Key Points

- •Mizuho Securities has lowered Circle Internet Group's stock target price to $70, citing market risks.

- •Circle's stock has experienced a nearly 40% decline in the past month.

- •Analysts attribute these concerns to increased competition and distribution costs.

Mizuho Adjusts Circle's Stock Outlook

Mizuho Securities has downgraded Circle Internet Group's stock, reducing its target price from $84 to $70, with a projected date of November 15, 2025. This adjustment is attributed to concerns regarding mid-term profitability risks and the escalating competitive landscape within the market.

This revised outlook from Mizuho stands in contrast to the more optimistic assessment previously provided by JPMorgan. It highlights the potential for significant market volatility, which can be influenced by fluctuations in interest rates and the ongoing challenges faced by the stablecoin sector.

Market Performance and Stablecoin Stability

As of November 15, 2025, there are no publicly available statements or direct quotes from Circle Internet Group's leadership, including CEO Jeremy Allaire, specifically addressing the Mizuho downgrade.

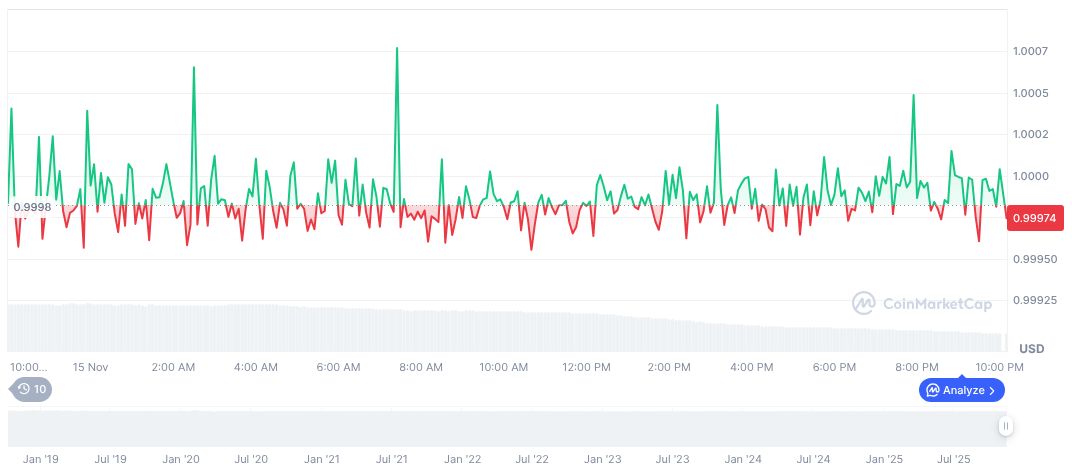

The stablecoin USDC continues to demonstrate stable pricing, maintaining its value at $1.00 despite moderate fluctuations in trading volume. According to CoinMarketCap data, the stablecoin recorded a 24-hour trading volume of $8.58 billion. The minimal price movement observed indicates a degree of stability, even amidst broader shifts within the cryptocurrency industry.

Divergent Analyst Perspectives on Circle's Future

Mizuho's assessment presents a stark range of potential outcomes for Circle's stock. Their pessimistic target is set at $38, which is considerably lower than their optimistic scenario of $251. This wide disparity underscores the significant uncertainty and variability inherent in current market predictions for the company.

The Coincu research team suggests that future interest rate adjustments and potential stagnation in stablecoin circulation could adversely affect both Circle's stock performance and the broader adoption of USDC. The research also indicates that increased competition is likely to put pressure on profit margins. However, the team notes that Circle's robust technological infrastructure and its strategic partnerships may serve as mitigating factors, potentially contributing to the company's resilience.