Record Losses and Market Anxiety

On November 17, a surge in panic selling hit the cryptocurrency market, with the Entity-Adjusted Realized Loss peaking at $860 million, surpassing previous records.

This event exacerbates existing market anxiety, aligning with the well-known four-year cycle, and raises questions about when a market rebound might occur.

Analyzing the Impact of Panic Selling

On-chain analyst Murphy noted the market downturn, highlighting a $860 million spike in EARL. Investor anxiety intensified following this second major sell-off in just a few days. According to Murphy, "The second wave of panic selling has resulted in the EARL metric hitting $860 million—surpassing previous records and intensifying market anxiety."

Market dynamics are shifting, with institutions focusing on risk management. Investors face increased volatility as crypto assets plummet and liquidations mount across exchanges.

Historical Trends and the Four-Year Cycle

Key figures like QwQiao have spoken about this downturn. Industry leaders emphasize the significance of this moment, referencing the four-year cycle theory widely recognized by traders. QwQiao remarked, "Crypto is a 'self-fulfilling asset class,' emphasizing the inevitability of the four-year cycle prophecy, putting the market at a frustrating crossroads. Most savvy traders and long-term investors have turned bearish."

The current panic selling phase aligns with the crypto market's historically observed four-year cycle, often marking a prelude to recovery periods.

Ethereum's Performance Amidst Volatility

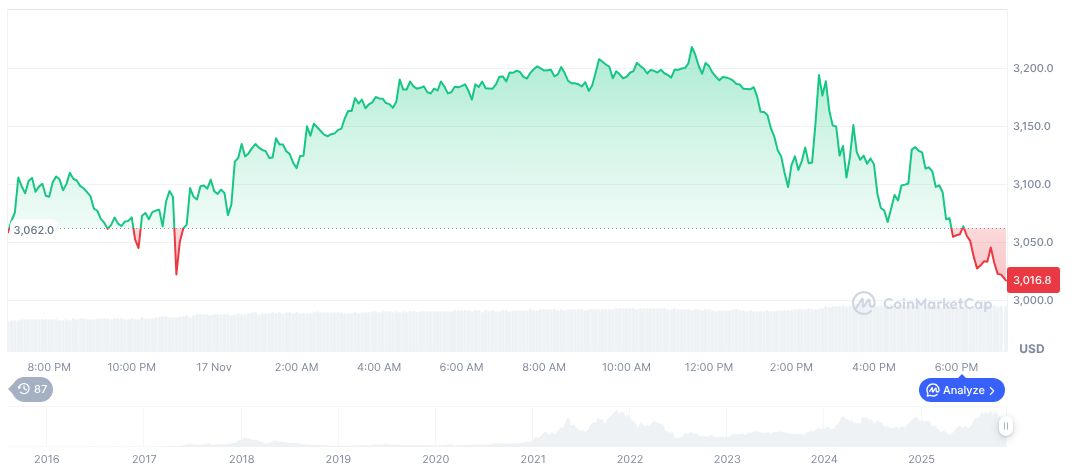

Ethereum (ETH) stands at $3,011.83 per data as of November 18th. ETH has experienced a 24-hour price decrease of 5.38% and a 7-day decline of 15.19%, reflecting ongoing volatility.

Coincu's research team suggests possible outcomes include market stabilization if panic selling subsides. Historical trends indicate potential rebounds following drastic sell-offs, underscoring investor behavior patterns.