Netflix is scheduled to report Q4 2025 earnings on Tuesday, January 20, 2026, after market close, followed by a conference call at 4:45 p.m. ET.

The report arrives at a pivotal moment for the stock, which has traded under pressure in recent months despite expectations for solid year-over-year growth.

Wall Street Expectations Point to Strong Growth

Analysts are forecasting a clear rebound in profitability compared with the same quarter last year. Consensus estimates call for earnings per share of $0.55, implying roughly 28–30% year-over-year growth. Revenue is projected to reach $11.97 billion, representing a 16.8% increase from Q4 2024.

Beyond headline numbers, operating margins remain a critical focus. In October, Netflix reported margins of 28.2%, well below the 31.5% estimate, which triggered a sharp selloff of nearly 30% in the stock. Investors will be looking for evidence that margin pressures have eased and that cost discipline is improving.

Guidance, Ads, and M&A in Focus

With Netflix no longer reporting quarterly subscriber figures, 2026 guidance takes center stage. Markets want clarity on whether ad-tier momentum and international growth can continue to offset a saturated U.S. market.

Another major overhang is the company’s reported interest in Warner Bros. Discovery assets, a potential deal valued around $83 billion. Any commentary on this front could move the stock sharply, especially given complications from a hostile bid involving Paramount Skydance and ongoing legal disputes.

Advertising strategy is also under the microscope. Traders are watching for updates on ad-tier adoption, monetization efficiency, and the likelihood of future price increases in the U.S. and Canada. Additionally, management’s commentary on live content, including sports and special events, is expected to be a key theme.

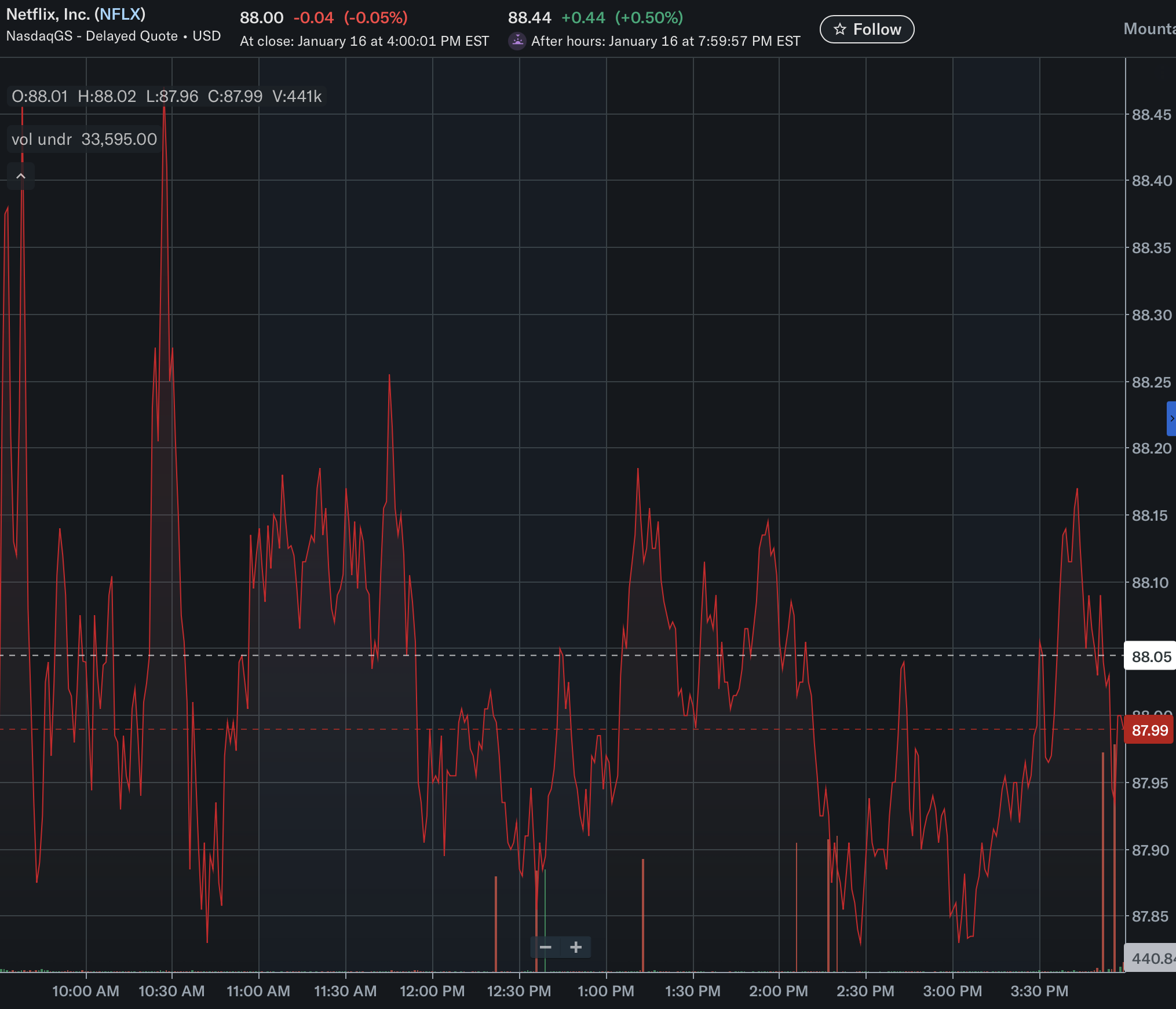

Stock Context Heading Into the Report

Netflix shares are trading near $88, far below their June 2025 high of $134.12. Despite the drawdown, analyst sentiment remains constructive, with a “Moderate Buy” consensus and an average price target around $127.46. That gap highlights how sensitive the stock is to this earnings report and forward guidance.

If Netflix delivers margin improvement and confident 2026 commentary, the setup leaves room for a sharp repricing. Conversely, any hesitation on guidance or deal-related uncertainty could extend the stock’s consolidation.