Key Developments

Nordea Bank Abp, a prominent Nordic financial institution, has announced that it is now enabling customers to trade Bitcoin-linked exchange-traded products (ETPs). This significant development reflects a strategic shift by the bank, influenced by a more mature regulatory environment surrounding digital assets.

This move represents a notable change in Nordea's approach, signaling broader acceptance and growing confidence in the cryptocurrency markets. The bank's decision allows customers to engage with Bitcoin-linked financial products, though Nordea has clarified that it will not offer any investment advice concerning these specific offerings.

Market Implications and Expert Analysis

Nordea Bank has departed from its historically conservative stance on cryptocurrencies by introducing Bitcoin-linked ETPs to its trading platform. This decision is directly attributed to the evolving and increasingly mature regulatory landscape for digital assets in Europe.

The bank's executive leadership has cited the growing demand for virtual currencies as a primary driver behind this strategic pivot. The introduction of these products is expected to facilitate greater customer access to Bitcoin-related investments.

"As the European regulatory environment for cryptocurrencies has matured and the demand for virtual currencies and cryptocurrencies is growing across the Nordics, Nordea has decided to allow customers to trade in a crypto-linked product on its platforms." - Frank Vang-Jensen, President and Group CEO, Nordea Bank

Expert analysis suggests that Nordea's initiative could significantly encourage increased institutional participation within the cryptocurrency sector. The integration of Bitcoin ETPs into the offerings of traditional financial institutions like Nordea may foster greater acceptance and broader utilization of cryptocurrencies in regulated financial markets.

Market Data and Context

Nordea Bank's decision to offer Bitcoin ETP trading aligns with similar trends observed in Swiss and German banks between 2021 and 2023, periods that saw enhanced access to crypto products and notable surges in ETP trading volumes.

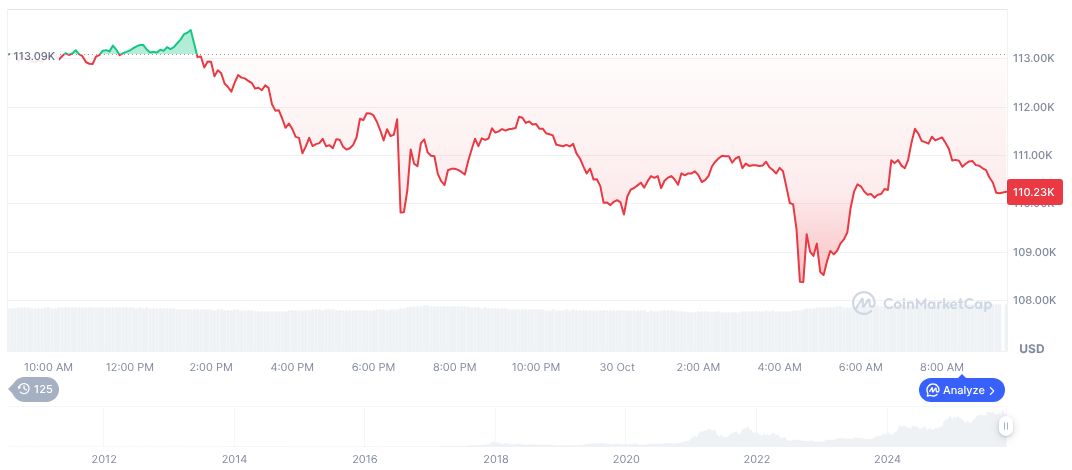

According to recent data, Bitcoin (BTC) is currently priced at $107797.13, with a market capitalization of $2.15 trillion and a market dominance of 59.08%. The cryptocurrency's 24-hour trading volume stands at $76.31 billion, indicating a 23.24% shift in activity. Over the past 24 hours, BTC has experienced a price decrease of 3.84%, and a 6.09% drop over the last 90 days.