The New York Stock Exchange (NYSE) is developing a 24/7 tokenized securities trading and on-chain settlement platform. This initiative signals a structural shift in market infrastructure that could reshape how equities, cash, and blockchain interact.

The Announcement

The New York Stock Exchange, the world’s largest equity marketplace by listed market capitalization, has confirmed that it is developing a 24/7 tokenized securities trading and on-chain settlement platform. This move immediately drew intense attention across both traditional finance and crypto markets because it signals, for the first time at the exchange level, a willingness to re-architect how U.S. equities and ETFs could trade, clear, and settle in a continuously operating digital environment rather than within fixed trading windows and multi-day settlement cycles.

According to publicly reported details, the proposed platform would allow tokenized representations of stocks and exchange-traded funds to trade around the clock, with settlement occurring on-chain and potentially using stablecoins as a cash leg, while maintaining a 1:1 linkage between tokenized shares and their underlying securities. This preserves economic rights such as dividends and corporate actions under existing legal frameworks, subject to regulatory approval.

Why NYSE Matters

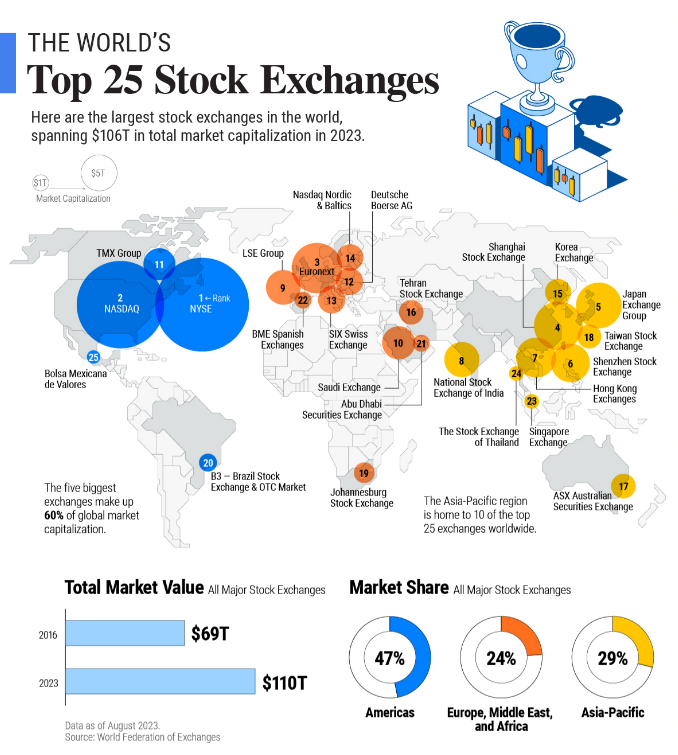

Unlike crypto-native trading venues or pilot projects launched by fintech startups, the NYSE occupies a uniquely systemic position within global capital markets, hosting companies whose combined market value exceeds $25 trillion. This means that even a partial shift toward tokenized infrastructure carries implications that extend well beyond incremental innovation and into the core mechanics of market liquidity, custody, and post-trade settlement.

Historically, tokenization efforts have been concentrated in private markets, money-market funds, or isolated pilots involving Treasuries and repo instruments. The NYSE’s involvement introduces the possibility that public equities, the deepest and most liquid asset class in the world, could eventually operate in a hybrid structure where traditional securities law coexists with blockchain-based settlement rails.

From T+1 to Real-Time

One of the most consequential dimensions of the announcement lies in settlement. U.S. equities only recently transitioned from T+2 to T+1 settlement, a change that required years of coordination across clearinghouses, brokers, and custodians. Yet, this still leaves capital tied up overnight and exposes participants to counterparty and operational risk that real-time settlement could, in theory, materially reduce.

A tokenized, on-chain settlement model—if approved—would compress settlement latency from days to minutes. This would reshape how margin, collateral, and liquidity are managed across the financial system, potentially freeing up trillions of dollars in capital currently immobilized by settlement buffers. It would also force regulators and market participants to rethink risk management in an environment where trades finalize almost instantaneously.

Stablecoins as Settlement Rails

The proposal’s reference to stablecoins as a settlement medium is particularly notable because it positions regulated digital dollars not as speculative instruments, but as infrastructure components that could function alongside traditional cash in institutional workflows. This narrative has been gaining traction as major banks and asset managers explore deposit tokens and tokenized money-market funds.

If implemented under regulatory supervision, stablecoin settlement could allow atomic delivery-versus-payment, reducing reconciliation complexity and operational cost. Simultaneously, it would bring crypto-native liquidity mechanisms into the heart of equity markets, blurring the historical boundary between “crypto rails” and “Wall Street plumbing.”

