The crypto market endured one of its sharpest corrections of 2025 after a cascade of macro, technical, and liquidity factors converged within 48 hours.

On October 10th, U.S. President Trump announced a 100 percent tariff on all Chinese imports, reigniting trade‑war fears just as inflation indicators in both economies were showing mixed signals. Global investors rushed to price in higher consumer costs and potential retaliation by China. Asian and European equities opened weaker, but because crypto trades 24 × 7, it was the first risk market to react. Bitcoin dropped from ≈ $119 000 to $104 000 within hours (–12 percent intraday).

At that point, owing to the surge in the Crypto Markets in the previous 6 months [CMC Index was up more than 50 %], funding rates across perpetual futures were at 8‑month highs. As Bitcoin began to slide, cascading liquidations wiped out ≈ $19 billion in derivatives positions and ≈ 1.5 million traders within 24 hours. Binance briefly suffered order‑book imbalances; wrapped assets such as wBETH and BNSOL de‑pegged temporarily.

Large‑caps (BTC, ETH) fell 9–11 percent; mid‑caps and DeFi tokens collapsed 15–30 percent; meme and AI tokens lost over 35 percent on average. Stablecoins like USDT and USDC retained their pegs but saw record inflows as investors sought safety. BTC dominance rose from 53 to 56 percent, a classic “flight to quality.”

As prices fell, market makers temporarily pulled liquidity from order books to avoid slippage. Binance’s volume surged above $150 billion in 24 hours, a record. Open interest in futures contracts plunged 20 percent overnight, signaling a massive deleverage. Funding rates turned negative for the first time since June, indicating bearish sentiment reset.

By the weekend, realized volatility in Bitcoin spiked to annualized 82 percent—its highest since late 2022—but liquidation pressures subsided. Institutional wallet data showed inflows of ≈ $350 million into BTC and ETH ETFs the following Monday, suggesting long‑term buyers used the dip to accumulate.

