Polkadot Price Prediction: Analysis and Trends

Introduction to Polkadot

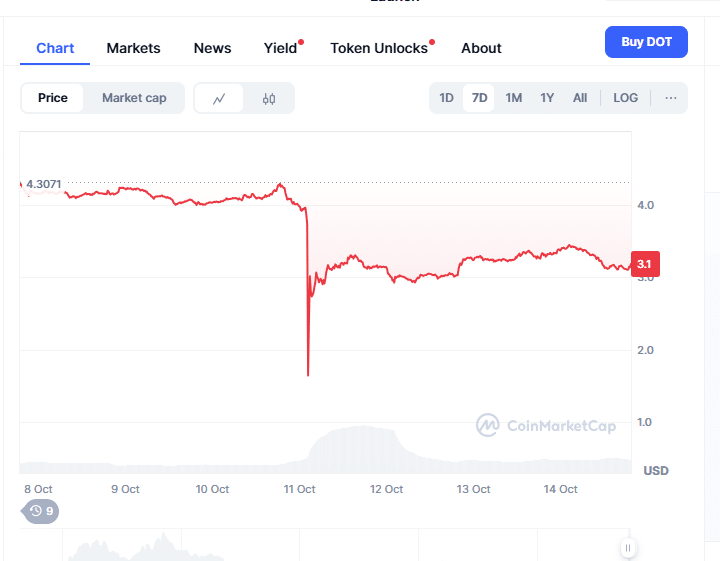

Polkadot has been drawing attention as its live price today stands at $3.18 with a 24-hour trading volume of $476,076,946. Over the last seven days, it has fallen 25.59%, causing concern among financial students, crypto enthusiasts, blockchain developers, and analysts. Will DOT recover or face further decline?

This article examines historical price trends, market sentiment, developer activity, and potential catalysts for 2025. Possible scenarios for Polkadot are explored in simple, understandable terms to help investors gauge risk and opportunity.

Polkadot Historical Trends and Movement

Polkadot has experienced wild swings since its launch, and recent price action has been no exception. The coin peaked near $50 in late 2021 and has since retreated significantly. Analysts note the current support levels are around $3.50 to $4.00. Falling below these levels could increase selling pressure and spark further declines.

Technical indicators show neutral to slightly bearish signals across moving averages and momentum charts. Community sentiment on social channels is mixed, with some predicting a strong recovery and others warning of extended weakness.

Bullish Outlook and Upside Potential

Polkadot also has several factors supporting potential gains. Optimistic analysts project a 2025 trading range between $4.50 and $5.07, with upside extending to $8 in strong bullish scenarios. This relies on the successful adoption of Polkadot 2.0 and cross-chain growth.

Institutional inflows and increased DeFi activity on Polkadot could further boost the price. Social sentiment is enthusiastic in certain communities, anticipating multi-chain adoption. Historical recovery patterns suggest periods of rapid rebound are possible after dips.

Polkadot 2025 Outlook: Balancing Risks and Potential Gains

A realistic Polkadot price projection for 2025 suggests a base case between $3.50 and $6.50. If market conditions improve, ecosystem adoption accelerates, and whales re-enter the market, DOT could reach $7 to $9. Downside scenarios with regulatory pressure, slow adoption, or broad market declines could see the price drop below $3.00.

Key support zones around $3.50 must hold for recovery potential. Resistance levels near $5.00 could define short-term price ceilings. Investors should monitor trading volume, social sentiment, developer activity, and macroeconomic indicators to assess likely trajectories.

Last Words

In conclusion, Polkadot offers a mix of potential upside and notable risks heading into 2025. With a base case price projection between $3.50 and $6.50, the coin could surge to $7–$9 if ecosystem adoption accelerates and market conditions improve.

Conversely, regulatory pressure or slow adoption may push prices below $3.00, making careful monitoring essential. Key factors like trading volume, social sentiment, developer activity, and macroeconomic trends will shape DOT’s trajectory.