Viral profit stories in prediction markets can be engineered through sybil accounts and selective disclosure, making headline returns unreliable indicators of real trading skill.

Prediction markets that rely on short time price windows and external spot prices are vulnerable to low cost manipulation, especially during periods of weak liquidity.

The growing presence of automated market making bots on platforms like Polymarket increases liquidity but also creates predictable behaviors that sophisticated traders can systematically exploit.

Prediction markets are one of the few crypto sectors that have kept rising since the start of the year. Stories of sudden wealth appear again and again.

Yet behind these “miracles,” the key question remains: Are they the result of sharp judgment and disciplined execution, or carefully staged illusions built on deception and structural loopholes?

In recent days, two controversial cases on Polymarket pushed this question into the spotlight. One involved a trader who claimed to turn $12 into over $100,000 through an “8,300x miracle,” only to be accused of using hundreds of sybil accounts to fabricate results. The other involved a trader who manipulated the spot price of XRP to harvest prediction market bots, earning over $230,000 in a single operation.

In a market where outcomes are reduced to yes or no, some dance with lies, while others exploit rules with precision. There is no unbeatable strategy. There are only adaptable ones.

From $12 to $100,000: The 8,300x Miracle or a Carefully Staged Illusion

The story began with a post that spread quickly across X. A trader named ascetic claimed he had turned $12 into more than $100,000 in profit on Polymarket. According to his account, he achieved this by making sixteen consecutive bets on short term Bitcoin price movements, doubling his capital each time.

He framed the journey as a test of conviction. He also stated that he had openly shared his betting logic and reasoning throughout the process.

Soon after, ascetic posted a link to his Polymarket account in the comments. He emphasized that such a wealth miracle could only happen on Polymarket. The language felt familiar. Similar claims have appeared before across platforms such as OpenSea, Blur, Pump.fun, Hyperliquid, and others.

The response was immediate. The comment section filled with praise and celebration. Some community members treated the story as proof that prediction markets reward courage and skill. Even Polymarket’s global growth lead LeGate congratulated him publicly and mentioned a Polymarket trader badge.

At first glance, it looked like a standard viral success story. That impression did not last long.

From Miracle to Fabrication: Doubts Around the 8,300x Returns

On the same day, a trader named Moses publicly challenged ascetic’s claims. Moses described himself as ranked 515 among Polymarket traders in 2025. His criticism was direct and detailed.