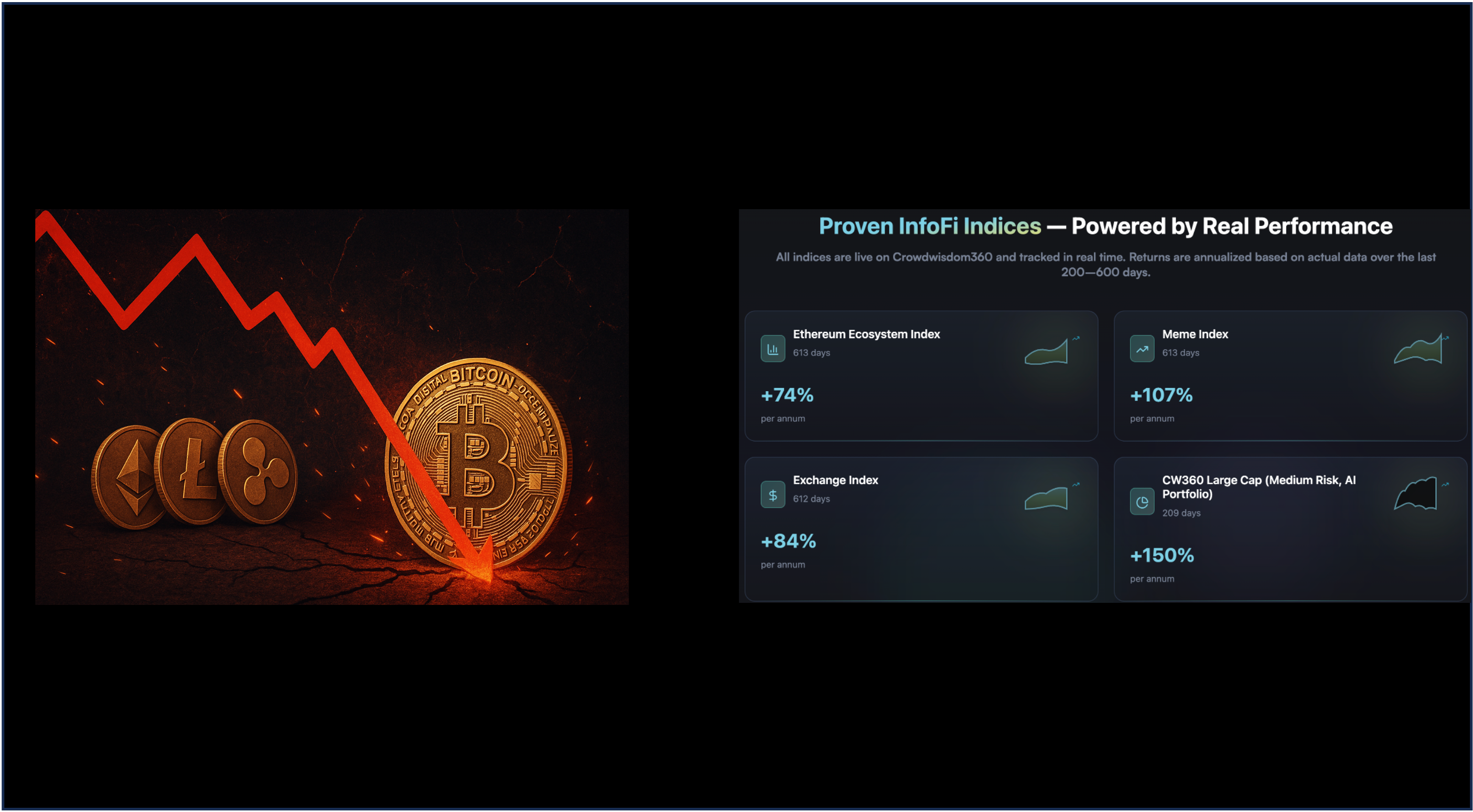

CW360 Indices Outperform During Volatility

While the CoinMarketCap (CMC) 100 Market Index fell ≈ 8 percent over the week [at the time of writing], some of Crowdwisdom360’s structured indices showed remarkable resilience, outperforming by 2–3 percentage points on average. Amongst the Top 5 Outperformers

- •CW360 Market Level Index was down 4.8 %

- •CW360 DeFi Tokens Index was down 5.7 %

- •CW360 Exchange Token Index was down 5.8 %

- •Mudrex Exchange Tracker Index was down 6.6 %

- •MarketVector Exchange Token Index was down 7.6 %.

CW360 indices demonstrated that data‑driven portfolio design matters. Weighted exposure driven by powerful machine‑learning tools helped us ride the crash better. While our Meme and AI Indices also suffered, they too outperformed most peers. Some of the good calls included BNB, Bittensor Tao, ZCash, Synthetix and Pancakeswap.

Why the Crash Matters for Investors?

The Crypto market remains highly correlated to global liquidity cycles and systematic indexing and portfolio discipline outperform impulse trading during panic. The October 2025 crash was a reminder that crypto markets still dance to global liquidity rhythms, but it also proved that intelligence‑driven portfolio systems can withstand the storm. Crowdwisdom360’s indices outperformed the broader market because they combined crowd data, on‑chain analytics, and AI‑based rebalancing into a cohesive InfoFi framework.

Crowdwisdom360: The InfoFi Engine Behind the Indices

Crowdwisdom360 is a full‑stack InfoFi platform that translates public crypto recommendations into actionable investment signals using ratings, AI tools, and verified performance data.

- •Over 28,000 predictions, 4,000 portfolios, and 3,000 experts actively contribute to the system.

- •Each new recommendation improves accuracy through crowd scoring and machine learning feedback.

- •Outputs feed directly into investment tools such as Portfolio Audit, Automated Portfolios, AI Portfolios, AI Alerts, and the Advanced Screener.

- •A creator program rewards accurate contributors with WISD tokens, sometimes thousands per month.

- •The founders are doxxed and the majority of platform modules are already live.

At the center of this ecosystem is Wisecoin (WISD), a Solana‑based utility token that connects the entire Crowdwisdom360 architecture. Comparable InfoFi tokens like Kaito which focuses more on insights and qualitative social‑media data have achieved valuations above $250 million while WISD’s presale at launch is valuing the project near $2 million market cap.

Presale Highlights

- •50 percent bonus on the first purchase.

- •Lowest entry price before exchange listing.

- •Immediate access to the Crowdwisdom360 platform to earn WISD for accurate predictions and portfolio creation.

- •Referral bonus + 50 percent WISD when friends join via your link.