Record Trading Volumes Signal Growing Market Engagement

Prediction market trading volume last week surpassed previous records set during the U.S. presidential election, according to Dune Analytics data reported by BlockBeats News on October 21. This surge in trading highlights increasing interest in prediction markets, potentially impacting cryptocurrency liquidity and indicating heightened market engagement, as platforms like Kalshi and Polymarket experience unprecedented volumes.

Dune Analytics data indicated that prediction market trading volumes surpassed peaks observed during previous U.S. presidential election cycles. Kalshi, led by Tarek Mansour and Luana Lopes Lara, noted an unprecedented surge in user participation. Polymarket's Shayne Coplan echoed such patterns from prior cycles.

The record $1 billion in contracts traded highlights the growing engagement in regulated markets. Higher volumes suggest significant institutional interest, driven partly by CFTC approvals and community trust in these platforms.

Community reactions are centered around record-setting activities. Tarek Mansour stated, "Volumes and engagement never before reached in regulated prediction markets." This reflects broader market trends, emphasizing user involvement in politically relevant events.

USDC's Stability Crucial Amid Trading Surge

The recent trading volume in prediction markets not only eclipsed the peaks of the 2020 U.S. election but also established a new standard for engagement in politically charged trading environments.

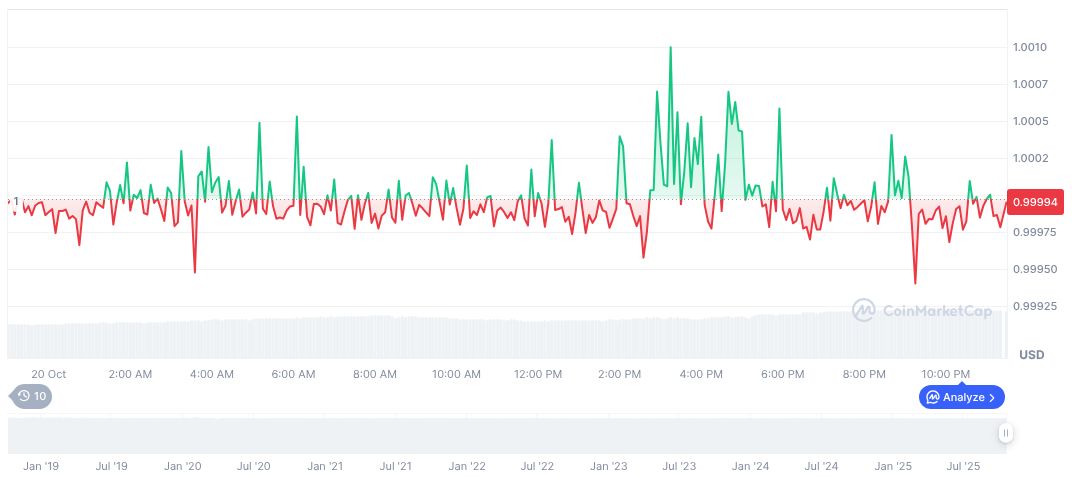

According to CoinMarketCap, USDC maintains a stable price of $1.00 with a market cap of $76.20 billion. Despite a small monthly price change of 1.14%, USDC remains a critical asset in prediction market operations with a 24-hour trading volume of $17.68 billion.

The Coincu research team highlights the surging market volume as indicative of high liquidity and regulatory interest, which could influence future financial norms. Data suggest long-term growth potential as institutional frameworks become more supportive of engaging in prediction markets.