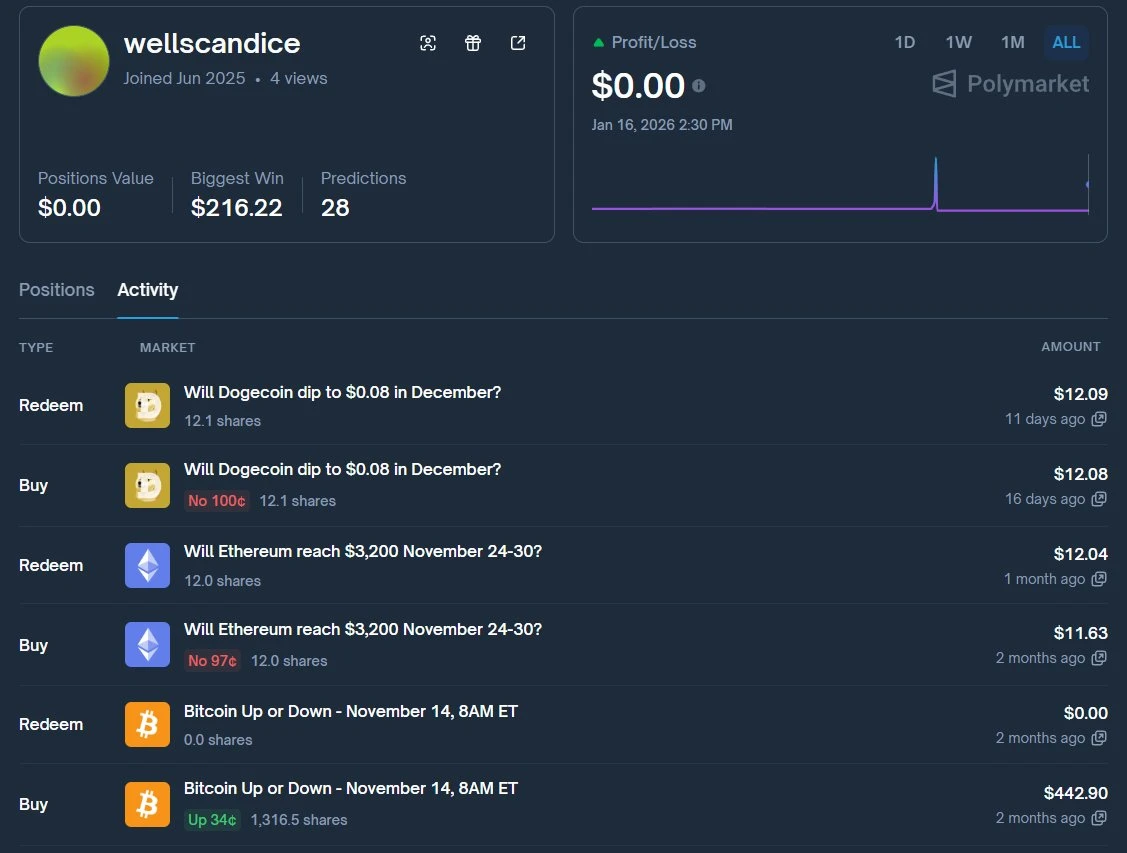

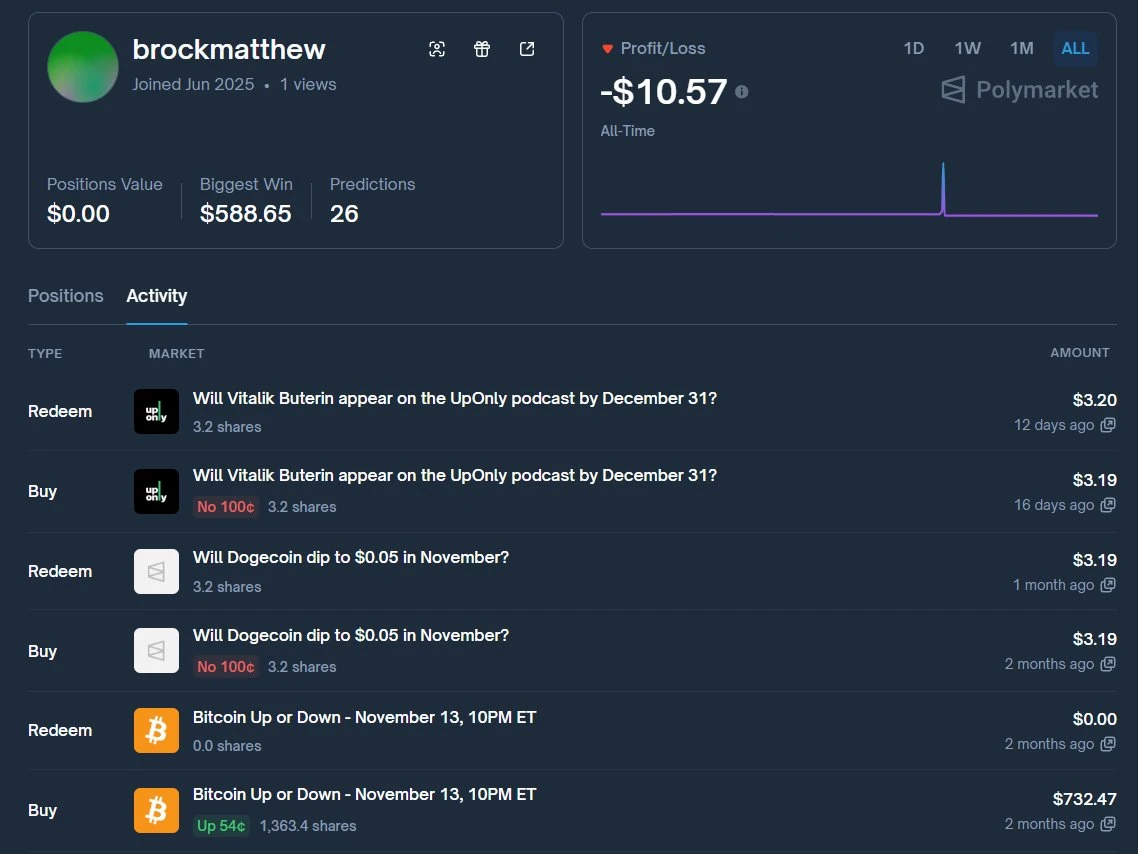

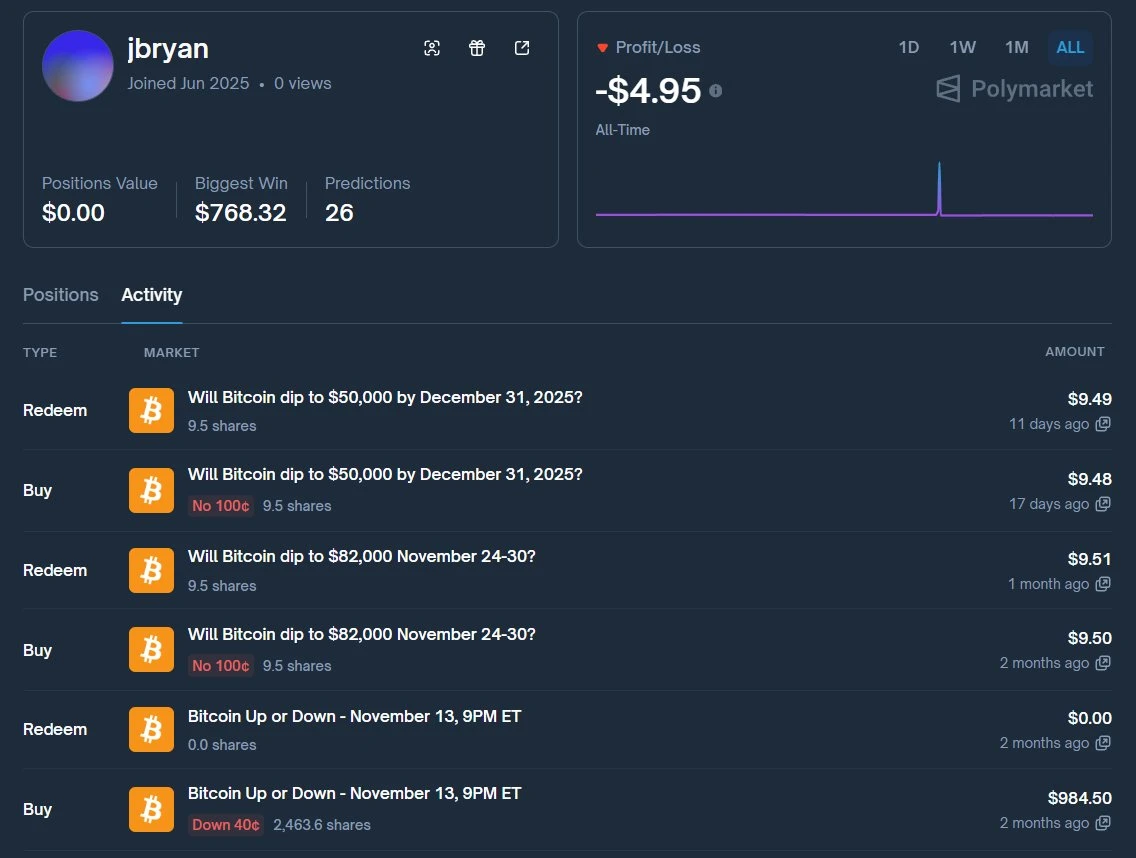

Moses pointed out that in ascetic’s first post, the account balance already showed around $3,000. According to Moses, this was not the result of a clean run from $12. Instead, he alleged that ascetic operated a large sybil network. Hundreds of accounts were created, each funded with $10 to $20. Once one account reached around $2,900, ascetic began promoting it publicly.

