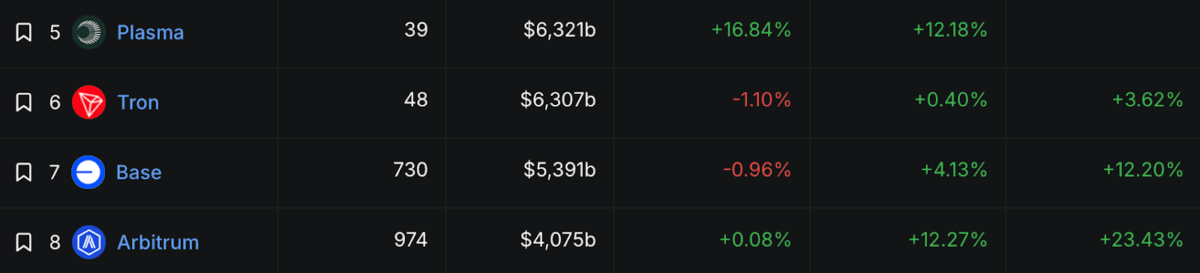

Plasma’s rise in the stablecoin hierarchy

This sharp upswing follows months of building in the stablecoin sector, where Plasma slowly emerged. The network’s low‑cost architecture and integrations with major wallets have fueled on‑chain activity, with DeFi participants migrating liquidity from higher‑fee alternatives like Tron.

Plasma’s recent dominance also underscores its growing relevance in global stablecoin infrastructure. By providing fast, low‑friction settlement rails, it’s now challenging incumbents such as Base and Arbitrum, which have struggled to match its pace of stablecoin inflows.

Trust Wallet partnership deepens ecosystem reach

Last week, Plasma announced a partnership with Trust Wallet, enabling over 210 million users to send, receive, and manage stablecoins directly on Plasma’s chain. This integration supports instant and zero‑fee USDT transfers, providing users, particularly in emerging markets, with faster and cheaper payment rails.

Plasma’s partnership with Trust Wallet underscores its push to close the accessibility gap in global crypto finance, pairing the wallet’s 210 million users with Plasma’s fast, low‑cost rails. In markets where stablecoins already function as everyday savings tools, this integration could sharply expand Plasma’s user base and transaction volume.

The move reflects a broader convergence between payments and blockchain infrastructure. With rising liquidity, new integrations, and growing stablecoin volume, Plasma isn’t following the trend, it’s quietly becoming the infrastructure beneath it.