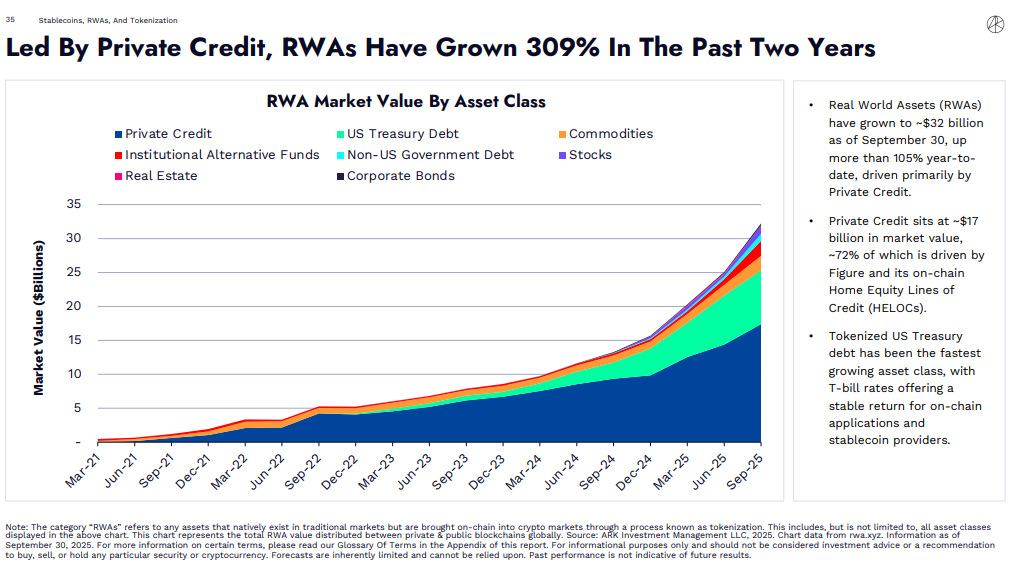

The tokenized Real World Assets (RWAs) market has experienced a significant surge of 309% over the past two years on public blockchains, according to ARK Invest’s The DeFi Quarterly report. As of September 30, 2025, the total value of RWAs tokenized on-chain reached approximately $32 billion. This growth indicates an accelerating trend in bridging traditional financial assets with decentralized ledger technology.

Key Drivers of RWA Growth

The tokenization of private credit has emerged as the dominant force in this market expansion. It is currently valued at roughly $17 billion and represents 72% of the RWA market’s overall growth.

Beyond private credit, the tokenization of U.S. Treasury debt has also become a significant growth factor. This particular product offers high, stable on-chain returns, making it an attractive option for decentralized applications and stablecoin providers seeking secure and liquid collateral. Other tokenized assets contributing to the market's expansion include institutional alternative funds, real estate, and commodities.

Ethereum Ecosystem Dominates Tokenization Efforts

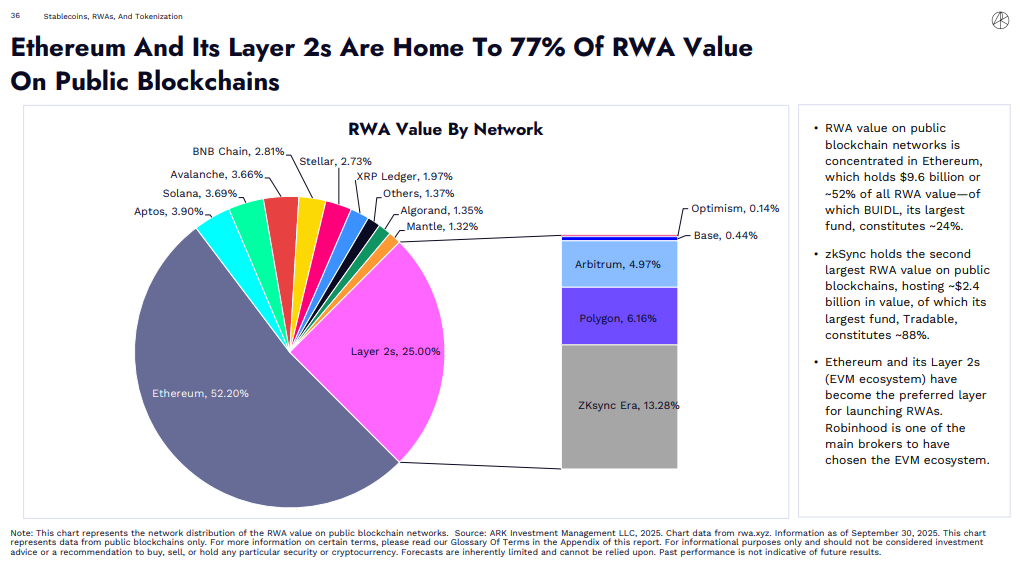

The Ethereum ecosystem is the primary driver behind this transformation, accounting for 77% of the total RWA value on public blockchains through its mainnet and Layer 2 (L2) scaling solutions. This dominance positions the Ethereum Virtual Machine (EVM) ecosystem as the preferred platform for institutional tokenization initiatives.

The distribution of RWA value is notably concentrated. Ethereum Mainnet holds the largest share at 52.2%. Layer 2 solutions collectively contribute 25% of the RWA market value. Among these L2s, ZKsync Era leads as the largest contributor, representing 13.2% of the overall RWA value, followed by Polygon at 6.16% and Arbitrum at 4.97%.