Pump.Fun, a meme token platform built on Solana, has crossed $40 million in revenue for the second consecutive month. Echoing the growth, its native token PUMP jumped by over 25% in the past 24 hours, currently trading at $0.006578, as per CoinMarketCap data.

In its recent report, GLC Research revealed that the platform generated over $130 million in January and over $80 million in February. However, the platform has been in a median range of $40 million since March. The only major drop came in July during what GLC described as the “Bonk War.” After that dip, revenues rebounded quickly, stabilizing above $40 million in both August and September.

https://t.co/zkr7fJ2lRT’s revenue has been remarkably consistent, with the only real dip in July due to incentives and the launchpad war with $BONK.

— GLC (@GLC_Research) October 1, 2025

Excluding that month, both average and median revenue have hovered around $40M since March. While there’s still skepticism about… pic.twitter.com/dLkYYeCoAL

Consistency and buyback strategy

GLC Research noted, “PUMP.Fun’s revenue has been remarkably consistent, with the only real dip in July due to incentives and the launchpad war with $BONK.” Moreover, PumpFun has shifted to a 100% buyback policy.

At the current pace, annualized revenues of $486 million could retire nearly 30% of the circulating supply within the next year. Already, about 7% has been bought back. Consequently, sustained revenue could keep buying pressure elevated for months.

Additionally, PumpFun has built up a massive cash reserve, holding between $1 billion and $1.5 billion against its $2 billion market value. Since no new tokens will unlock until July 2026, many see this as a strong bullish signal.

Moreover, another GLC data shows the platform has completed over 619,080 SOL in purchases, worth about $122 million. These transactions have already reduced nearly 8% of its circulating supply.

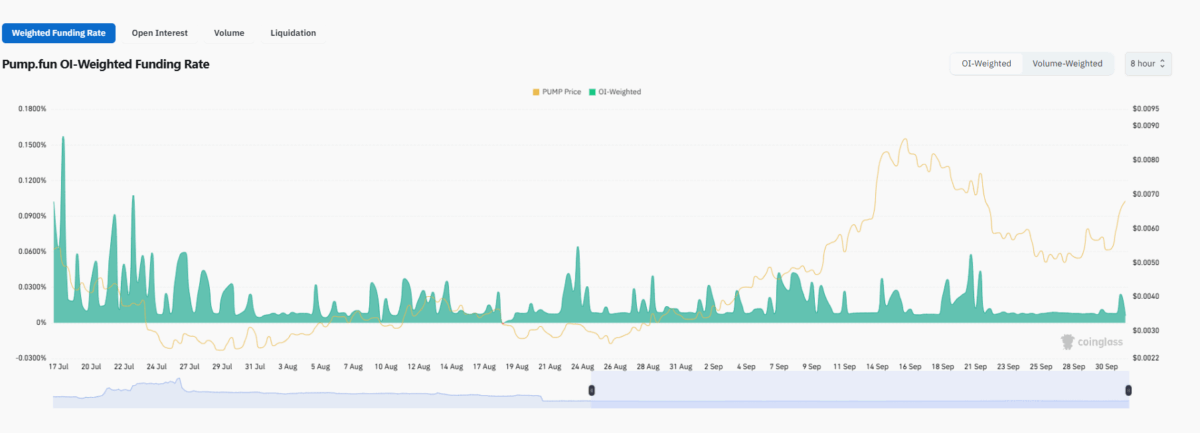

Notably, data from CoinGlass shows that PumpFun’s funding rates have cooled off since the wild swings in July. Back then, traders were paying steep premiums to hold positions. Now, those rates have dropped close to zero.

This suggests that PUMP’s price growth is being fueled by real buying rather than risky borrowing. Since early September, the token has steadily climbed from $0.004 to over $0.008 before easing a bit. Even after the correction, it remains strong above $0.006.

PumpFun’s steady revenue, ongoing token buybacks, and big cash reserves point to a positive outlook if the crypto market keeps up its momentum.