Key Takeaways

- •The supply of ERC20 stablecoins has reached $160 billion, a significant marker for potential Bitcoin price movements.

- •Historical data suggests that increases in stablecoin supply often precede rallies in Bitcoin's price.

- •The current stablecoin supply indicates a strengthening purchasing power within the cryptocurrency markets.

Record Stablecoin Supply Reaches $160 Billion

CryptoQuant's latest report indicates that the supply of ERC20 stablecoins has surpassed $160 billion in 2025, a critical threshold that has historically been linked to Bitcoin's price trends. This figure represents an all-time high and suggests a significant increase in market liquidity. The analysis from CryptoQuant emphasizes a notable correlation between the liquidity provided by stablecoins and the subsequent pricing of Bitcoin, with stablecoin growth often acting as a precursor to bullish market movements.

This surge in stablecoin supply reflects an enhanced availability of liquidity across major cryptocurrency exchanges, with platforms like Binance holding a substantial portion. The data points to a potential shift in trader behavior, possibly indicating a preparatory phase for anticipated market changes. These indicators have historically foreshadowed significant price rallies for Bitcoin, as observed in previous market cycles. The expansion of ERC20 stablecoins on various platforms also suggests a broadening of investor engagement with prominent cryptocurrencies.

Bitcoin's Price Rise Linked to Stablecoin Growth

During significant market events, such as the 2021 bull market and the 2024-2025 market recovery, an increase in the supply of ERC20 stablecoins has consistently mirrored the subsequent rise in Bitcoin prices. This phenomenon reflects heightened investor readiness and enhanced liquidity within the market.

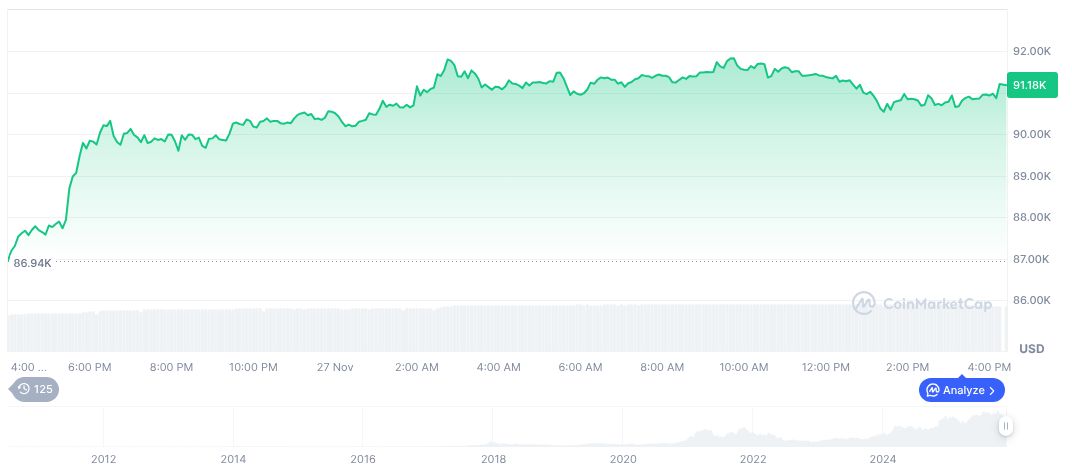

Current data from CoinMarketCap shows Bitcoin (BTC) trading at $91,569.01, with its market capitalization exceeding $1.83 trillion. Bitcoin holds a dominant market share of 58.44%, and its fully diluted market capitalization reaches $1.92 trillion. Despite a recent decrease in 24-hour trading volume, Bitcoin's price has experienced a notable increase of 9.86% over the past week.

Insights from Coincu's research team highlight that trends in stablecoin supply are of considerable economic importance for both Bitcoin and altcoins. The observed growth in liquidity and purchasing power underscores the potential for market resilience, even in the face of traditional economic pressures. Shifts in stablecoin liquidity may also influence future regulatory discussions concerning the stability of the cryptocurrency market.