Ripple continues to be a significant topic in the cryptocurrency space, marked by its ongoing global expansion and the formation of strategic partnerships. Despite its native token, XRP, not yet mirroring the broad market rally, numerous analysts anticipate a substantial surge in its value in the near future.

Ripple's European Focus

In response to regulatory complexities encountered in the United States over recent years, Ripple has strategically shifted its operational focus internationally, with Europe emerging as a pivotal region. Earlier this week, the company received preliminary approval for an Electronic Money Institution license from the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. This permit, once fully granted, will empower Ripple to issue digital cash and offer a range of services, including digital wallets, payment processing, money transfers, and prepaid cards, across all jurisdictions regulated by the CSSF.

Prior to this development, Ripple Markets UK Ltd, the firm's United Kingdom subsidiary, secured registration with the Financial Conduct Authority (FCA). This registration confirms the company's adherence to local anti-money-laundering regulations and counter-terrorist financing rules. Ripple has also established a notable presence in other European countries such as Switzerland, Ireland, and Spain.

Recent Partnership Announcement

On January 15th, LMAX Group, a global fintech company based in London, announced a partnership with Ripple. This collaboration aims to accelerate institutional stablecoin adoption and enhance cross-asset mobility. Under the terms of the agreement, LMAX Group will integrate RLUSD, Ripple's stablecoin, into its institutional trading infrastructure. This integration will provide LMAX clients with access to a wider array of trading options.

RLUSD, which is pegged 1:1 with the US dollar, was introduced towards the end of 2024 and has garnered support from various exchanges and prominent banking institutions. For instance, BNY Mellon, the oldest bank in the United States, serves as the custodian for RLUSD. The stablecoin has steadily gained traction in the crypto market and is currently the 81st largest digital asset, boasting a market capitalization of nearly $1.4 billion.

Performance of XRP ETFs

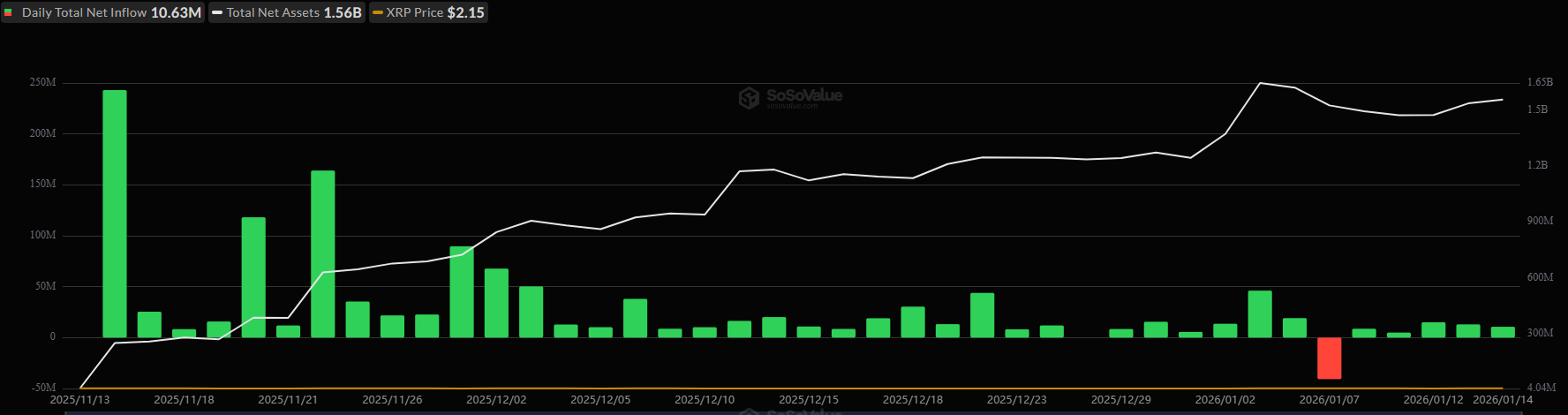

In November of the previous year, Canary Capital made history by launching the first spot XRP ETF in the United States, known as XRPX, which offers 100% exposure to the XRP token. Following this pioneering move, other well-known entities such as Bitwise, Franklin Templeton, Grayscale, and 21Shares introduced their own XRP ETFs, attracting significant investor interest. Data from SoSoValue indicates that these financial instruments have collectively achieved cumulative net inflows of $1.26 billion to date. The only instance where outflows exceeded inflows was on January 7th. In the past 24 hours, total net inflows for these ETFs amounted to approximately $10.6 million.

XRP Price Predictions

As of the current writing, XRP is trading at approximately $2.12, reflecting a modest increase of 0.6% over the past week. This performance stands in contrast to the double-digit price increases observed in other altcoins, such as Monero (XMR) and Internet Computer (ICP), during the same period. Despite this period of consolidation, many industry observers suggest that XRP may be poised for a significant bull run. One notable prediction comes from X user Amonyx, who forecasts a surge above $18 and advises investors that "patience is key." Similarly, LEB CRYPTO holds a very bullish outlook, envisioning a potential price explosion to nearly $60 in the coming years.

However, there are also cautionary voices. X user EGRAG CRYPTO has warned of a potential pullback, describing a possible crash to the $1.40-$1.20 range as the "worst-case zone."