Key Insights

- •Vanguard’s $505 million entry into MicroStrategy came during price stabilization, not during an uptrend, indicating early positioning.

- •VanEck’s combined equity and preferred holdings signal long-term confidence in MicroStrategy’s Bitcoin-backed financial strategy.

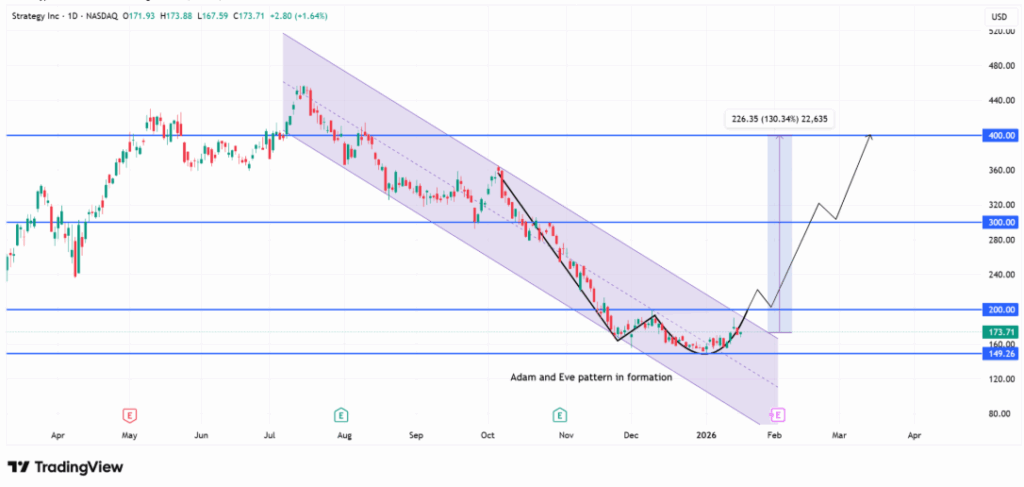

- •MSTR price action reflects a transition phase, with volatility compressing and structure holding above key support at $149.

MicroStrategy (MSTR) stock continues to consolidate near the lower end of its broader technical structure, holding steady after a prolonged decline. Despite months of controlled downside pressure, selling momentum has eased, and volatility has narrowed, pointing to stabilization rather than renewed weakness.

Vanguard disclosed a $505 million direct investment in MicroStrategy, marking its first exposure to the company. This move is notable for its timing, as the purchase came not during a price surge but when volatility had compressed. The entry indicates accumulation during structural stabilization, favoring early exposure ahead of a confirmed breakout.

VanEck also added to its position in MicroStrategy, holding around 284,000 common shares, along with preferred instruments tied to the company’s Bitcoin-backed balance sheet. The firm’s position highlights a long-term strategy anchored in financial exposure rather than short-term market moves. These institutional actions reduce available float and lower reactive selling.

Price Structure Signals Exhaustion of Selling, Hints at Reversal

MSTR stock remains within a descending channel, though recent daily candles lean toward the upper boundary. This movement suggests sellers are losing momentum. The November decline acted as the “Adam” phase, with rapid selling followed by a December bottom. Since then, price has gradually formed higher lows, shaping a rounded “Eve” recovery pattern.

Currently trading at $173.71, MSTR stock maintains support above the $149 base. Holding this level keeps the reversal structure intact. A move above $200 could trigger a breakout toward $300. If $300 holds, it may open the path toward $400. A drop below $149 would break the structure and signal renewed bearish control.

Market Stability Driven by Institutional Influence and Structure

With both Vanguard and VanEck participating, price action has transitioned from reactive trading to strategic positioning. The stock’s current pattern reflects stabilization rather than momentum-driven moves. Structural strength appears to be forming beneath current levels, keeping pressure contained while setting the stage for a potential breakout.