MicroStrategy's Strategic Bitcoin Plans

MicroStrategy, under the leadership of Michael Saylor, is preparing to unveil its latest Bitcoin acquisition strategy this coming Monday. This move signifies the company's ongoing commitment to substantial investment in the digital asset.

The forthcoming announcement is anticipated to have a notable impact on Bitcoin's market dynamics. It will underscore MicroStrategy's steadfast dedication to cryptocurrency, even in the face of market volatility, and could establish new bullish precedents for the asset.

Bitcoin's Institutional Support in a Volatile Market

MicroStrategy, recognized for its systematic accumulation of Bitcoin, will disclose its updated buying strategy next week. Despite prevailing market fluctuations, the company remains committed to its established Bitcoin acquisition approach. Michael Saylor, the founder of MicroStrategy, has publicly confirmed that the company has not sold any Bitcoin, reinforcing the firm's long-term perspective on BTC.

In response to recent market speculation, Saylor's explicit denial of any Bitcoin sales serves to reassure investors about the company's unwavering commitment to holding its cryptocurrency assets. The broader community's reaction indicates continued faith in MicroStrategy's strategy, with many viewing Monday's announcement as a potential catalyst for significant shifts in the Bitcoin market.

Market Data and Insights on Bitcoin

Did you know? Historically, MicroStrategy's announcements regarding Bitcoin purchases have frequently correlated with short-term price increases, reflecting strong institutional backing and confidence in Bitcoin's value.

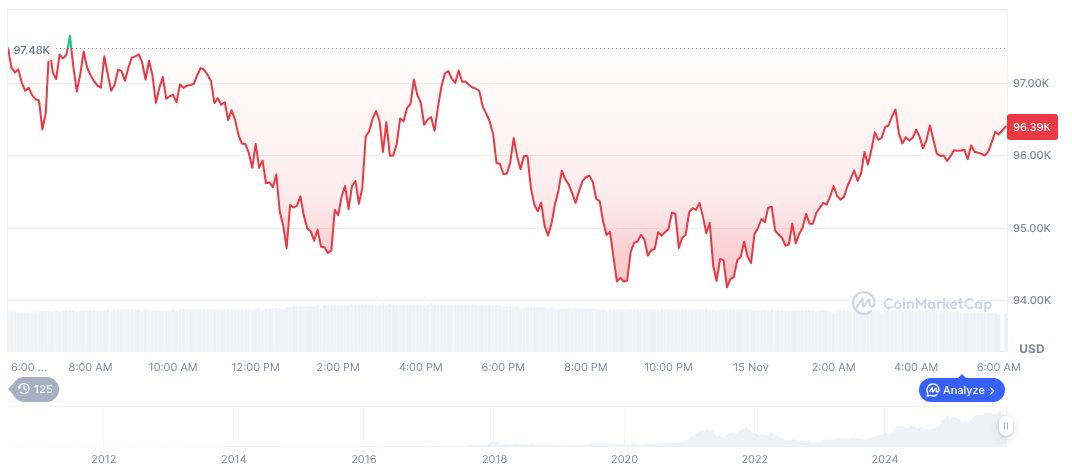

Bitcoin (BTC) is currently trading at $96,046.62, with a market capitalization of $1,916,015,912,638.93 and a 58.93% dominance in the cryptocurrency market. The 24-hour trading volume stands at $97,049,818,845.14, indicating a recent decrease of 14.94%. In terms of price performance, BTC has seen a daily decline of 1.05%, a weekly drop of 6.30%, and a three-month decrease of 18.68%, according to data from CoinMarketCap.

The research team at Coincu suggests that MicroStrategy's consistent actions could stimulate heightened institutional interest in the cryptocurrency markets. A sustained pattern of purchasing by a prominent entity like MicroStrategy reinforces the potential for regulatory and market adjustments, thereby promoting Bitcoin as a resilient asset in the face of financial instability.