NVIDIA reported its strongest quarter in company history on November 19, 2025, delivering $57.0 billion in revenue for Q3 fiscal 2026. The results mark a 22% jump from Q2 and a 62% surge year-over-year, underscoring the massive global demand for accelerated computing and AI infrastructure.

The standout driver was once again the company’s data center business, which reached $51.2 billion in quarterly revenue, up 25% from the previous quarter and 66% compared to last year. NVIDIA said adoption of its latest Blackwell platform and cloud GPU systems continues to accelerate across industries.

Huang: “We’ve entered the virtuous cycle of AI”

Founder and CEO Jensen Huang described the quarter as a turning point in the broader AI landscape, citing overwhelming appetite for both training and inference hardware.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said. “Compute demand keeps accelerating and compounding across training and inference, each growing exponentially. We’ve entered the virtuous cycle of AI.”

Huang added that the AI ecosystem is expanding rapidly, with new model developers, new startups, and broader global adoption fueling long-term visibility for continued growth.

Profitability Climbs on Strong Margins

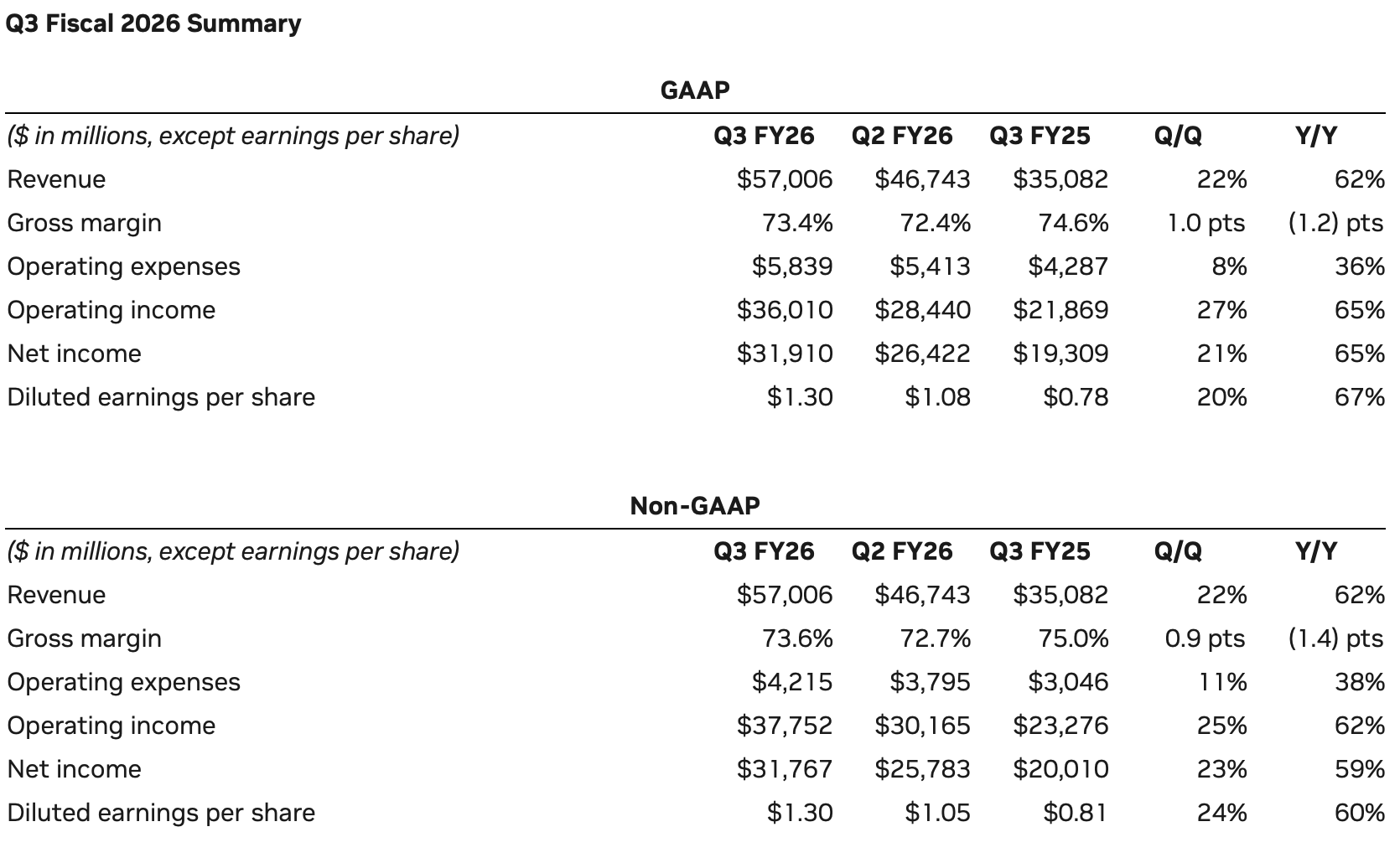

NVIDIA posted GAAP gross margin of 73.4% and non-GAAP gross margin of 73.6%, maintaining one of the highest profitability profiles in the semiconductor industry.

GAAP operating income rose 27% quarter-over-quarter to $36.0 billion, while GAAP net income increased to $31.9 billion, up 65% year-over-year. Diluted earnings per share came in at $1.30 GAAP and non-GAAP, up sharply from $1.08 last quarter.

During the first nine months of FY26, NVIDIA returned $37 billion to shareholders through buybacks and dividends. The company still has $62.2 billion authorized for future repurchases.

NVIDIA also confirmed a quarterly dividend of $0.01 per share, payable on December 26 to shareholders of record as of December 4.

Q4 Outlook: Revenue Target of $65 Billion

Looking ahead, NVIDIA expects another strong quarter, forecasting Q4 FY26 revenue of $65 billion, plus or minus 2%. The company anticipates:

- •GAAP gross margin: 74.8%, ±50bps

- •Non-GAAP gross margin: 75.0%, ±50bps

- •GAAP operating expenses: ~$6.7B

- •Non-GAAP operating expenses: ~$5.0B

- •Other income: ~$500M (excluding equity investment adjustments)

- •Tax rate: 17%, ±1%

With AI infrastructure spending showing no signs of slowing, NVIDIA enters its final fiscal quarter positioned for another round of record-breaking performance.