Market Performance and Support Levels

NEAR Protocol experienced a notable 14% price decline during recent market movements, drawing the attention of traders as the token approached the critical $1.80 support area. This level has historically played a significant role throughout the year, and analysts have cautioned that a breach below it could lead to further downward price action.

Analyst Ali Martinez highlighted the potential consequences of falling below this key support, stating that a break under $1.80 "could point toward $1." His analysis, supported by chart projections, indicated several possible price paths below this critical zone.

NEAR Protocol $NEAR must hold $1.80. Break it, and the chart points to $1 next. pic.twitter.com/5hMO8PQstf

— Ali (@ali_charts) November 23, 2025

This price action occurs amidst broader market volatility, leading many traders to adopt a cautious stance. The current proximity to a previously established support level is a significant point of observation. The potential downside scenarios illustrated by Martinez's chart have intensified the focus on NEAR's reaction at the $1.80 mark.

Network Activity Amidst Market Decline

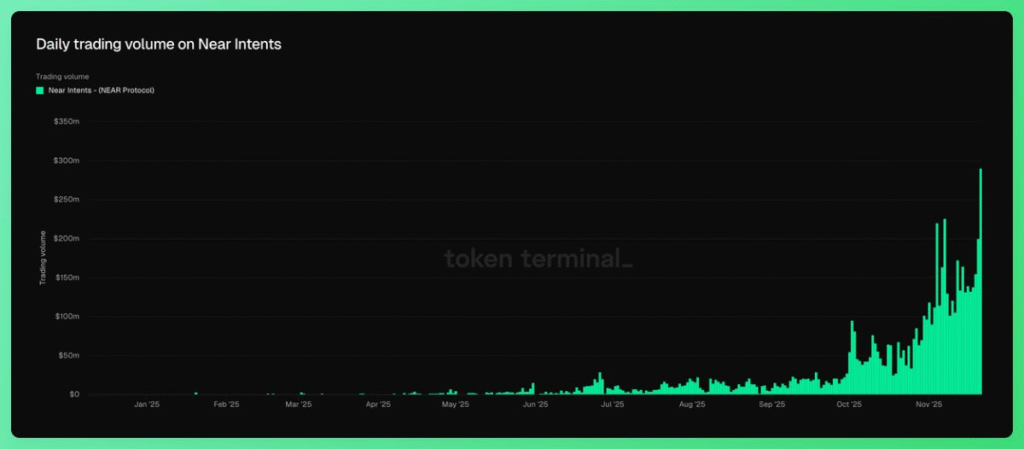

Concurrently, NEAR Protocol recorded its highest single-day trading volume. Analyst Emperor Osmo reported that the token's trading volume surged to $290 million within a 24-hour period. He also noted that the total trading volume has reached $6.5 billion, with network fees accumulating to $11.8 million.

Emperor Osmo expressed optimism, stating, "Nothing stops this train," attributing the surge to organic network activity. This increase in activity followed the recent addition of SPX, which traders believe has contributed to enhanced engagement and attracted more users to the NEAR network.

The consistent rise in network fees has also garnered attention, particularly as half of the total fees generated have occurred within the current month. This trend sparks a renewed discussion regarding network utility and user engagement, especially during periods of market pressure.

Potential Double Bottom Pattern and Analyst Outlook

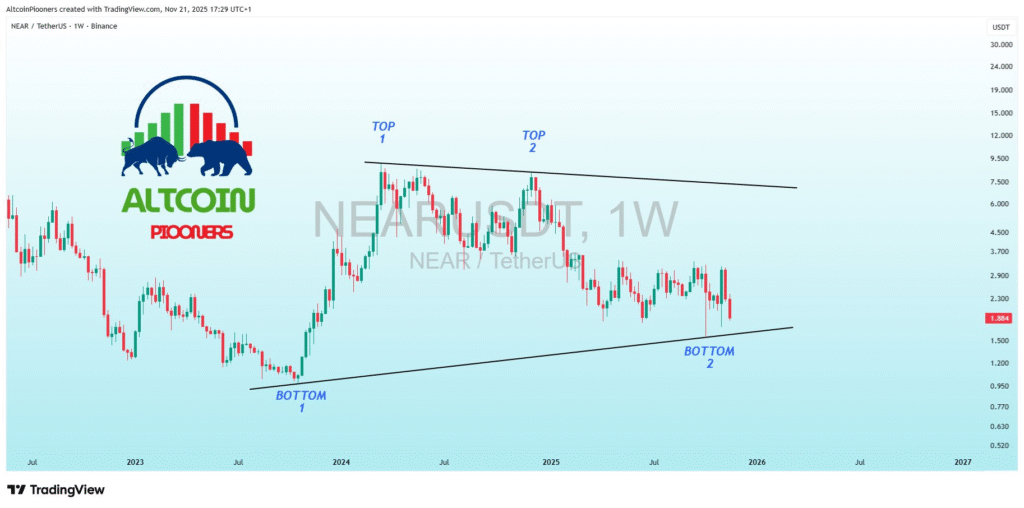

In a separate analysis, Altcoin Pioneers identified a potential double bottom pattern forming on NEAR's chart. The analyst indicated that this pattern is situated around the $1.80 to $1.85 price range, aligning with a retest of the 2023 low. The accompanying chart also depicted NEAR's price nearing a long-term trendline, alongside a rising weekly Relative Strength Index (RSI).

The analyst further suggested that if the trendline is broken, subsequent price targets could reach $4.20, $6.80, and the area between $9.50 and $11. The setup is described as "clean," with an invalidation level set below $1.60.

These divergent analyses highlight a contrast between short-term market caution and sustained long-term interest in NEAR Protocol. Traders are closely monitoring the asset as price pressures and growing network activity continue to shape its current trajectory.