The cryptocurrency markets have experienced a significant return of volatility at the start of December, this time in a positive direction.

Following a sharp decline to under $84,000 yesterday, the market leader, Bitcoin, has experienced a substantial surge, surpassing $91,000 minutes ago. Analysts from The Kobeissi Letter have indicated that Bitcoin is on track to achieve its largest daily increase since May of this year.

The Kobeissi Letter has reiterated its stance that these price fluctuations are primarily driven by mechanical factors rather than fundamental shifts in the industry, which they maintain remain robust.

BREAKING: Bitcoin is on track for its biggest daily gain since May 2025, nearing $91,000, as levered short liquidations surge.

In the last 60 minutes alone, ~$140 million of shorts have been liquidated compared to just ~$3 million of longs.

Recent swings in crypto are ENTIRELY… https://t.co/cIDnDkvV6Bpic.twitter.com/ElxAw4BUiw

— The Kobeissi Letter (@KobeissiLetter) December 2, 2025

Market-Wide Recovery and Altcoin Performance

Given the significant market-wide plunge experienced yesterday, the 24-hour charts now present a notably impressive picture. In addition to Bitcoin's 7% surge, Ethereum (ETH) has seen a 9% pump, pushing its price to $3,000. XRP has gained over 7% in value, while Solana (SOL) has experienced a substantial increase of 12%. Among the larger-cap altcoins, Cardano (ADA) has been the top performer, surging by 15% to reach $0.43.

Impact on Over-Leveraged Traders

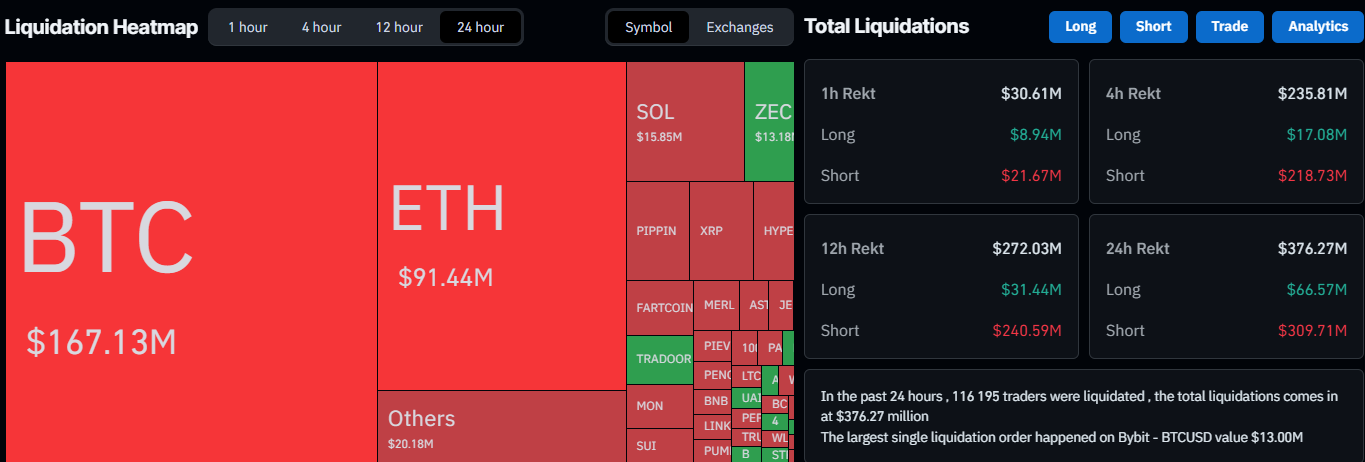

These rapid fluctuations have inevitably impacted traders who were over-leveraged. According to data from CoinGlass, the total value of liquidated positions has risen to nearly $380 million. This time, however, short positions account for the majority of these liquidations, exceeding $300 million.

Bitcoin shorts represent over half of this total amount, followed by $91 million in Ethereum shorts. The single largest liquidation event occurred on Bybit and was valued at $13 million.

Analyst Outlook and Key Price Levels

Analysts maintain a bullish outlook on Bitcoin, provided it remains above critical support zones, including the $83,000 level which was tested yesterday. Furthermore, Bitcoin's rally could potentially resume if the asset successfully overcomes the next significant resistance level at $91,800, which is currently just above its current trading price.