The US Federal Reserve announced a 25 basis point reduction in key interest rates earlier today, a move largely anticipated by the market.

While a rate cut is typically viewed as a positive signal for risk-on assets such as cryptocurrencies, the immediate market reaction has been contrary to expectations.

Bitcoin's Reaction to Rate Cuts

Even prior to the Federal Open Market Committee (FOMC) meeting, there were indications that Bitcoin might not react positively. Historical data suggests that the cryptocurrency often experiences a price correction shortly after the US central bank implements rate cuts, a pattern noted by analyst Merlijn The Trader.

BITCOIN HISTORY REPEATS UNTIL IT DOESN’T.

Every FOMC meeting this year triggered a $BTC dump:

10%. 6%. 8%. The pattern is clear.Today’s meeting?

The setup is the same. The outcome doesn’t have to be.Position accordingly. pic.twitter.com/LqIqO145R2

— Merlijn The Trader (@MerlijnTrader) October 29, 2025

Bitcoin had been trading around the $112,000 to $113,000 mark in anticipation of the FOMC announcement. Following Fed Chair Jerome Powell's confirmation of the rate cut, BTC experienced a sharp decline, dropping to just above $109,000.

In the subsequent hour, BTC saw a recovery and is currently trading above $110,500. Some analysts suggest this dip might have been influenced by the CME gap that emerged after the weekend rally, which has now been filled. This development could potentially pave the way for future price increases.

Altcoin Performance and Market Impact

Altcoins mirrored Bitcoin's downward trend, with Ethereum (ETH) falling below $3,850, XRP dipping below $2.55, and many smaller-cap cryptocurrencies experiencing even more substantial losses.

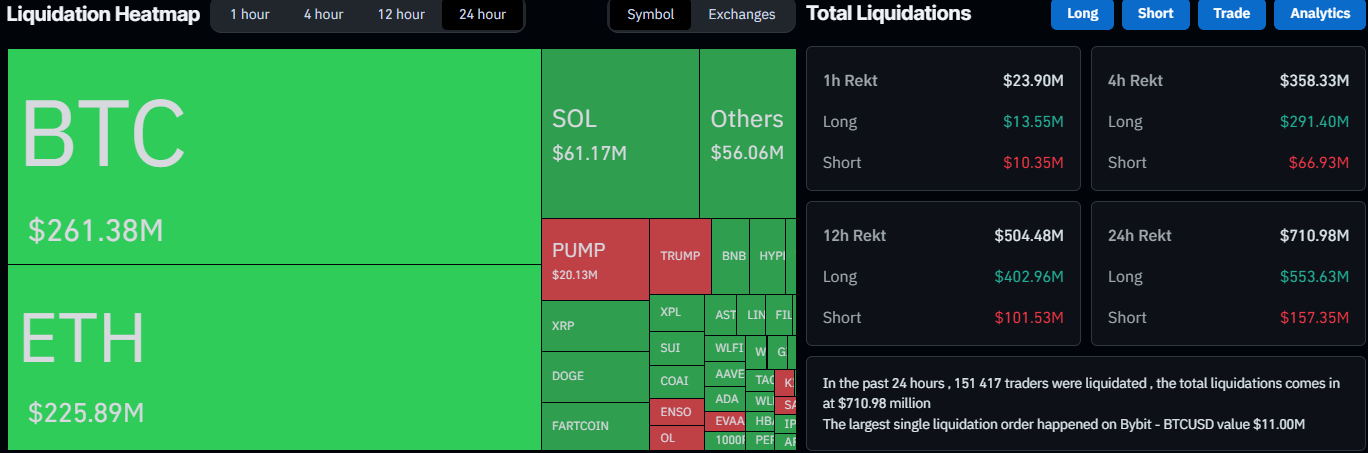

The market reaction has led to a surge in liquidations, exceeding $700 million in total daily liquidations, with over half of these occurring in the past four hours. More than 151,000 traders have been liquidated, and the single largest liquidation recorded was on Bybit, valued at $11 million.