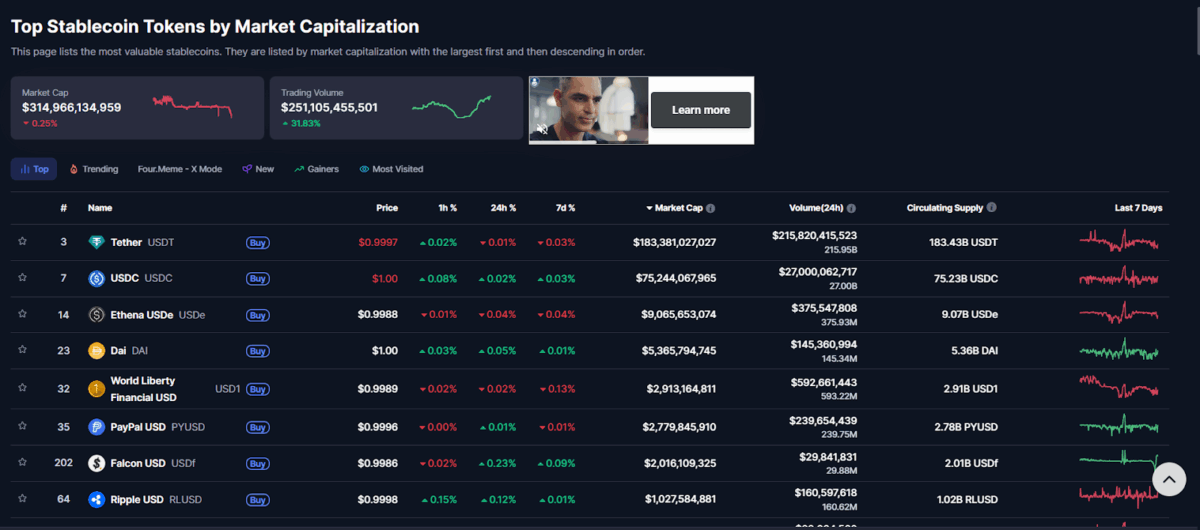

Ripple USD (RLUSD), a US dollar-pegged stablecoin issued by Ripple, has surpassed a $1 billion market capitalization. This places RLUSD among the fastest-growing stablecoins, currently ranking within the top 10 dollar-denominated stablecoins by market cap.

The current market valuation stands at approximately $1.02 billion, with a circulating supply of just over 1 billion RLUSD tokens. The token is maintaining its 1:1 peg with the US dollar, trading at $1.00.

The stablecoin’s surge in value, which pushed RLUSD into the global top 10 stablecoins list, shows the growing demand for regulated and compliant digital dollars.

The Climb to the $1 Billion Mark

The rise of RLUSD is built on its core principles of regulatory compliance. Launched by Ripple in December 2024, the stablecoin was designed for institutional use cases and cross-border payments, with a focus on regulatory certainty.

It is issued by Standard Custody & Trust Company, a Ripple subsidiary operating under a New York Department of Financial Services (NYDFS) charter, which is considered a regulatory standard worldwide. Each RLUSD token is fully backed by reserves consisting of US dollar deposits, short-term U.S. Treasury bonds, and cash equivalents, with reserve attestations published monthly by an independent third party to ensure transparency.

RLUSD’s utility is centered on augmenting Ripple’s existing payment infrastructure, which has long utilized the native XRP cryptocurrency for liquidity. The stablecoin offers institutional clients a reliable, efficient, and cost-effective method for global transactions, treasury operations, and liquidity management.

Since its launch approximately a year ago, its adoption has expanded from its initial listing on major exchanges like Uphold and Bitso to broader integrations across both centralized and decentralized platforms. The token is now available on both the XRP Ledger and Ethereum blockchains.

This focus on institutional trust and utility is the key factor behind its rise to the $1 billion mark. RLUSD’s place got solidified as a competitor to industry giants like Tether’s USDT and Circle’s USDC.

Ripple Expands Institutional Reach with Palisade Acquisition