Key Insights

- •Michael Saylor’s Strategy (formerly MicroStrategy) has purchased 10,624 BTC for $962.7 million.

- •The largest Bitcoin treasury company expanded its holdings to 660,624 BTC.

- •MSTR stock jumped more than 2% following the massive purchase.

- •Bitcoin price pared earlier gains and fell under $92K.

Michael Saylor revealed on Monday a massive 10,624 BTC purchase by MicroStrategy, now operating as Strategy. With this latest acquisition, the company, which holds the largest corporate Bitcoin treasury, has expanded its total Bitcoin holdings to 660,624 BTC.

MicroStrategy (MSTR) stock price experienced a jump of more than 2% as Saylor attended the Bitcoin MENA conference and bulls strongly targeted upside.

Strategy Acquires 10,624 BTC

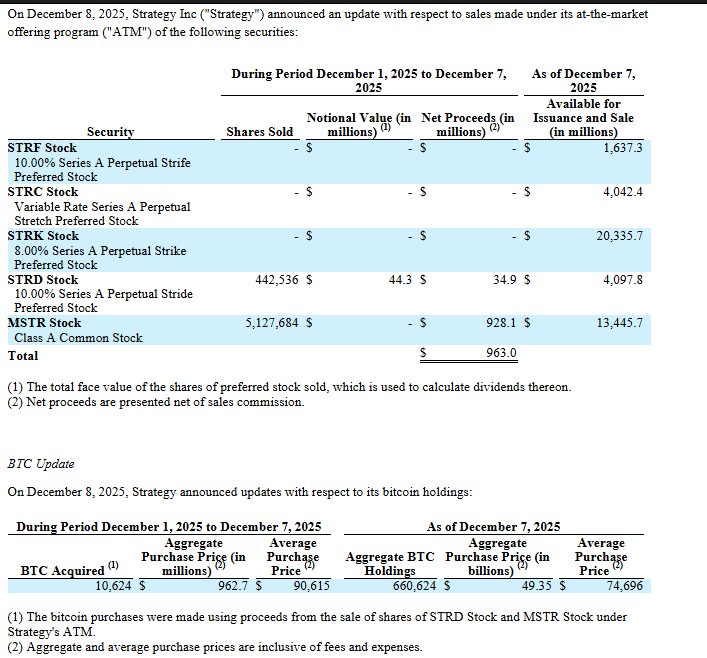

According to a press release on December 8, Strategy (formerly MicroStrategy) acquired an additional 10,624 BTC at an average price of $90,615 per coin between December 1 and 7. The company utilized proceeds from its at-the-market (ATM) offerings for MSTR and STRD shares to fund these Bitcoin purchases.

Executive Chairman Michael Saylor announced the significant Bitcoin purchase to his shareholders and the broader crypto community via X. He highlighted that the company has achieved a year-to-date (YTD) Bitcoin yield of 27.8%. During the Bitcoin MENA conference, Saylor also disclosed plans to meet with sovereign wealth funds in the Middle East.

With this latest acquisition, MicroStrategy has increased its total Bitcoin holdings to 660,624 BTC, purchased for a total of $48.38 billion at an average price of $74,436 per coin. The company's current holdings are valued at $60.41 billion at the prevailing market price, representing unrealized gains of nearly $12 billion.

Previously, Michael Saylor’s MicroStrategy added 130 BTC for $11.7 million at an average price of $89,960 per coin. At that time, the firm also announced the establishment of a $1.44 billion reserve for dividends.

MicroStrategy (MSTR) Stock Sees Gains

At the time of writing, MSTR stock had jumped more than 2% to $182.45 during Monday's pre-market trading hours. Bitcoin price experienced a tumble below $85K.

On Friday, MicroStrategy (MSTR) stock closed 3.77% lower at $178.99 amid a pullback in Bitcoin price below $88K. However, trading volumes were rising above the average of 13 million.

Strategy stock provided an approximate 2% return last week, despite selling pressure. According to Google Finance, the YTD 2025 stock return has seen a decrease to a 38% loss.

Despite this, MicroStrategy has received buy ratings from Bernstein and Cantor Fitzgerald. Gautam Chuggani from Bernstein continues to maintain a bullish outlook, although he has reduced his price target from $600 to $450.

Bitcoin Price Fluctuates Below $92K

BTC price pared earlier gains and dropped below $92K. The price remained 3% higher after a rebound from a low of $87,799, coinciding with a surge in MicroStrategy (MSTR) stock.

Trading volume increased by 67% over the last 24 hours amid the pullback, indicating that traders remained cautious ahead of the key FOMC Meeting.

Derivatives market data from CoinGlass confirmed jitters among traders, with the 24-hour BTC futures open interest beginning to decline from more than 3% upside.

At the time of writing, the total BTC futures open interest fell 0.77% to $58.06 billion in the past 4 hours. Notably, futures open interest on CME and Binance dropped by 0.57% and 0.51%, respectively.