Key Insights

- •The over 40% weekly rally in Monero (XMR) crypto price propels it to a new historic top.

- •Monero is now eyeing the top 10 spot by market cap and could be on track to dethrone Cardano.

- •Analysis reveals a correlation between Monero’s rally and the price action of gold or silver.

The past seven days have been particularly noteworthy for the Monero cryptocurrency and its community, marked by an unexpected parabolic price surge.

Monero's price (XMR) experienced a 51% increase over the last seven days, establishing it as the best-performing cryptocurrency among the top 50 coins by market capitalization this week.

Last Friday, Monero traded as low as $450. By Wednesday, it had surged to a new all-time high (ATH) of $799, representing a 77% rally. However, the price has since pulled back to $701 at the time of reporting.

This slight retracement occurred while the XMR price was in significantly overbought territory. Despite this, the privacy coin successfully surpassed Bitcoin Cash and Chainlink, securing the 11th position among the top cryptocurrencies by market cap.

Monero is now strategically positioned to target the top 10. Further upward movement could potentially allow it to overtake Cardano in market capitalization.

Is Monero Crypto the New Digital Gold?

Monero's rally (XMR) is occurring while many leading cryptocurrencies are struggling to sustain bullish momentum. In fact, some, including Bitcoin, have faced difficulties pushing their weekly gains beyond 5%.

More significantly, Monero's price action has shown a stronger alignment with that of gold and silver. These precious metals have also achieved impressive bullish price movements this week, reaching new historic highs.

This alignment suggests that Monero's price surge might reflect how the market is currently valuing the privacy coin. The increased demand indicates that Monero's emphasis on privacy and restricted access aligns with the characteristics of a safe-haven asset.

XRM has regained its status as the leading privacy coin, especially following a developer exit from Zcash, which had previously impacted confidence in that project. Zcash (ZEC) saw a more modest 7% increase this week, indicating lower demand.

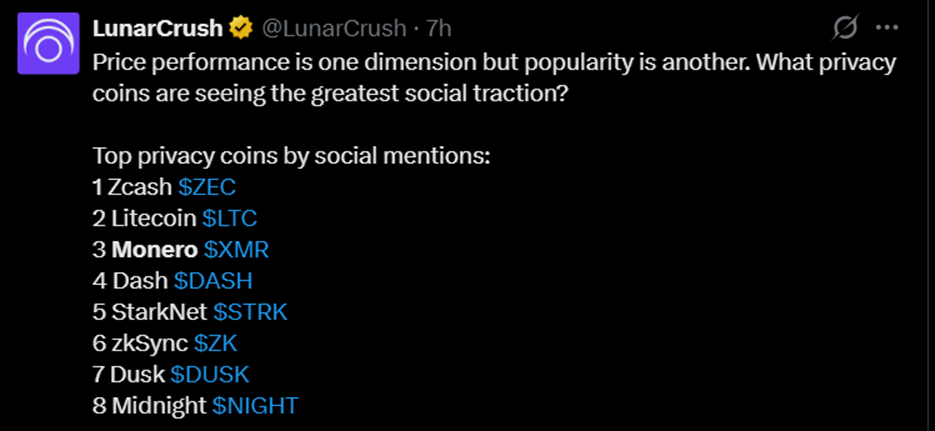

Interestingly, the latest privacy coin rankings by social mentions from LunarCrush showed Monero in third place, following Zcash and Litecoin.

XMR Demand Drivers and Major Liquidation Event This Week

The rally in Monero crypto is likely driven by a combination of factors. The challenges faced by Zcash may have prompted a significant migration of investors towards XMR.

Furthermore, escalating privacy concerns are encouraging investors to embrace privacy coins, and Monero is well-positioned to capitalize on this trend due to its first-mover advantage and established leadership in the sector.

These observations suggest that the narrative surrounding privacy coins could become a dominant theme in the market for the upcoming year. Concurrently, demand dynamics have also led to notable shifts this week.

For instance, Monero may have experienced its largest daily short liquidation event in recent history. Approximately $3.9 million worth of XMR shorts were liquidated on Tuesday, contributing to a short squeeze that fueled its ascent to new highs.

Notably, XMR recorded over $5.7 million in net outflows on Tuesday, marking the highest daily net outflow for the privacy coin in the past 12 months.

This selling pressure was likely driven by profit-taking, as the cryptocurrency was trading in significantly overbought conditions at the time. These outflows indicated bearish sentiment and mirrored the rising short positions in the derivatives market.

In related news, Monero crypto has achieved a record open interest of $278 million. This suggests that Monero crypto is likely to experience further volatile price movements as derivatives interest in the coin continues to grow.