Pi Network ($PI) has experienced a 6.74% decrease in price over the last 24 hours, currently trading at $0.2297. This decline follows a recent peak of $0.2458, indicating heightened volatility.

A primary driver for this downward movement is the increased transfer of tokens to centralized exchanges, a common precursor to selling activity. In the past 24 hours, nearly one million PI tokens have been moved to exchanges, suggesting a potential rise in sell orders.

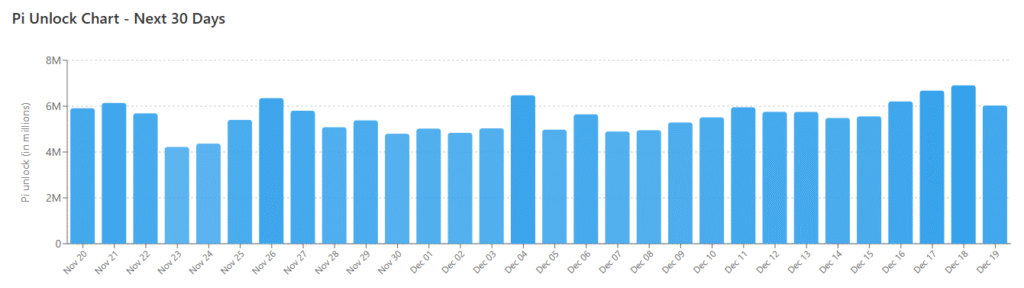

Furthermore, with over 166 million PI tokens slated for release within the next 30 days, there is a significant possibility of increased selling pressure, which could continue to impact the price negatively. These combined factors contribute to an uncertain and potentially bearish short-term price outlook.

Technical Indicators: RSI and Bollinger Bands Suggest Neutral Sentiment

Analysis of technical indicators reveals that Pi Network's price is nearing the lower boundary of the Bollinger Bands, suggesting that the current downtrend might persist. The Relative Strength Index (RSI) is positioned at 48.64, indicating neutral market sentiment and a lack of strong directional momentum.

As the price approaches key support levels, traders are advised to monitor for any signs of a potential breakout or further decline. A critical support level to observe is the $0.2276 price point.

If Pi Network's price can maintain support above this level, there is a possibility of stabilization or even a price reversal. Conversely, a drop below this level could signal continued bearish movement in the near term.

Upcoming Token Unlocks and Potential Market Impact

The impending release of 166 million PI tokens over the course of the next month could have a substantial effect on Pi Network's price. Token unlocks frequently serve as catalysts for increased selling activity, as holders may opt to sell their newly accessible assets.

With such a substantial volume of tokens scheduled to enter circulation, market liquidity is likely to increase, potentially intensifying the existing selling pressure.

While the recent release of MiCA compliance development, made public earlier this week, might offer long-term regulatory clarity, its immediate impact on the price may be limited. The market appears to be prioritizing short-term challenges, such as the increased coin transfers to exchanges and the upcoming token unlocks, over long-term developments.