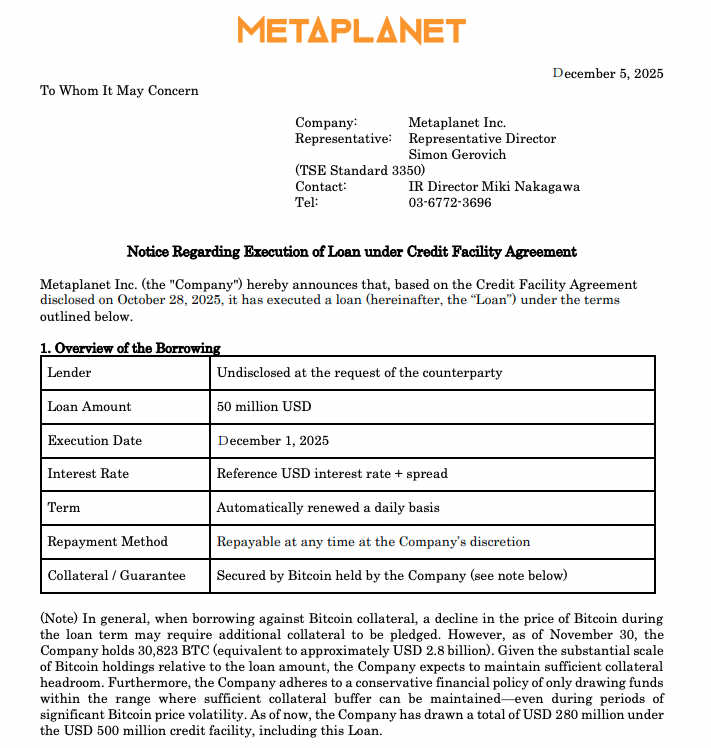

In an official announcement on December 5, Metaplanet disclosed that it had secured $50 million in funding by leveraging its existing Bitcoin holdings as collateral. The firm plans to utilize these funds primarily for acquiring more Bitcoin, with a stated target of accumulating 100,000 BTC by 2026 under its Bitcoin acquisition strategy.

Additionally, Metaplanet will allocate funds towards expanding its Bitcoin income generation business and for share repurchases. According to a statement from the firm, "Funds allocated to Bitcoin Income Generation business will be used as collateral for selling bitcoin options to earn premium income."

The Bitcoin treasury company intends to adopt a more conservative financial policy by drawing limited funds. This strategic shift comes in light of the significant volatility observed in the Bitcoin price.

To date, the company has drawn a total of $280 million from its $500 million credit facility, which now includes the recently secured $50 million loan. This follows a previous instance where the firm borrowed another $130 million against its Bitcoin holdings. Metaplanet has indicated that it plans to use the loan proceeds for additional Bitcoin purchases, income-generating activities, and potential share buybacks.

MTPLF Stock Sees Gains as Net Asset Value Reclaims 1x

Metaplanet's enterprise value has risen to a level that aligns with its Bitcoin holdings, resulting in its net asset value (mNAV) rebounding to 1x.

The company currently holds a total of 30,823 BTC, valued at over $2.82 billion at the time of reporting. Through its aggressive Bitcoin accumulation strategy, the firm has achieved a year-to-date yield of 496.4% in 2025.

On Friday, Metaplanet's stock price closed 0.76% lower at 392 JPY. The 24-hour trading range was between 390 JPY and 400 JPY.

A recent rebound in the Bitcoin price contributed to a 15% increase in the stock over the past week. However, at the time of writing, the stock remained down 70% over the last six months.

Meanwhile, MTPLF stock closed 0.80% higher at $2.52 on Thursday. The stock has also experienced a rebound of more than 10% in the past week. The 24-hour trading range was between $2.44 and $2.53. This recovery occurred amidst lower trading volumes.

It is noteworthy that the asset management firm Vanguard, which manages $11 trillion, holds 27.2 million MTPLF shares, valued at $69 million.

Bitcoin Price Drops to $91,000 Amidst Market Volatility

The price of Bitcoin was trading 2% lower over the preceding 24 hours, influenced by the expiration of crypto options. At the time of writing, Bitcoin was trading at $91,253.

The 24-hour low and high prices were $90,035 and $92,829, respectively. Furthermore, trading volume decreased by 19% over the last 24 hours, reflecting the ongoing volatility in anticipation of the FOMC Meeting.

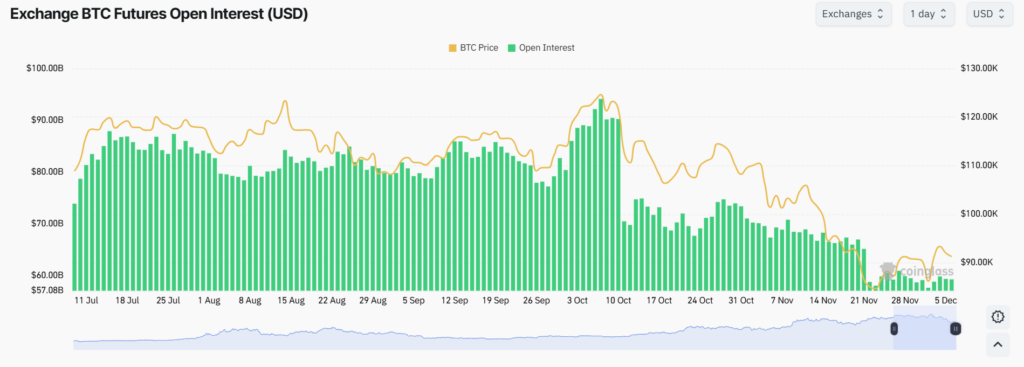

Data from CoinGlass indicated mixed sentiment in the derivatives market over the past few hours.

At the time of writing, the total BTC futures open interest had increased by 0.88% to $60.06 billion in the past hour. The 24-hour BTC futures open interest was down more than 1.44%. Notably, futures open interest on CME fell by 2.60%, and on Binance, it decreased by 2%.