Key Developments in Russia's Crypto Derivatives Market

The Moscow Exchange has officially launched cash-settled Bitcoin and Ethereum index futures, marking a significant step in Russia's expanding crypto derivatives market and attracting considerable investor interest.

This new offering for qualified investors underscores the financial market innovation occurring in Russia and could influence future approaches to cryptocurrency access and regulation within the country.

MOEX Introduces Bitcoin and Ethereum Futures

The Moscow Exchange recently introduced cash-settled Bitcoin and Ethereum futures specifically for qualified investors. As Russia's largest stock market operator, MOEX's move, approved by the Central Bank of Russia, represents a regulated expansion into cryptocurrency products. This provides a pathway for professional investors to engage with digital assets without the need for direct custody.

These futures allow investors to speculate on the price movements of Bitcoin and Ethereum, with settlements conducted in rubles. This development enhances the financial landscape for eligible participants. The trading volume for Bitcoin futures has already shown substantial interest, reaching 7 billion rubles and involving over 10,000 participants within the initial period. Maria Patrikeeva, Managing Director at MOEX, stated:

The first three weeks of BTC futures have seen a cumulative trading volume of 7 billion rubles, reflecting significant interest among qualified investors.

Central Bank's 2025 Strategy Facilitates Crypto Market Growth

The Central Bank of Russia's 2025 decision to permit crypto derivatives trading for qualified investors has been instrumental in expanding MOEX's crypto offerings. This aligns with broader global trends in regulated crypto investments and has significantly enhanced the Russian market's capabilities.

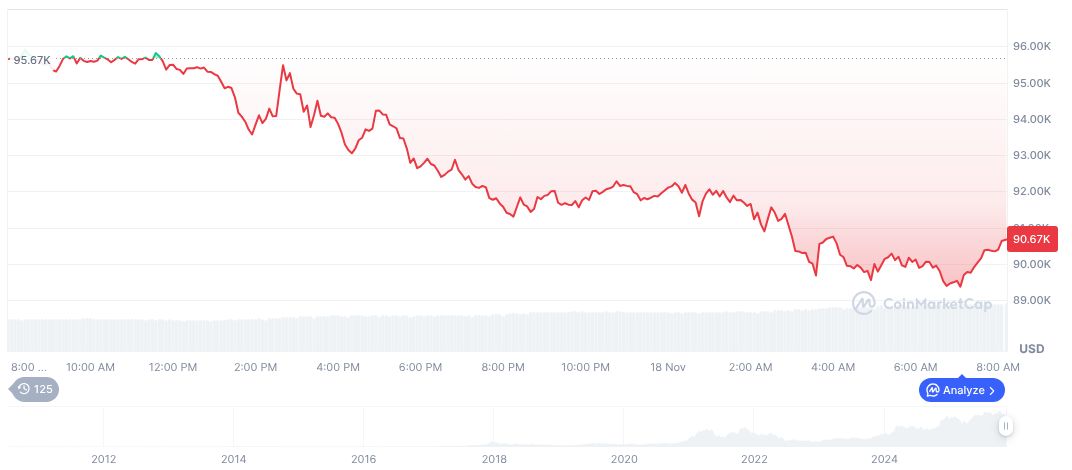

According to available data, Bitcoin's current price is $93,415.75, with a market capitalization of 1,863,685,359,350 and a dominance of 58.38%. The 24-hour trading volume stands at 122,397,634,245. Bitcoin's price has seen a recent 0.52% decrease, continuing a downward trend over the past 90 days.

The Coincu research team observes that MOEX's expansion of its product offerings may encourage further regulatory adaptations within Russia's crypto market. This development reflects a global trend where traditional financial platforms are integrating digital currencies to address the demand from professional investors. Such integration fosters technological innovation and has the potential to influence future regulatory policies concerning cryptocurrencies.