Key Features of the New Service

Revolut Ltd. has launched a zero-fee USD-to-stablecoin exchange service, enabling users to swap significant amounts across multiple blockchains without incurring transaction fees or facing currency spreads. This innovation is designed to simplify interactions between cryptocurrency and fiat currency, thereby improving financial efficiency for businesses, particularly those operating in regions with high economic volatility.

Revolut Implements Zero-Fee Stablecoin Exchange on Six Blockchains

Revolut's new feature facilitates zero-fee USD-to-stablecoin exchanges on blockchains including Ethereum and Solana. This initiative, led by Leonid Bashlykov, aims to address liquidity and operational challenges inherent in cryptocurrency transactions, with the goal of streamlining financial operations for its user base.

Businesses located in economically unstable regions are expected to gain considerable advantages from this service. It will help them minimize foreign exchange losses and reduce overall transaction costs. For example, Turkish companies can now optimize their capital management through more accessible stablecoin transactions, lowering the barriers to cross-border payments and reducing currency exchange expenses.

Market observers have characterized the launch as a transformative development, especially for capital management in areas prone to high volatility. Leonid Bashlykov has stated that this initiative removes "all anxiety" associated with fiat-to-crypto transactions, thereby empowering affected businesses to enhance their financial strategies.

Stablecoin Market Dynamics and Regulatory Potential

Revolut's initiative offers significant benefits to Turkish businesses by mitigating currency exchange losses and transfer fees, which are critical factors in navigating local economic instability.

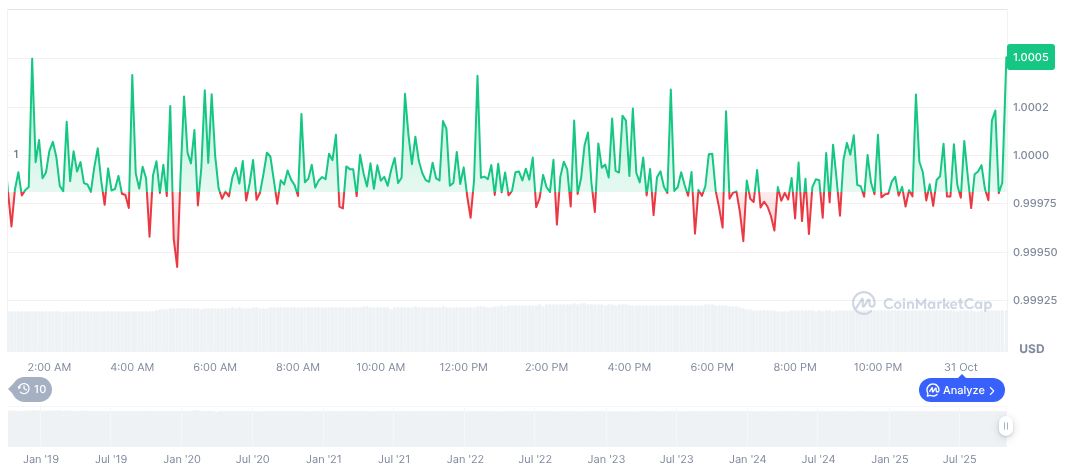

The current price of USDC is $1.00, with a market capitalization of $75.75 billion, according to CoinMarketCap. Despite minor price fluctuations, its stable value over recent months indicates market confidence amidst prevailing challenges. The 24-hour trading volume stands at $19.24 billion, showing a slight decrease of 12.42%.

Research from Coincu indicates potential regulatory benefits and anticipates forthcoming changes in global stablecoin regulatory frameworks. As businesses adopt Revolut's model, enhanced cross-chain liquidity and more efficient capital flows could redefine the future landscape of financial services.