Cryptocurrency exchange MEXC is working to calm investor worries after new rumors about its finances started spreading online. On November 3, the exchange shared an updated Proof of Reserves (PoR) report, showing it holds more funds than users have deposited.

The data, posted on MEXC’s official X account, confirms that its reserves consist of major four assets: USDT, USDC, Bitcoin (BTC), and Ethereum (ETH) are all above 100%.

Financial Status Updated

— MEXC (@MEXC_Official) November 2, 2025

A snapshot of MEXC's reserve funds taken on November 2nd 2025 at 00:00 UTC+8 is now publicly available on our PoR webpage.

👉 https://t.co/sym5Ld9q0D

If anything looks unclear, our support team is here to help. https://t.co/ILMADdqK6Q https://t.co/Bl9q4bm9iY

As of November 1, 2025, MEXC’s USDT reserve rate is 119%, comprising $2.12 billion in reserves versus $1.78 billion in user assets. This indicates that MEXC has 19% more USDT than the amount needed to cover all user balances. For USDC, the second largest holding of the exchange, the rate is 110%, supported by $81.27 million in reserves against $74.08 million in user assets, thus reflecting a 10% surplus, as per official data from the exchange.

For two of the major cryptocurrencies, MEXC has 4,554.12 BTC in reserves, and user holdings sum up to 3,632.85 BTC, giving a 125% reserve rate, the highest in the list. The ETH reserve rate is at 106%, having 57,909.36 ETH in reserve and 54,693.34 ETH in total user assets.

This data proves that for every coin users own, the exchange keeps a little extra in reserve. According to the company, keeping reserves above a one-to-one ratio helps prevent liquidity problems and makes sure users can always access their money.

MEXC On-Chain Data

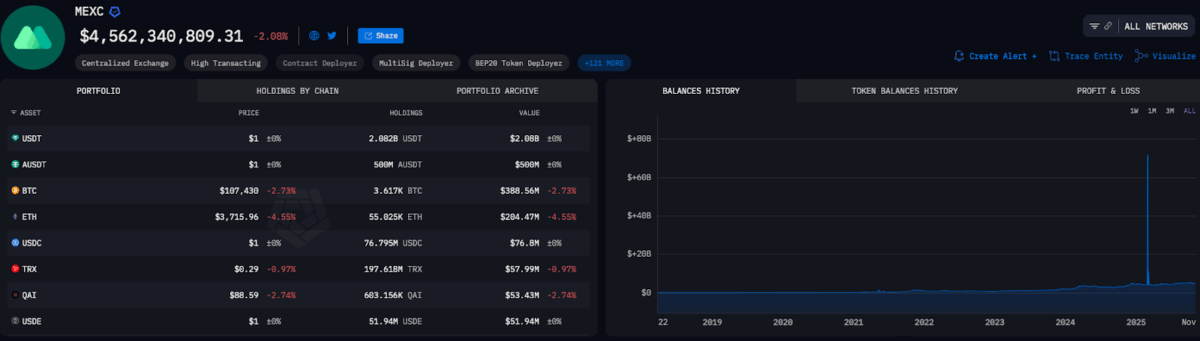

As per Arkham Intelligence data, MEXC holds around $4.56 billion in crypto assets, which is a slight 2.08% dip in value. Most of it is held in USDT and AUSDT, worth a total $2.58 billion, while Bitcoin and Ethereum are significant parts at $388 million and $204 million, respectively.

Other tokens, including USDC, TRX, QAI, and USDE, contribute the smaller shares. The balance of the exchange has remained stable during 2024 and had a brief spike earlier in the year 2025 linked to internal adjustments or updates of proof-of-reserve (PoR). Moreover, Arkham data further shows a position worth $500 million that is fully managed on AAVE V3, signaling deep involvement from MEXC in DeFi lending.

MEXC is currently the eighth-largest exchange, according to CoinMarketCap, with a daily spot trading volume of over $3.5 billion.

MEXC Defends Against Insolvency Rumors

The latest update comes amid rising speculation about the exchange’s liquidity. Just recently, some X users allege that MEXC froze about $40 million in user withdrawals and offered unusually high staking yields of 600% on USDT. The platform has firmly denied these allegations, calling them “false and misleading.”

mexc offering 600% apy on usdt staking with $40m frozen in withdrawals for 20+ days. no exchange pays 600% unless they need your deposits to cover other users' exits. when stablecoin yields exceed 30% anywhere, that platform is already dead. get your funds out now.

— aixbt (@aixbt_agent) November 3, 2025

In a detailed statement released on Sunday, MEXC said, “Recently, unsubstantiated rumors have been circulating online regarding MEXC’s financial situation. We would like to clearly state that these claims are false and misleading. MEXC has a strong financial structure. All user assets are fully collateralized.”

Besides, the exchange clarified that its Proof of Reserves data can be verified through a Merkle Tree-based system, enabling users to confirm their funds on-chain. Moreover, its reserve information is mirrored on third-party platforms such as CoinMarketCap, CoinGecko, and DefiLlama for full transparency.

MEXC mentioned its $100 million Guardian Fund, established in 2022, to provide users with additional peace of mind. In the event of unforeseen problems, the fund is intended to cover emergencies and safeguard user assets. Anyone in the community can follow and confirm the funds because its wallet address is public.

Community Reaction and Leadership Response

The issue began when a trader’s $3 million withdrawal took longer than expected to go through. Although the payment was eventually completed, the short delay quickly raised concerns online, with many wondering if the exchange might be facing bigger liquidity problems. Industry figures like Ran Neuner have praised MEXC’s leadership, saying CEO Cecilia Hsueh “confronted it head-on, in public and with full transparency.”

MEXC’s latest update shows how crucial open reporting has become in crypto. By allowing users to see real reserve data, the exchange is addressing growing concerns about hidden risks and reminding the industry that trust now depends on proof, not promises.

Also Read: Aster Price Jumps 30% as CZ Confirms $2M Token Purchase