The Securities and Exchange Commission (SEC) has disclosed that Nigerians have lost a staggering N300.2 billion to Ponzi schemes in recent years. This figure encompasses losses from various fraudulent investment schemes, including MMM, Famzhi Interbiz Ltd, and MBA Forex and Capital Investment, excluding losses attributed to CBEX.

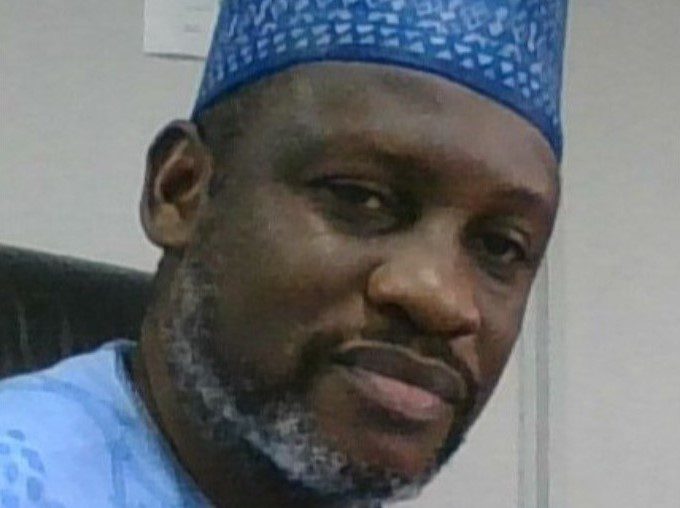

AbdulRasheed Dan-Abu, Head of Fintech and Innovation Department at the SEC, revealed these findings at the 2025 Journalists Academy in Abuja. He explained that the amount was compiled based on in-depth investigations into prominent Ponzi schemes, highlighting the devastating financial and social impact these operations have had on Nigerian households and small investors.

These notorious schemes enticed investors with promises of extraordinarily high and unsustainable returns.

Dan-Abu further clarified that the N300.2 billion estimate represents only a portion of the total losses. It does not include all Ponzi Schemes, such as CBEX, which alone reportedly caused Nigerian losses amounting to N1.4 trillion. Other unregistered schemes have also led to additional losses estimated at tens of billions of naira.

Sources close to the report indicated that the actual losses could be significantly higher due to the prevalence of unreported cases and the proliferation of online schemes that evade regulatory scrutiny.

A detailed breakdown of the N300.2 billion reveals that MMM Nigeria accounted for approximately N18 billion. MBA Forex and Capital Investment Ltd amassed about N213 billion from Nigerians before its collapse, while Nospecto Oil and Gas defrauded investors of roughly N45 billion.

Other Ponzi Schemes, including Chinmark Group, Ovaioza Farm Produce Storage Business, and Famzhi Interbiz Ltd, collectively cost Nigerians over N24 billion.

Analysts suggest that the addition of unreported cases would substantially increase the total figure, indicating that the reported amount may not represent the complete picture of losses incurred by Nigerians due to Ponzi Schemes.

In a significant prior event, the investment platform CBEX crashed after abruptly blocking investor withdrawals, leading to losses of approximately N1.3 trillion, reportedly invested by over 600,000 Nigerians.

Following this incident, the Economic and Financial Crimes Commission (EFCC), in conjunction with the SEC, pledged to take action against the operators and promoters of Ponzi Schemes, including those associated with CBEX. The EFCC has since arrested several promoters and recovered an undisclosed sum related to the scheme.

Ongoing Efforts to Crack Down on Ponzi Schemes

The SEC, EFCC, Nigerian Financial Intelligence Unit (NFIU), and the Central Bank of Nigeria (CBN) have committed to identifying and freezing accounts linked to illegal investment operators. The SEC is leveraging its regulatory authority to protect investors and maintain the integrity of Nigeria’s financial system.

The fight against Ponzi schemes has gained significant momentum following the enactment of the Investment and Securities Act (ISA) 2025, signed by President Bola Tinubu in March. This legislation empowers the SEC to prosecute Ponzi scheme promoters, with potential sentences of at least 10 years imprisonment and penalties of up to N40 million.

SEC Director General Emomotimi Agama stated in March that the N40 million penalty is only a portion of the sanctions that can be imposed. He emphasized that the goal is not solely the quantum of the fraud but to implement deterrent sanctions.

Agama further explained that the ISA Act aims to equip the SEC with the authority to sanction offenders, bring them to justice, and facilitate the rehabilitation of victims.

In addition to the ISA, the commission employs a comprehensive strategy that integrates investor education, stringent enforcement, and inter-agency collaboration. This includes partnerships with relevant agencies to educate Nigerians on verifying a company’s regulatory status before investing and on how to identify Ponzi Schemes.