Key Developments

MicroStrategy announced a net profit of $2.8 billion for its third quarter, a figure largely attributed to its substantial Bitcoin holdings valued at $69 billion. This announcement was made after the U.S. market closed. Despite this reported profit, the company is facing considerable market skepticism, which has led to a significant decline in its stock value. The stock has dropped 44% since its peak in November 2024, effectively erasing its previous premium over the market.

Bitcoin's Role in Corporate Finance Strategies

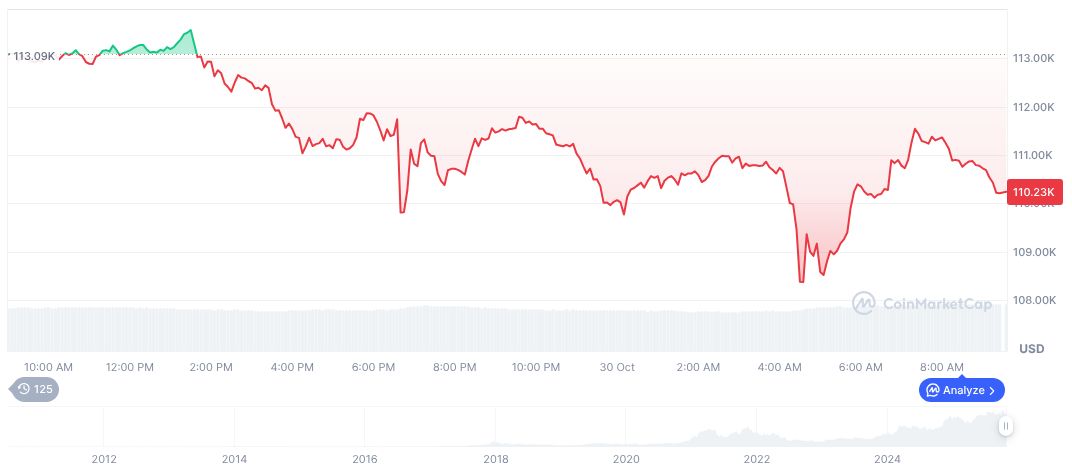

Bitcoin (BTC) is currently trading at $109,715.04 with a market capitalization of $2.19 trillion, commanding a 59.32% market dominance. Recent data indicates a slight negative price change over the past 24 hours and a broader 4.01% decline over the last 30 days, despite earlier quarterly highs. Bitcoin's fundamental metrics, including its limited supply and trading volume, underscore its critical position within MicroStrategy's financial operations.

Research from the Coincu team suggests that MicroStrategy's aggressive Bitcoin strategy might invite increased regulatory attention regarding corporate Bitcoin reserves. This approach could pave the way for a transformation in how large corporations engage with digital assets, potentially influencing future investment strategies and shaping regulatory responses.

"We continue to explore innovative financing mechanisms and are actively assessing international capital markets and ETF structures to optimize shareholder value," stated Phong Le, CEO of MicroStrategy.

Market Analysis and Future Outlook

A notable observation is that while MicroStrategy's stock has depreciated by 44% year-over-year, Bitcoin's value has surged to over $126,000. This disparity highlights the volatile relationship between equity markets and cryptocurrency, demonstrating the dynamic nature of asset performance.

The current trading price and market cap of Bitcoin continue to emphasize its importance in corporate finance, particularly for companies with significant exposure to digital assets.

As the cryptocurrency market continues to mature, MicroStrategy's strategic decisions may serve as a precedent, prompting other corporations to re-evaluate their asset allocations and risk management frameworks.