Bond Initiative Details

The New Hampshire Business Finance Authority has approved the nation's first Bitcoin-collateralized municipal bond, totaling $100 million. This significant financial innovation, with Bitcoin held as collateral by BitGo, was finalized on November 19, 2025. The initiative represents a pivotal moment in the integration of digital assets with traditional financial systems, potentially shaping future municipal finance practices and drawing institutional investor interest in cryptocurrency-backed securities.

This bond initiative is a collaborative effort involving Wave Digital Assets and Rosemawr Management. It establishes a direct link between digital currencies and conventional finance, signifying a major stride in U.S. financial innovation. The bond is structured with over-collateralization to safeguard investors, featuring an automatic liquidation mechanism if Bitcoin's value falls below 130% of its collateralized value. The proceeds generated from this bond will be channeled into local innovation projects through the "Bitcoin Economic Development Fund," thereby promoting economic growth while ensuring robust investor protection.

Governor Kelly Ayotte praised the initiative, characterizing it as a pioneering financial strategy. Financial experts highlight that this approach could serve as a blueprint for more cryptocurrency-backed government financing mechanisms. This collaboration offers a sustainable model for future bond issuances, designed to leverage Bitcoin's potential upside without exposing taxpayer funds to risk.

Les Borsai, Co-founder of Wave Digital Assets, commented on the significance of this development:

"This isn’t just one transaction, it’s the opening of a new debt market... We believe this structure shows how public and private sectors can collaborate to responsibly unlock the value of digital assets and digital asset reserves."

Bitcoin Market Context and Regulatory Outlook

The United States, a recognized leader in both technology and finance, is now connecting cryptocurrency with municipal bonds, thereby forging new avenues for digital and fiscal innovation.

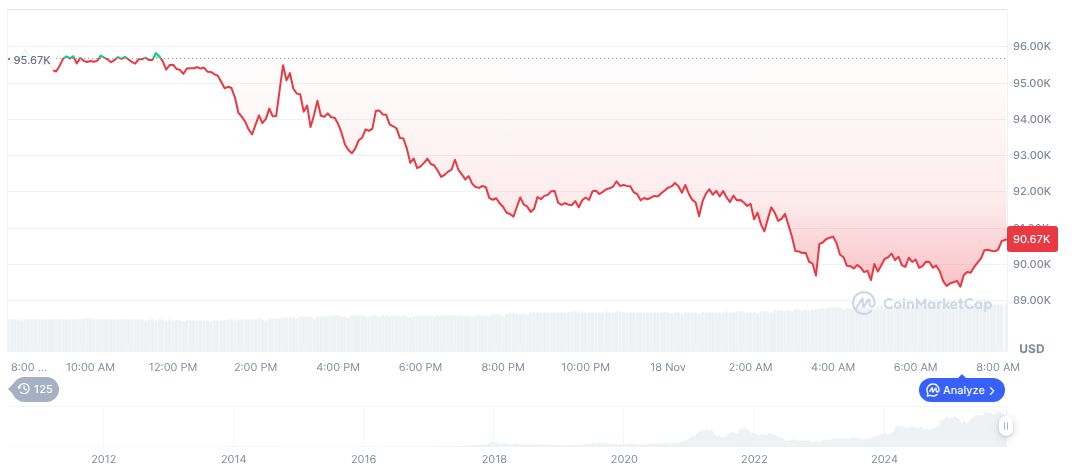

As of November 19, 2025, Bitcoin is trading at $92,192.04, with a market capitalization of $1.84 trillion, holding 58.20% of the cryptocurrency market share. In the preceding week, its value experienced a decline of approximately 10.69%. The 24-hour trading volume is reported at $97.62 billion, with significant price fluctuations observed over recent months.

The Coincu research team anticipates that innovative financial structures like this Bitcoin-collateralized bond may prompt regulatory bodies to reassess existing digital asset frameworks. This strategic approach has the potential to bolster investor confidence and stimulate the development of similar projects, thereby encouraging further fiscal experimentation involving cryptocurrencies.