Ripple Labs’ application to establish a federally regulated trust bank has been made public by the Office of the Comptroller of the Currency (OCC).

The “Interagency Charter and Federal Deposit Insurance Application” document details Ripple’s plan to form the Ripple National Trust Bank under U.S. banking law. The filing was submitted under the National Bank Act, which governs the creation of national banks.

The application provides the information needed by the OCC and the Federal Deposit Insurance Corporation (FDIC), including business plans, financial projections, and operational information. Ripple must also post a public notice of the proposed bank in a local newspaper. Key sections of the filing, including the business plan, remain confidential.

Approval in October?

There is speculation that the Ripple filing could be approved this month. According to the Comptroller’s Licensing Manual, the OCC generally aims to decide a national bank charter application within 120 days of receipt, or sooner if the filing qualifies for expedited review. Ripple submitted its filing on July 2, 2025, so the approval decision could very likely come by October 2025.

The OCC also noted that it “does not approve applications that fail to provide the necessary information for the OCC to fully evaluate the proposal. The application is expected to stand on its own at the time of filing, with only general clarification from the organizing group concerning its members, the CEO, and/or the business plan.”

Industry observers, including Bill Morgan, have highlighted that October could be a busy month for the crypto sector. In addition to delays in spot XRP ETFs, Ripple’s charter application could be decided around the same time.

Who else is in the race?

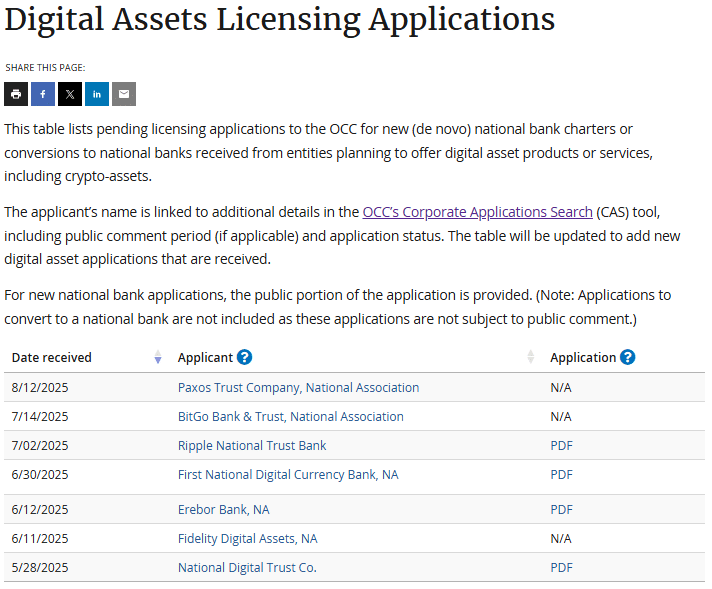

In the race for federal recognition, several major crypto firms have moved to secure national trust charters from the OCC.

Just a few days ago, Coinbase applied for a National Trust Company Charter to expand its regulated operations. Further, Circle, issuer of the USDC stablecoin, and Paxos, a blockchain and tokenization firm, also filed similar applications in recent months.

However, the filings from Coinbase, Circle, and Paxos are not yet available on the OCC’s public records, indicating that these applications are still under review or awaiting publication.