Multicoin's Strategic Investment in Ethena Protocol

Vishal Kankani, Principal at Multicoin Capital, announced on social media that the firm's Liquidity Fund invested in ENA, Ethena Protocol's native token, on November 15th. This investment underscores the synergy between stablecoins, perpetual contracts, and asset tokenization, with potential impacts on institutional participation and Total Value Locked (TVL) in the cryptocurrency ecosystem.

Multicoin Capital, led by Vishal Kankani, has invested in Ethena Protocol's ENA token. Kankani highlights Ethena's position at the intersection of major transformations: stablecoins, contracts, and tokenization. The investment is viewed as a strategic alignment with Multicoin's broader market thesis.

Implications of this investment include growing stakeholder interest in synthetic currencies, with expected increases in Total Value Locked (TVL) and liquidity for ENA. Enhanced engagement within the ecosystem may further drive financial innovation and adoption.

"We believe stablecoins are the largest addressable markets in crypto and yield is the final frontier... Ethena sits at the intersection of three major financial transformations: precision-positioned stablecoins, the popularization of perpetual contracts, and asset tokenization. Each trend will contribute to its compounded growth, leveraging its validated risk management capabilities and a clear path to value capture." — Vishal Kankani, Principal, Multicoin Capital

Market reactions have shown a cautious optimism. Kankani emphasized that Ethena's validated risk management and adherence to principles ensure sustainable value capture. The market is closely watching for potential regulatory responses or broader market movements.

Ethena's Market Performance and Future Outlook

Multicoin Capital's strategic moves in the synthetic dollar space align with historical trends observed during the 2020-2021 DeFi boom, which saw significant growth in decentralized finance asset values.

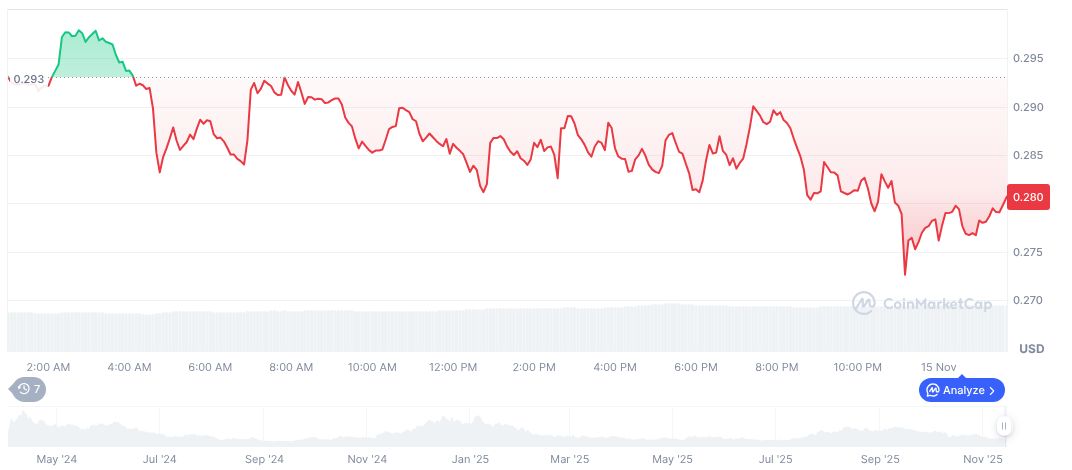

According to CoinMarketCap, Ethena (ENA) trades at $0.28, with a market cap of $2.04 billion and a 24-hour trading volume down by 30.85% to $235,464,687. Prices have fallen 2.66% over 24 hours and 61.75% over 90 days.

Coincu's research team points to Ethena's potential in driving regulatory conversations, given its synthetic stablecoin positioning. Historical parallels with past financial innovations underscore the importance of leveraging market insights for strategic growth.