The proposed BNB ETF has edged closer to reality as its issuer filed updated paperwork with the U.S. regulator, detailing aspects that could shape its launch and investor reception.

Key Details from the Updated Filing

The filing reveals that the fund plans to hold actual BNB tokens and will be listed under the ticker symbol VBNB on the Nasdaq exchange. Share prices will be calculated by tracking the MarketVector BNB Index. The structure of the ETF explicitly excludes derivatives and leverage, aiming to provide straightforward exposure to BNB's real-time value.

The update clarifies that the trust will own tangible BNB rather than utilize derivatives or futures. Investors in the BNB ETF should anticipate price movements that directly mirror BNB itself.

Furthermore, the filing states that the ETF will not stake the BNB it holds. Early drafts had indicated that staking might be used to generate yield. This removal likely reflects a cautious approach following recent scrutiny of cryptocurrency regulations.

Officials have also included a cautionary note, emphasizing that BNB remains a volatile asset. The ETF carries inherent risks associated with custody and token volatility. Should regulators classify BNB as a security in the future, the fund could face significant disruption or even dissolution.

BNB Market Context and Price Snapshot

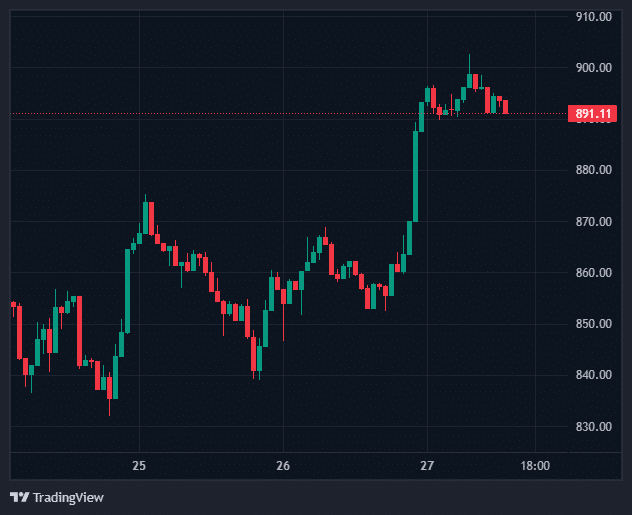

As of today, BNB is trading near USD 891, representing an increase of approximately 3.5% over the past 24 hours. This price level places the coin firmly above the recent support zone identified near USD 830.

This current price level frames the BNB ETF offering as a potentially timely avenue for investors seeking regulated exposure, particularly for those who prefer not to manage crypto wallets or handle BNB custody directly.

Potential Impact of the BNB ETF for Crypto Investors

- •The ETF could significantly lower the entry barrier for both retail and institutional investors. Users of traditional brokerage platforms may find it easier to gain exposure to BNB.

- •The potential for institutional inflows could enhance BNB's liquidity and narrow trading spreads, contributing to market stabilization.

- •Considering BNB's utility on the BNB Chain for transaction fees and smart contract execution, a regulated fund could bring greater attention to BNB's real-world applications beyond mere speculation.

However, the absence of staking means potential passive income opportunities are removed. The inherent volatility of the asset and ongoing regulatory risks remain significant considerations, suggesting the BNB ETF may be more suitable for investors with a higher risk tolerance.

Next Steps in the ETF Approval Process

Several key events will likely shape the path forward. Regulators may request further revisions as they review the updated filing. The Nasdaq exchange must also approve the listing before the fund can move closer to its official launch. Market sentiment can shift rapidly, as traders often react to every new development concerning cryptocurrency ETFs.

Industry analysts anticipate increased clarity in the coming weeks as the review cycle progresses. Any public statements from regulators or the issuer could influence market sentiment. Investors will be closely watching for signs of momentum, given that similar ETF filings in the past have historically triggered significant price movements in the underlying assets.

Once the relevant agency completes its assessment, attention will shift to the confirmed listing date and the commencement of public trading.

Conclusion

The updated filing represents a significant step forward, moving the BNB ETF from a conceptual stage toward a potential listing. With its proposal to hold direct BNB holdings and utilize index-based pricing, the plan offers a more straightforward and regulated pathway for accessing BNB. The recent price strength, with BNB trading around USD 891, provides a favorable context for this development.

Nevertheless, the absence of staking yield and the inherent volatility of the token serve as reminders for investors to carefully consider the associated risks. If the approval process proceeds smoothly, the BNB ETF could emerge as a key gateway for mainstream investors to participate in the BNB market.

Frequently Asked Questions About the BNB ETF

1. What is the BNB ETF?

It is a planned exchange-traded fund designed to hold actual BNB tokens and trade on the Nasdaq under the ticker symbol VBNB.

2. Will the fund stake BNB for rewards?

No, the latest filing explicitly removed any staking component from the fund's operations.

3. Is the BNB ETF safer compared to holding BNB directly?

The ETF aims to reduce custody and wallet-management risks. However, it still retains the inherent volatility of the cryptocurrency asset and exposure to regulatory risks.

4. What is the current BNB price?

As of November 27, 2025, the BNB price is approximately USD 891.

5. What are the next steps before the BNB ETF launches?

The fund requires final regulatory approval, a green light for listing on the Nasdaq, and confirmation of the official trading start date.