MEXC's Apology and Market Reaction

On November 1st, MEXC's Chief Strategy Officer Cecilia Hsueh publicly apologized and returned $3 million to crypto influencer The White Whale. This action followed an initial freezing of the influencer's account, which MEXC had cited as being due to alleged trading violations.

This incident has brought to light significant issues concerning the practices of centralized exchanges, the importance of transparency, and the necessity of robust user protection measures. The substantial engagement from the cryptocurrency community played a crucial role in prompting policy reform at MEXC, and the MEXC token experienced an immediate impact in the market.

Cecilia Hsueh acknowledged errors in MEXC's operational processes and extended a public apology on behalf of the exchange. The White Whale's account had been frozen on the grounds of allegedly engaging in non-manual trades, which subsequently ignited a public campaign demanding the return of the frozen funds. The efforts of chain detective ZachXBT in supporting the influencer further amplified community pressure on MEXC.

MEXC's decision to return the $3 million represented a critical turning point in the influencer's campaign. The returned funds are designated for distribution to supporters of The White Whale and to various nonprofit organizations. This event has reignited discussions and calls for greater transparency in the operational procedures of cryptocurrency exchanges.

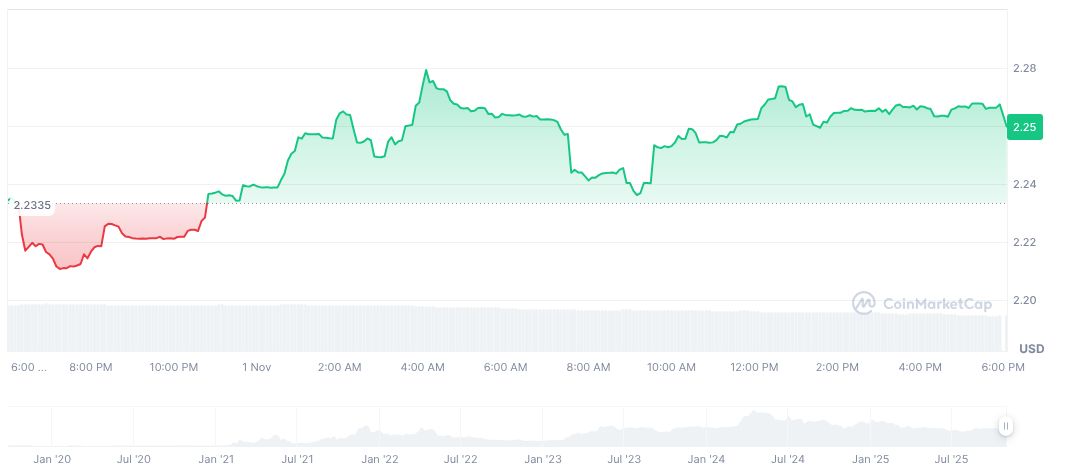

The public apology issued by MEXC resulted in a discernible market reaction, with approximately $39 million in assets being withdrawn from the exchange. This outflow indicates a decline in user trust following the incident. The MX token experienced a price drop of 3.5% shortly after the disclosure, further signaling investor concerns regarding asset security on the platform.

Centralized Exchange Transparency and Regulatory Implications

Centralized exchanges, including MEXC, have encountered similar public backlash in the past. Notable instances include exchanges like Binance and FTX, which faced criticism for their perceived opaque fund management practices. While public outcry has occasionally led to comprehensive reforms, direct and transparent redistribution of funds, as seen in this incident, has been a rare occurrence.

Following the return of the frozen funds, the MX Token was valued at $2.26, with its market capitalization reaching $209 million. Over the preceding 24 hours, the token saw a 1.3% increase, although it experienced a 5.68% decline over the last week. Trading volume also decreased by 22.20%, reaching $16.3 million, according to data from CoinMarketCap.

Analysts from Coincu suggest that this event could potentially lead to regulatory reforms. Regulatory bodies might consider implementing increased oversight on centralized exchanges to prevent future occurrences of asset freezing issues. The heightened emphasis on enhancing user protection and refining remedial processes could reshape the operational practices of these exchanges, especially as impacted users increasingly advocate for systemic changes within the industry.