Key Insights

- •MicroStrategy (MSTR) stock saw a 2% daily chart increase despite negative commentary regarding potential delisting from the MSCI index.

- •Ledger CTO highlighted the rapid growth of the crypto industry, now attracting attention from major banks like JPMorgan and Morgan Stanley.

- •MSTR is positioned for a short-term target of $200, bolstered by support from the crypto community.

Current MicroStrategy (MSTR) Stock Price Outlook

The price of MicroStrategy (MSTR) stock has rebounded today, November 28, 2025, amidst a campaign against its potential delisting from the MSCI index. Following this rally, analysts and investors are now looking towards the $200 milestone as the next potential target for the stock.

As of this writing, MSTR stock is trading at $185, marking a 5.35% increase over the past 24 hours. The stock also experienced a 2.08% gain in pre-market trading.

However, MicroStrategy stock has seen a significant decline over longer periods, down 38.29% in the past month and 51.8% over the previous six months. Year-to-date, MSTR is down sharply by 39.4%, and over the past year, it has fallen by 54.7%.

The stock experienced volatility in early November, trading between $169.70 and $180.63, with an average daily volume of nearly 14 million shares. The MSTR stock price largely mirrored the recent pullback observed in Bitcoin (BTC) from its peak levels.

In mid-November, MicroStrategy Chairman Michael Saylor experienced a significant personal financial loss, over $4 billion in six months, as both MSTR stock and Bitcoin prices declined.

MSTR stock also saw a drop following reports that MSCI was contemplating the exclusion of companies like MicroStrategy that hold digital assets exceeding 50% of their total assets.

Following a response from Michael Saylor, who stated that MicroStrategy is a publicly traded company that utilizes Bitcoin as productive capital, MSTR stock experienced a rebound of nearly 1%.

MSCI and the Delisting Implications

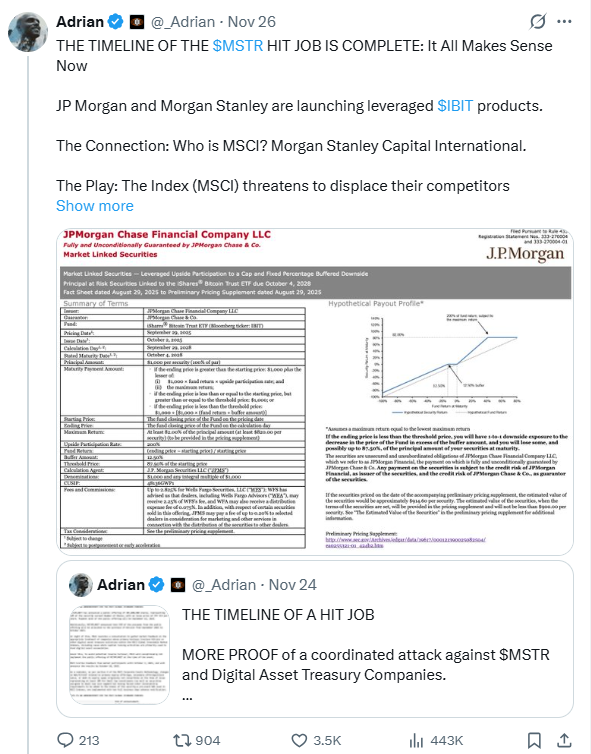

According to crypto analyst Adrian on X, the campaign to delist MicroStrategy from MSCI and other major indices is ongoing.

The analyst suggested that JPMorgan, Morgan Stanley, and MSCI are collaborating to devalue or delist MSTR from prominent stock indices. Adrian argued that this move is not primarily about risk management but rather a strategic takeover attempt.

Adrian noted that delisting MSTR stock from major indices would likely trigger forced selling. MSCI provides global stock indices that are tracked by trillions of dollars in passive funds. Consequently, if MSTR were to be delisted, index trackers would be compelled to sell their shares, leading to a forced liquidation.

This forced selling could potentially free up billions in capital, which could then be redirected into investment products tied to BTC, such as BlackRock’s iShares Bitcoin Trust ETF (IBIT).

The analyst further explained that JPMorgan and Morgan Stanley are already introducing leveraged IBIT products designed to capture Bitcoin that might be displaced from MicroStrategy.

Adrian outlined the banks' actions as a sequence of escalating decisions. This began with hedge fund manager Jim Chanos announcing a direct Bitcoin purchase while simultaneously shorting MSTR stock.

The analyst characterized this move as a "blatant attempt to sway sentiment."

Shortly thereafter, JPMorgan increased the cash available for borrowing MSTR shares for leveraged trades.

Adrian views this action as hostile, intended to raise selling pressure, particularly since MicroStrategy stock had been rallying on Bitcoin's gains.

Community-Wide Solidarity for MicroStrategy

Other stakeholders in the crypto space, such as Ledger CTO Charles Guillemet, have also expressed support for MicroStrategy and voiced their displeasure regarding its potential removal from major global stock indices.

In an X post, Guillemet stated that the move represents a desperate attempt to impede the momentum of the crypto market.

The Ledger CTO contended that the delisting effort is a pushback from traditional finance (TradFi) gatekeepers.

He believes that Bitcoin treasuries are challenging established corporate cash management norms, while stablecoins like USDT are enabling global payments to bypass traditional banking systems.

Guillemet concluded by stating, "The paradigm shift is inevitable: you either embrace it, or you get disrupted."

Market analysts also perceive the negative commentary surrounding a potential MSTR delisting from MSCI positively. Some have forecasted that the MSTR stock price could reach $200 in the short term.

Meanwhile, TipRanks analysts have issued 14 buy ratings and 0 sell ratings for MSTR. They have also predicted an average target price of $524.

These analysts pointed out that MicroStrategy's balance sheet remains secure as long as Bitcoin stays above approximately $87,300.

As of this writing, the BTC price has rallied back towards the $91,000 levels.