Key Launch Details and Tokenomics Strategy

Monad is poised to launch its public mainnet on November 24, 2025. The launch will feature a carefully considered tokenomics approach and will operate with 200 globally distributed validator nodes. These nodes are designed to run on consumer-grade hardware, emphasizing efficiency and accessibility.

A significant decision revealed is the exclusion of locked MON tokens from staking eligibility. This measure is intended to foster a healthier token distribution, which could influence market dynamics and contribute to the long-term stability of the ecosystem.

Tokenomics Strategy Emphasizes Balanced Distribution

Monad co-founder Keone Hon announced the exclusion of locked MON tokens from staking as the mainnet launch approaches. Hon emphasized that this measure was designed to ensure long-term success through balanced token distribution. "As the launch of the public mainnet is approaching, I would like to share an important principle of Monad's tokenomics: locked MON tokens will not be eligible for staking. This will help Monad achieve long-term success through a more healthy token distribution." Additionally, Monad plans a launch with 200 validator nodes distributed globally, running on consumer-grade hardware, promising efficiency without high infrastructure costs.

With the exclusion of staked MON tokens, the dynamics of circulating supply will focus on unlocked tokens. By limiting staking eligibility, Monad aims to prevent centralization risks and encourage more decentralized participation. This decision aligns with previous successful policies seen in other blockchain launches that discouraged staking of locked tokens.

Market reactions have been mixed, with community members on Monad’s official channels showing support, while others express concern over the decision's immediate impact on potential returns. Hon's statement on X (formerly Twitter) has been a focal point for reactions, highlighting the importance of Monad's leadership in navigating these restructuring strategies.

Market Implications of Token Distribution Changes

Historical blockchain launches that introduced restrictions similar to Monad's have demonstrated reduced short-term speculation and fostered longer-term investor confidence.

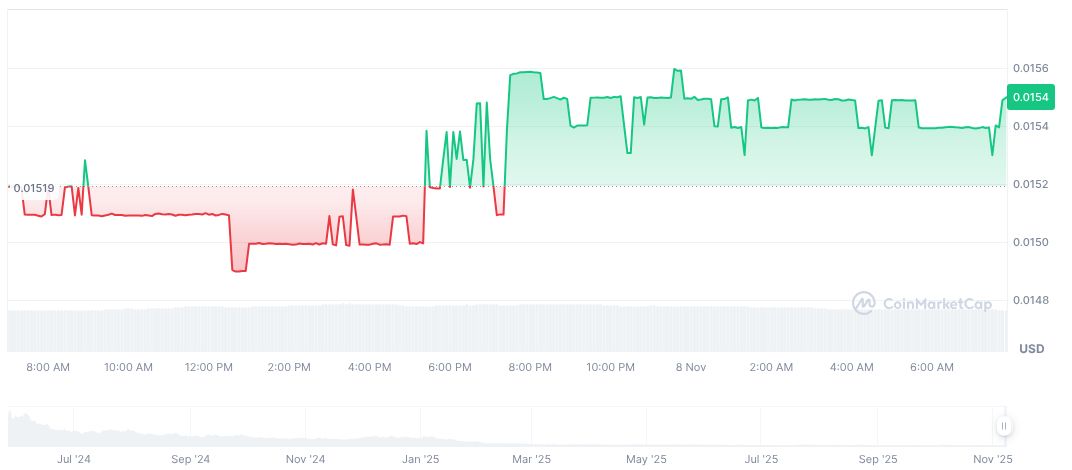

According to CoinMarketCap, MON's price is currently $0.02, with a market cap of $9.21 million. Over the past 90 days, MON's price has declined by 27.40%. The 24-hour trading volume is reported at $1.25 million, marking an 8.33% drop from the previous day, illustrating market volatility leading up to the mainnet launch.

The Coincu research team suggests that Monad's focus on healthy token distribution could enhance long-term stability and appeal to consistent, long-term investors. Regulatory feedback post-launch might affect the perception of such tokenomics decisions, yet their potential to deter over-concentration remains a potential positive for market dynamics.