Pump.fun has implemented a significant fundamental update in the meme coin sector, characterized by concrete mathematical advancements rather than speculative promises.

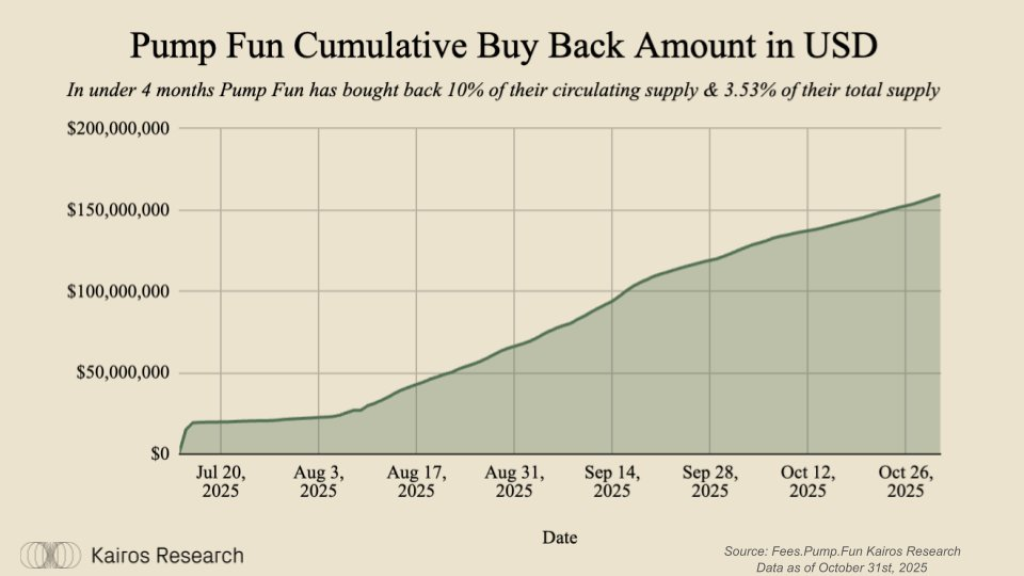

Kairos Research, an analytics platform, reported that Pump.fun has successfully repurchased 10% of its circulating supply in under four months. This action has resulted in the removal of 35.28 billion PUMP tokens from the market, at a cost of approximately $160 million to the protocol. In terms of total supply, 3.53% of all PUMP tokens that will ever exist have already been burned.

To provide context, the amount of PUMP bought back now exceeds the entire PUMP liquidity available on Binance, which stands at 3.29% according to Arkham. This metric underscores the considerable buy-side pressure that has been active.

The Chart Shows a Relentless Uptrend in Buybacks

The graph provided by Kairos Research highlights several key trends:

- •A rapid increase in buybacks began in early August.

- •A consistently parabolic trend has been observed from September onwards.

- •There has been no discernible slowdown in buyback activity, even amidst market volatility.

If Pump.fun continues at its current rate, it is projected to repurchase approximately 33% of its circulating supply annually, which translates to 11.7% of the total supply each year.

This represents a substantial token-burning mechanism, distinct from mere marketing narratives.

So Why Did PUMP Crash 30%+ in October?

Even robust fundamentals can be overshadowed by market conditions. The price of PUMP experienced a decline of over 30% in the past month, entering a correction phase as traders shifted their focus to newer, trending coins.

The current market capitalization is around $1.6 billion, placing PUMP significantly below its previous peak performance.

However, several key observations are noteworthy:

- •The protocol's fees and revenue streams did not diminish.

- •Buyback activities continued to increase.

- •The burn pressure persisted, effectively reducing the token supply.

In essence, the underlying fundamentals of the token improved while its market price experienced a downturn.

This situation typically leads to one of two potential outcomes:

- The price eventually realigns upwards to reflect the improved fundamentals.

- The market significantly undervalues the asset until a catalyst emerges to drive its price appreciation.

Is a Comeback Setting Up for November–December?

PUMP is still trading more than double its all-time high, and this target is not considered unrealistic if the market sentiment turns bullish towards the end of the year. This outlook is further supported by the recent stabilization of Bitcoin and major altcoins following the October market corrections.

The following formula is key:

Strong revenue + constant buybacks + falling circulating supply

This combination creates a scenario where the token is poised for potential growth. A shift in liquidity back towards meme coins could position PUMP as a particularly compelling narrative trade.

Pump.fun Holders Don’t Have a Reason to Worry

Pump.fun is no longer solely competing in the meme culture space like Dogecoin. It has evolved into a revenue-generating platform that directly translates hype into price support.

The operational model can be summarized as:

Trade memes → fund buybacks → reduce supply → repeat

Following a challenging October, PUMP is not in decline; it may be preparing for the next phase of the market cycle.

A retest of its all-time high is a reasonable target if bullish sentiment continues through the final two months of the year. Furthermore, if buyback activities maintain their current pace, the supply reduction dynamics will naturally contribute to price appreciation for traders.