Key Insights

- •Michael Saylor states that major U.S. banks have transitioned from being anti-Bitcoin to pro-crypto within the past 12 months.

- •Eight of the top 10 U.S. banks are now involved in Bitcoin-backed lending, with most joining in the last six months.

- •Schwab and Citi are preparing to offer BTC custody and credit services starting next year.

- •Saylor argues that the banking sector's pivot to Bitcoin is occurring years earlier than industry forecasts had predicted.

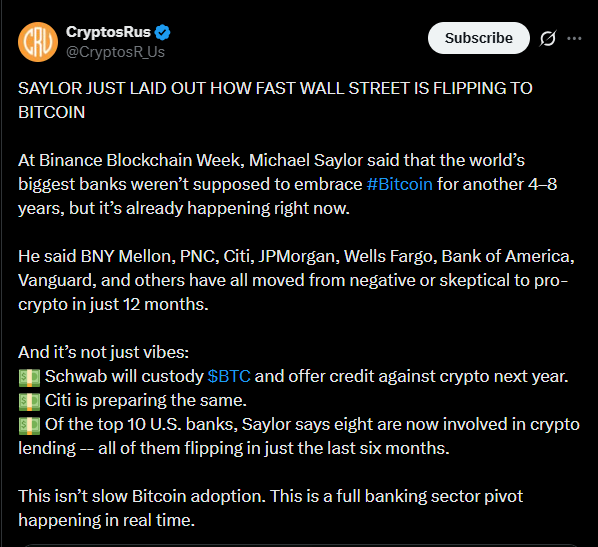

Bitcoin news emerging from Binance Blockchain Week in Dubai took a significant turn on December 4, 2025. Strategy Inc. executive chairman Michael Saylor revealed that Wall Street's largest banks had shifted from being crypto skeptics to active participants in just 12 months, a timeline far ahead of the 4–8 year prediction experts had once made.

During his address to a packed audience at the Coca-Cola Arena, Saylor identified BNY Mellon, PNC, Citi, JPMorgan, Wells Fargo, Bank of America, and Vanguard as institutions now offering Bitcoin custody and credit services. He further explained that eight of the top 10 U.S. banks entered the crypto lending space within the last six months alone.

As Bitcoin traded at $92,669 and spot ETF inflows reversed to positive flows, according to Farside Investors data, Saylor's comments highlight a fundamental shift in the market. Mega-finance entities are now significantly influencing Bitcoin's trajectory, decoupling it from retail-driven cycles and aligning it more closely with macroeconomic forces such as Federal Reserve easing and fiscal deficits.

For investors, this development serves as a validation of long-term conviction, though it also necessitates continued vigilance regarding regulatory developments.

From Skepticism to Bitcoin Custody in 12 Months

Saylor shared these insights during a fireside chat at Binance Blockchain Week, moderated by The Bitcoin Therapist. The conversation was shared in a December 5 X post by @CryptosR_Us. He stated:

The world’s biggest banks weren’t supposed to embrace Bitcoin for another 4–8 years, but it’s already happening right now.

He proceeded to list several prominent institutions: BNY Mellon is now providing Bitcoin custody services for ETFs, PNC is offering lending against BTC collateral, and Citi is preparing to launch similar services in 2026.

JPMorgan, Wells Fargo, and Bank of America have also followed this trend, with Vanguard launching Bitcoin-linked products in the fourth quarter.

This accelerated adoption can be traced back to the Basel III reforms, which were finalized in July 2025. These reforms classified Bitcoin as a Tier 1 asset for banks, following Federal Reserve guidelines issued in the same month.

According to a PwC report released on November 28, 2025, which analyzed $50 billion in new credit lines extended since September, eight of the top 10 U.S. banks are now facilitating crypto lending. This is a significant increase from zero such activities in Q4 2024. Schwab's planned custody rollout in Q1 2026, announced on December 2, further solidifies this trend.

Responses to the clip reflected significant excitement among traders. On December 5, @CryptoJoeReal posted, "Institutions want Bitcoin. Everyone wants Bitcoin," while @GuoyuRwa added, "Wall Street was supposed to ‘warm up to Bitcoin’ by 2030… and they’re already sprinting in by Q4 2025."

Bitcoin News on Lending Boom: $50 Billion in New Credit Lines

Saylor specifically emphasized lending as a key indicator of this shift. He referenced JPMorgan’s $10 billion BTC-backed credit facility, which was launched on October 15, 2025, as reported in company filings.

This development is part of a broader surge in crypto lending. Kaiko Research's December 3 report indicated that crypto lending volumes reached an annualized $150 billion in Q4, marking a 300% increase from Q1. Banks have captured a 40% share of this market, previously dominated by DeFi protocols.

Banks are holding Bitcoin as collateral with loan-to-value ratios between 50% and 70%, issuing USD loans at rates of 4% to 6%. These rates are notably lower than the average of 8% found in DeFi protocols like Aave, according to its dashboard.

PNC's lending program, which began on November 20, has already originated $2.5 billion in loans, primarily to family offices, as reported by American Banker on December 2.

This trend in Bitcoin lending effectively reduces volatility drag for borrowers. By having access to credit, individuals and entities can avoid selling their Bitcoin during market downturns, thereby preserving potential upside gains.

Institutional flows further support this narrative. By December 5, BlackRock’s IBIT ETF AUM had reached $62.45 billion, showing a 5% weekly increase. Concurrently, derivatives notional value surged from $10 billion to $50 billion over four weeks, according to CME Group data confirmed on November 28.

Saylor linked these developments to broader macroeconomic factors:

It’s macro. It’s political. It’s structural. Mega-finance actors are steering Bitcoin now.

Saylor also expressed his view that the traditional 4-year halving cycle is becoming less relevant for Bitcoin's price movements. "The halving isn’t what drives Bitcoin anymore," he argued in the clip, pointing out that daily trading volumes have reached $100 billion, which is five times the average seen in 2021. This high volume, he suggested, makes supply shocks less impactful.

Since the halving event in April 2024, Bitcoin has seen a year-to-date gain of 120%. This growth is attributed to factors such as ETF inflows and the holdings of corporate treasuries, including MicroStrategy’s significant Bitcoin reserves, which amount to 650,000 BTC.