From that point on, the promoted account made seven trades, all winners. Moses argued that this behavior was a red flag. Real traders do not go all in on every trade. This pattern suggested performance chasing and narrative building rather than risk management.

Moses also claimed that when liquidity was insufficient, ascetic appeared to use other accounts to create artificial fills in order to reach desired prices. He warned readers not to blindly trust viral traders and shared screenshots of failed sybil accounts that had only reached about $1,000 in profit.

He later added more details. All of the suspected accounts were created seven months earlier. They traded random markets for months. Then, two months ago, all of them began the same challenge on the same day. According to Moses, the entire “$10 to $100,000” story was fiction.

He shared several account links as examples.

Despite these accusations, ascetic denied any connection to the listed wallets and accounts. Some members of the ZSC DAO, a Polymarket trader community, also defended him and described the accusations as online harassment.

Still, observers noticed similarities between ascetic’s Polymarket activity, bot replies on X, and other accounts with overlapping behavior patterns. These links significantly weakened the credibility of the so called miracle.

Some commenters noted the irony. Even seven consecutive successful bets would already be an impressive achievement. Others suggested the entire setup looked like a bot driven spray strategy rather than genuine skill.

Adding another layer of irony, Moses’ own profile described a journey from $1 to $1 million. Whether that line reflected real results or personal ambition remained unclear.

Compared with this murky case, the next example is far easier to verify and far more instructive.

Manipulating XRP to Drain Bots: A $230,000 Operation

On January 18, a Polymarket trader known as PredictTrader revealed a striking case of market manipulation. According to his analysis, a trader labeled a4385 earned approximately $233,000 by exploiting prediction market bots. The operation unfolded over just a few hours and initially escaped broad attention.

The timing was carefully chosen. It was a Saturday night, when overall market liquidity was thin. Liquidity on Binance spot markets was also weaker than usual.

The target market was an XRP prediction event. The question was whether XRP would rise or fall within a 15 minute window, from 12:45 to 1:00 PM Eastern Time on January 17.

Trader a4385 aggressively bought “up” shares on Polymarket. His counterparties were mostly personal market making bots. On Polymarket, market making is relatively simple. The barrier to entry for individual developers is low. As a result, trading bots are widespread.

Ten minutes into the event, XRP was down about 0.3 percent from the opening price. Despite this, the price of “up” shares was pushed to 70 percent. Bots detected what appeared to be a profitable imbalance and began selling more “up” shares to a4385.

By the end of this phase, a4385 had accumulated about $77,000 worth of “up” shares at an average price of 48 percent.

Two minutes before settlement, a wallet on Binance bought roughly $1 million worth of XRP on the spot market. This purchase pushed the price up by about 0.5 percent. Seconds after the prediction market settled, the same spot position was sold.

The cost structure of the manipulation was simple. It consisted mainly of spot market slippage and fees. The estimated one way slippage was around 0.25 percent, plus trading fees.

Using a Binance VIP level 4 account with fees of 0.06 percent, which is relatively easy to obtain, and assuming 0.25 percent slippage in both directions, the total cost was about $6,200. The actual cost may have been even lower.

By repeating this strategy and taking advantage of weak weekend liquidity, the trader drained multiple bot wallets. Some bots were shut down in time. Others reacted too slowly and lost all their funds. One bot operator, known as aleksandmoney, reportedly lost an entire year of profits, around $160,000.

What These Cases Reveal About Prediction Markets

These two incidents expose different but related weaknesses in prediction markets. The first highlights how easily performance narratives can be fabricated through sybil behavior and selective disclosure. The second shows how mechanical strategies and shallow liquidity can be exploited through external price manipulation.

Information on prediction markets is not always what it seems. Results can be staged. Signals can be gamed. Platform rules and settlement standards are human designed systems, not neutral truths.

For traders who thrive on the thrill of binary outcomes, separating appearance from reality is essential. In prediction markets, truth is often less important than how truth is defined and enforced.