Ripple executives have begun exploring the possibility of integrating staking into the XRP Ledger. The aim of this potential addition is to better align incentives among validators and token holders, fostering greater long-term participation and enhancing network security.

J. Ayo Akinyele, head of engineering at RippleX, highlighted in a blog post that expanding the blockchain's utility and capabilities is a frequent topic of discussion, with adding staking to the XRP Ledger being a prominent suggestion.

Restructuring Required for XRP Ledger Staking

Akinyele explained that implementing staking on the XRP Ledger would encourage sustained participation and bolster network security by rewarding those who contribute to maintaining consensus. However, he also noted that successful implementation necessitates a designated source for staking rewards and a fair distribution mechanism for these rewards.

Furthermore, introducing staking would present a challenge to the XRP Ledger's foundational principles, particularly its Proof of Association mechanism, which prioritizes trust and stability over direct financial incentives.

Ripple CTO Proposes Two Staking Implementation Ideas

Despite these challenges, David Schwartz, a core architect of the XRP Ledger and Ripple's CTO, has outlined two potential approaches for implementing staking on the platform via X (formerly Twitter).

There are two ideas floating around. Both are awesome technically but probably not realistically likely to be good, at least not any time soon.

One is to switch to a two-layer consensus model with the inner layer being incentivized. The inner layer would have 16 inner validators…

— David 'JoelKatz' Schwartz (@JoelKatz) November 18, 2025

The first proposed method involves a two-layer consensus model where an inner layer is incentivized. This dual-layer system would feature an inner layer comprising approximately 16 validators, selected by an outer layer based on stake. The inner layer would be responsible for ledger advancement, utilizing standard staking and slashing mechanisms to prevent issues like double-spending. The outer layer, consisting of the current validators without a staking component, would oversee amendments, fees, and the policing of the inner layer.

Schwartz's second idea suggests maintaining the current consensus structure but leveraging fees for zero-knowledge proofs. These proofs offer a cryptographic method to verify the truth of a statement without revealing additional details, thereby enabling verification without direct trust.

Schwartz cautioned that while both proposals are technically impressive, they are unlikely to be practically viable in the near future. He elaborated that the two-layer consensus approach would involve significant effort and risk, with theoretical benefits to network stability and robustness that are not currently necessitated by any existing issues. He also noted that without substantial revenue generation, the effort involved might not yield proportionate gains, and this approach is not essential for achieving programmability.

On two-layer consensus: It's a lot of work and risk. The benefits to network stability and robustness are largely theoretical and there aren't any current issues in either area. If there isn't a lot of revenue generated, it will be a lot of work for little gain. It isn't needed…

— David 'JoelKatz' Schwartz (@JoelKatz) November 18, 2025

Regarding the zero-knowledge proof mechanism, Schwartz described it as a cutting-edge yet technically complex approach. He indicated that if adoption is minimal, the extensive work required might result in negligible benefits. However, he also expressed optimism about its potential to fundamentally transform the XRPL, offering unique capabilities compared to other blockchains while preserving its core attributes.

Discussions on Staking Emerge Amid XRP ETF Interest

The conversations surrounding staking for the XRP Ledger coincide with a surge of interest in spot XRP exchange-traded funds (ETFs).

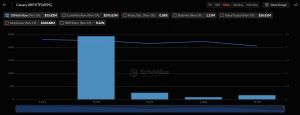

Last week marked the debut of the first US spot XRP ETF, issued by Canary Capital under the ticker “XRPC.” This ETF experienced significant inflows of $245 million on its initial trading day.

An additional nine XRP ETFs are anticipated to launch within the current week.