Access and Control

Crucially, the NYSE has emphasized that the platform would initially be restricted to broker-dealers and institutional participants. Retail investors would access tokenized securities only through compliant intermediaries. This underscores that the initiative is not about bypassing regulation, but about modernizing infrastructure within it.

This constraint highlights a broader reality: tokenization at the exchange level is less about democratizing access overnight and more about improving efficiency, resilience, and interoperability for regulated market participants. Downstream benefits, such as tighter spreads, faster settlement, and extended trading hours, could eventually reach retail investors.

Regulatory Dependence

The platform's launch remains contingent on approval from U.S. regulators, particularly the Securities and Exchange Commission. It would need to align with existing securities laws governing custody, transfer agents, shareholder rights, and market surveillance. Consequently, its rollout is likely to be incremental rather than disruptive in the near term.

Yet, the mere fact that the NYSE is investing resources into such a system suggests a growing institutional consensus that tokenization is no longer a speculative experiment, but a credible path toward modernizing financial market infrastructure. This is especially true as global competitors and foreign exchanges explore similar models.

Implications for Crypto Markets

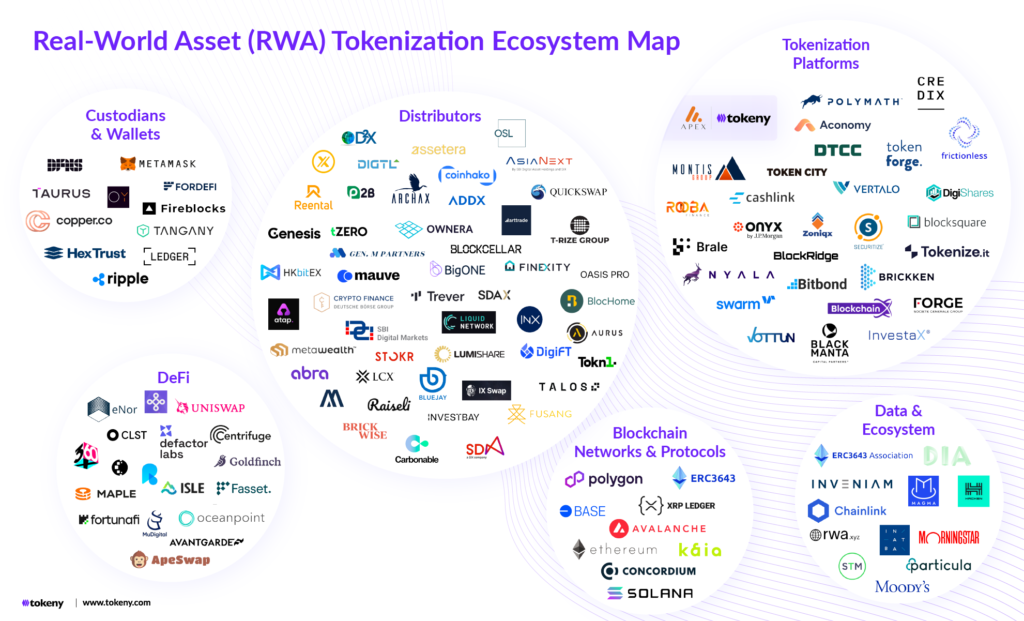

For crypto markets, the announcement is significant not because it promises an immediate influx of retail traders or speculative capital, but because it strengthens the structural case for blockchain as a settlement layer for real-world assets. This reinforces narratives that have underpinned recent growth in tokenized Treasuries, on-chain funds, and institutional DeFi applications.

By anchoring tokenization to one of the most trusted brands in global finance, the NYSE effectively de-risks the concept in the eyes of conservative allocators. Over time, this could support higher institutional participation across crypto infrastructure providers, stablecoin issuers, and Layer-2 networks positioned to support high-throughput, compliant settlement.

Is This a Bull Catalyst?

Whether the NYSE’s move becomes a catalyst for a broader crypto bull market depends less on price mechanics and more on timeline and execution. Infrastructure shifts of this magnitude unfold over years rather than weeks, and their impact is felt through adoption curves, regulatory clarity, and capital efficiency rather than sudden speculative bursts.

However, history suggests that markets often price structural change well before it materializes. The symbolism of the NYSE embracing tokenization—however cautiously—adds to a growing body of evidence that blockchain is being integrated into the core of global finance, not relegated to its periphery.

Conclusion

The NYSE’s plan to build a 24/7 tokenized trading and on-chain settlement platform does not mark an instant transformation of equity markets, nor does it guarantee a new crypto bull run on its own. However, it represents a profound signal that the world’s most established financial institutions are preparing for a future where securities, cash, and settlement increasingly coexist on digital rails. This shift, once underway, is difficult to reverse and likely to redefine how capital moves across markets in the decade ahead.