Monero (XMR) has experienced a significant price surge today, breaking past the $400 mark and becoming the top gainer in the cryptocurrency market. This development has caught many traders by surprise, particularly given the history of regulatory actions against Monero.

Governments have, for years, pursued a strategy of delisting Monero from exchanges and even implementing bans in certain European regions. However, rather than diminishing demand, these actions may have inadvertently fostered Monero's independence from the broader crypto market.

This strategic pressure has potentially transformed XMR into one of the most uncorrelated and self-reliant digital assets, and the market is now reflecting this unique position.

It turns out that by delisting $XMR from every exchange and banning it in the EU, governments have actually created the perfect uncorallated asset. Monero is the only crypto that does not rely on exchange liquidity, and almost no one can buy on margin.

Jake Browatzke

Reasons Behind the Monero Price Rally

The current rally gained significant momentum once XMR decisively surpassed the substantial $400 resistance level. This price point had previously acted as a barrier to upward movement on multiple occasions. However, this time, buyers were able to push through it with sustained force.

With the absence of margin trading, reduced exposure on centralized exchanges, and a growing user base seeking private transaction capabilities, the price action of XMR is primarily influenced by spot buyers. This means the surge is driven by genuine demand rather than leverage or speculative hype.

Many market analysts suggest that the delisting of Monero may have curtailed short-term speculative trading but, in turn, strengthened long-term ownership and conviction among its holders.

Given that a significant portion of XMR is held in self-custody wallets and traded directly between peers, its market behavior diverges from that of many other cryptocurrencies. When demand increases, the limited available liquidity can lead to rapid price appreciation.

Technical Analysis of the XMR Chart

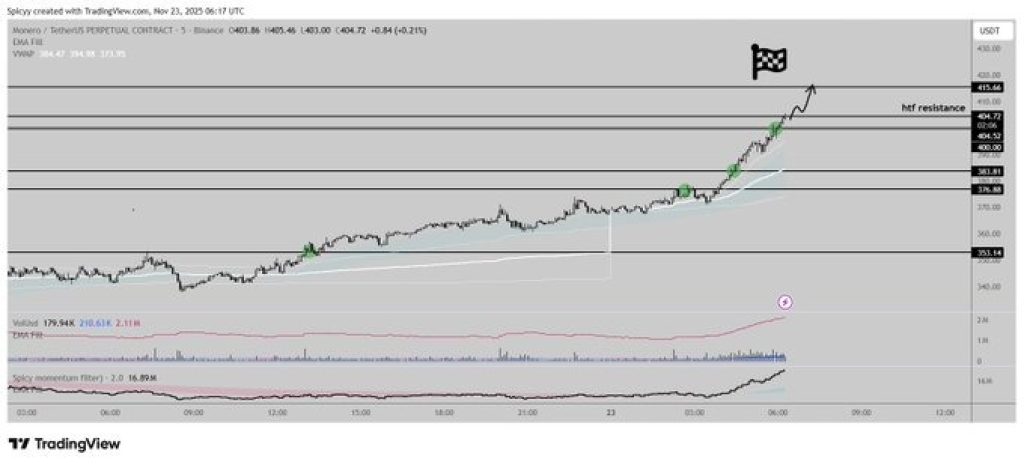

According to top analyst Spicy, the Monero price chart illustrates a powerful breakout. Monero not only broke through resistance levels but also advanced through each major price barrier with considerable momentum.

Following the reclaim of the $400 level, the price continued its ascent with minimal hesitation, indicating a clean, orderly, and controlled trend.

There appears to be limited visible resistance until the price range of $450 to $480. This suggests that XMR has substantial room for further upward movement if current momentum is sustained.

Trading volume further supports the strength of this move. Each upward price movement has been accompanied by increased trading activity, rather than isolated spikes. This suggests that the rally is not solely driven by a single large order but by broad market participation.

XMR Price Outlook and Future Prospects

If Monero maintains its current pace, traders will likely focus on a test of the $450 level as the immediate target. Beyond that, the next significant psychological milestone is expected to be around the $500 mark.

Conversely, if the rally begins to cool, the $400 level will become a critical point for bulls to defend. A sustained break below this level would not necessarily signal the end of the uptrend but would likely lead to a period of consolidation or a slowdown in price momentum.

Currently, the Monero (XMR) price exhibits strong upward momentum, with limited immediate resistance and a growing narrative driving demand. In a market often characterized by correlated price movements, Monero is demonstrating its unique trajectory, which is proving to be highly rewarding today.

The efforts by governments to curb Monero's adoption may have, paradoxically, contributed to the creation of one of the year's most significant price breakouts.