Standard Chartered Hong Kong to Launch Crypto ETF Trading

Standard Chartered Hong Kong is reportedly set to launch trading services for crypto exchange-traded funds (ETFs) in November.

According to a study on wealthy clients cited by local newspaper Ming Pao, nearly 80% of respondents plan to invest in digital assets within the next year, while over 30% already have some form of crypto exposure.

The survey included more than 500 respondents who possessed at least 1 million Hong Kong dollars (approximately $128,650) in liquid assets.

Hong Kong has been actively expanding its crypto ETF offerings, recently approving its first spot Solana ETF.

However, Hong Kong Exchanges and Clearing (HKEX) is reportedly adopting a stricter approach towards firms seeking listings focused on crypto holdings. Bloomberg reported that the exchange has raised concerns about several companies aiming to list as digital asset treasury firms, questioning their adherence to listing rules and overall business viability.

South Korea to Ban Interest Payments on Stablecoins

South Korea plans to prohibit yield-bearing stablecoins, mirroring the regulatory approach seen in the United States regarding stablecoins.

Financial Services Commission (FSC) Chairman Lee Eog-weon announced his agency's intention on Monday, responding to a statement from lawmaker Yoo Young-ha who advocated for blocking interest-bearing structures in any form.

This stance aligns with the GENIUS Act in the US, which prohibits interest payments on funds held or utilized for payment stablecoins.

Lee indicated that South Korea would adopt the same principle as part of its second phase of crypto legislation, which is anticipated to be submitted to the National Assembly before the end of the year.

Nonetheless, Lee also suggested that stablecoins could serve broader functions beyond crypto trading, particularly in areas such as payments, remittances, and cross-border transactions, and stated that the FSC would prepare for swift and effective implementation of the law once it is passed.

Thai Finance Official Resigns Amid Pig Butchering Link Allegations

Thailands Deputy Finance Minister Vorapak Tanyawong resigned on Wednesday following allegations that he was linked to Cambodia-based pig-butchering scam networks.

The investigative newsletter Whale Hunting claimed that Vorapak's wife received $3 million in cryptocurrency from Chinese-Cambodian criminal networks, which he was responsible for investigating as part of a government committee.

Vorapak has denied any wrongdoing and stated that he is stepping down to concentrate on his legal defense.

Pig butchering is a type of cybercrime where scammers cultivate trust with victims online before enticing them into fraudulent investments, frequently involving cryptocurrency. In recent years, criminal networks have been involved in the abduction of civilians and tourists across Southeast Asia, forcing them into compounds where they are compelled to operate these scams.

Earlier this month, the US Department of the Treasury and the UK Foreign Office announced the largest coordinated sanctions ever imposed targeting Southeast Asia's scam networks. The US designated Cambodia's Prince Group, led by tycoon Chen Zhi, as a transnational criminal organization for orchestrating industrial-scale fraud and human trafficking operations, while the UK implemented parallel sanctions on Chen and his associates.

The Treasury's Financial Crimes Enforcement Network (FinCEN) took action to disconnect Huione Group from the US financial system, determining that it had laundered over $4 billion in illicit proceeds. The subsidiaries of this Cambodia-based conglomerate include crypto payment services and a cryptocurrency exchange.

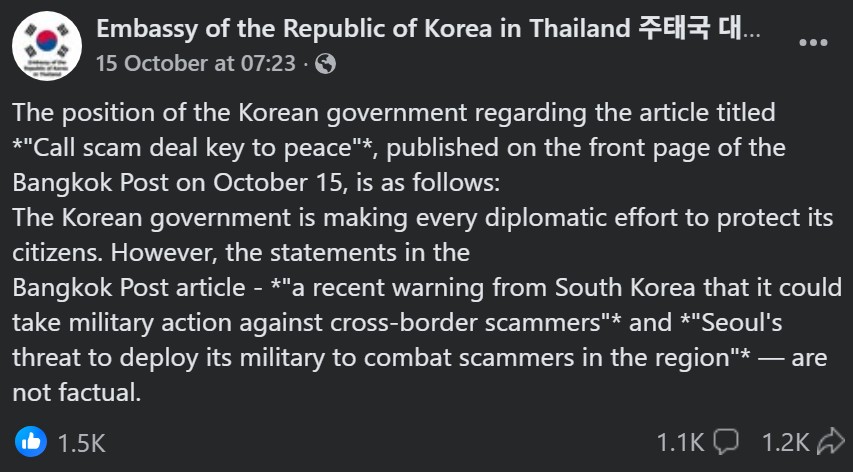

South Korea has also been contending with the human consequences of the scam economy. President Lee Jae-myung recently ordered the establishment of an emergency task force and imposed a travel ban to Cambodia's scam hubs. On Thursday, 57 South Koreans were apprehended in Cambodia following a raid on a scam compound.

Pig-butchering scams and associated abductions have been a persistent issue across Southeast Asia and surrounding regions for years, often involving networks with connections to local elites and politically influential figures. The recent increase in kidnappings and international sanctions has finally drawn the crisis to the attention of the highest government levels and mainstream media.

Japan May Allow Banks to Hold Bitcoin

Japans Financial Services Agency (FSA) is considering permitting banks and insurance companies to invest in cryptocurrencies for their own portfolios.

The proposal, discussed during the FSA's fourth Working Group on the Crypto-Asset System on Wednesday, would allow parent banks and insurers to hold crypto as proprietary investments, provided they meet capital and risk management requirements. This is part of a broader plan to shift crypto oversight from the Payment Services Act to the Financial Instruments and Exchange Act, effectively treating digital assets similarly to other financial instruments.

Currently, Japanese banks and insurers are prohibited from directly owning cryptocurrencies. Only their licensed subsidiaries are permitted to manage crypto investments. Under the proposed framework, the FSA would gradually broaden the scope of activities that parent institutions can undertake.

However, the proposal does not grant banks or insurers the ability to broker or sell crypto to retail customers. Regulators are concerned that doing so might lead consumers to mistakenly believe that cryptocurrencies offer the same protections as deposits or insurance products.

The working group also addressed related reforms, including insider trading regulations for crypto, enhanced prohibitions against market manipulation, stricter enforcement actions against unregistered overseas exchanges, and new custody requirements for licensed platforms.

The FSA aims to finalize this framework in advance of a legislative proposal for the 2026 parliamentary session.